A series of atmospheric river events has brought much-needed rain to California and some relief to dried-out almond farmers. Multi-year drought conditions should ease boosting reservoir levels. However, according to the latest reports, levels are still below the Jan average, with a lot of excess rain expected to end up in the ocean. Produce supply in all California growing regions is being impacted due to rain, with supplies to tighten in Mexico, Florida, and South Texas as these regions help fill the shortages out of California.

In Oxnard, California, which received many inches of rain, most strawberry farms have canceled or delayed harvests, with growers expected to rely on transfers of Mexican-grown fruit to supplement California shipments through mid-January. Produce loading volumes in McAllen, TX, are expected to increase for reefer carriers as this freight market is boosted by volumes filling the shortages from California. Even though strawberry plants are recovering from previous rains and freezing temperatures in Florida, supply is expected to tighten as the region fills shortages in California.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

The impact of ongoing storms is significantly affecting California produce volumes, as expected. According to the USDA, weekly truckload volumes of produce in California are at the lowest levels since 2010 and are currently around 70% lower than the same time last year. Outbound state-level reefer spot rates were down $0.01/mile the previous week to $2.42/mile, the second lowest in seven years. Spot rates on the regional lane from Los Angeles to Las Vegas have been rising over the last month, and at $4.69/mile, they are $0.35/mile higher than in December but $1.52/mile lower than the previous year. Loads to Seattle were paying $2.64/mile last week, up $0.30/mile m/m, while loads east to Phoenix continued to cool, dropping $0.10/mile to $2.87/mile last week.

As reported last week, import volumes of produce from Mexico have stepped up to fill shortages in California. According to the USDA, weekly truckload volumes are up 7% y/y and the highest in 12 years, with most of the volume crossing in the Laredo and McAllen border markets, where volumes are up 18% y/y. Avocado loadings are up 22% y/y as retailers position the product ahead of peak demand in a few weeks lead-up to the Super Bowl. Reefer loads from McAllen to Atlanta were paying $2.71/mile last week, up $0.10/mile on the December average. Loads to Orlando were paying slightly higher at $2.86/mile, and loads west to Los Angeles at $2.09/mile were at the highest in 12 months. Loads to Phoenix, home of the NFL’s premier event, were up to $2.46/mile, the highest in 12 months.

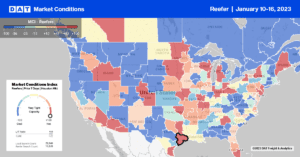

Load to Truck Ratio (LTR)

Reefer volumes in the spot market continue to be impacted by lower national produce volumes, which are currently 8% lower y/y and the weakest since 2016. The ongoing flooding and road closures in California are having a significant import on produce volumes at their lowest levels since 2010 and 70% lower y/y. Carrier equipment posts remained at their highest level in seven years and 16% higher than in 2019. As a result of a drop in volumes and a spike in equipment posts, last week’s reefer load-to-truck (LTR) plunged from 10.18 to 4.80.

Spot Rates

Last week’s national average reefer linehaul rate plunged to $2.27/mile, dropping almost $0.10/mile from the previous week. Unlike Week 2 last year, spot rates are 30% or $0.94/mile lower. Last week’s spot rate was just $0.17/mile lower than in 2018 but still $0.25/mile higher than the average in pre-pandemic years.