After years of drought, rain is welcome news for California farmers of every commodity. Within 12 months, Californian farmers have gone from the grips of a multi-year drought and reduced crop acreage to concerns about the amount of water running off into the ocean. In just a few weeks, historic storms have hammered California, resulting in fatalities, widespread flooding, road closures, power outages, and evacuations in numerous counties. The storms also inflicted a harsh toll on agriculture, where mudslides and fierce winds ruined thousands of acres of crops, flooding vegetable fields with contaminated water.

Dick Peixoto, owner of Lakeside Organic Gardens in Watsonville, says, “There’s quite a bit of property underwater. We have creeks that run over and lakes that are overfilled and backed up into the fields. Peixoto estimated he lost a hundred acres of broccoli, cabbage, chard, and kale after being underwater for days. Because flood waters often contain sewage and other debris, growers must destroy crops, including berries, leafy greens, and other vegetables, the edible portions of which are exposed to the water. Richard Bianchi, ranch manager at Sabor Farms in San Benito County. “Across the whole area, there’s a lot of acreages that’s underwater.” In addition to immediate crop losses, Bianchi said continuous rain caused the ranch to miss broccoli, cauliflower, and lettuce plantings. Those plantings would typically be harvested in late April, but they’re just not going to be there,” Bianchi added.

According to state data, as of January 11, the Sierra Nevada snowpack was more than double its average for that date. It had already exceeded the end-of-season average, typically measured on April 1. As of Friday, the rain had lifted much of California out of “extreme drought,” though nearly half the state remained in “severe drought” status. The state’s largest reservoirs rose significantly, though most remained below their historical average.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

According to the latest USDA data, lower produce volumes in key winter markets, including Florida, Arizona, and California, were down 33% y/y. Digging deeper into these markets, Florida’s produce season is just getting started, and while volumes are currently 30% lower than the previous year after a slow start, we’re still a long way from May’s peak shipping volume. State-level rates in Florida at $1.33/mile for outbound reefer loads are around the lowest in the last seven years as spot market volumes remain flat for all of January.

In Arizona, home to the Winter Salad Bowl in Yuma and this year’s Super Bowl in Phoenix, produce volumes are running 25% higher y/y. The Nogales border market was only one of 18 produce markets to report a slight shortage of trucks last week, all others reported an adequate supply, with California, Florida, and the Yakima Valley reporting a surplus of trucks. Produce volumes in California are still reeling from recent wet weather pushing weekly truckload volumes down to around a third of what we expect this time of the year. State-level rates in California averaged $2.20/mile last week, the same as in 2020, with only 2017 being lower at $1.87/mile in the previous seven years.

On the East Coast in Philadelphia, spot rates were flat at $2.28/mile following last week’s 5% w/w increase in reefer load posts, while capacity was very tight further south in Savannah. Outbound spot rates jumped by $0.23/mile last week to an average of $2.47/mile, with gains reported on the 700-mile haul west to New Orleans. At $1.59/mile, rates on this lane are at a 6-month high, while short-haul loads to Atlanta were flat m/m at around $780/load. Loads south to Lakeland averaged $1,100/load last week or about $100/load lower m/m or almost $500/load lower than the previous year.

Load to Truck Ratio (LTR)

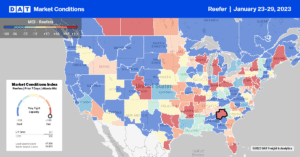

The winter produce market continues to dampen demand for reefer carriers nationally – last week’s produce volumes were down by almost 9% y/y or the equivalent of 2,500 weekly truckloads, according to the USDA. Total reefer load post volumes, including produce, were 11% lower last week compared to week four during prior pre-pandemic years. In contrast, carrier equipment posts run around 30% higher over the same timeframe. The net result of a slight increase in load posts and a 4% w/w decrease in equipment posts, last week’s reefer load-to-truck (LTR) increased slightly from 3.03 to 3.17, the lowest in seven years for the end of January.

Spot Rates

National average reefer linehaul rates continue to cool faster than other equipment types following last week’s $0.08/mile decrease to an average of $2.10/mile. Including the last two pandemic-influenced years, reefer spot rates in the previous seven years typically decrease by 9% during the year’s first month. Year-to-date, reefer linehaul rates have declined at around double that rate (18% YTD).

Following last week’s decrease, reefer spot rates are $1.07/mile lower than the previous year and around $0.10/mile higher than in 2019. The national average is still $0.16/mile higher than the average in pre-pandemic years for this time of the year.