California is now entering the third year of drought with many reservoirs at low levels following the driest and hottest year on record in 2021. This comes during a larger 22-year megadrought in the West Region with recent announcements by Federal water managers that it won’t deliver water to farmers in California’s agricultural belt of most concern for farmers and produce haulers alike. In normal years, California is responsible for nearly 70% of U.S. fruit and vegetable production.

With state produce volumes already down by around half what we’d normally expect to see shipped from The Golden State in early April, the impact of the drought and water restrictions will most certainly result in fewer acres planted and lower truckload volumes this year. We’re still three months away from the July shipping peak but with farmers already being forced to fallow hundreds of thousands of acres of land due to lack of water, many are expecting this year to be worse than 2021.

Despite the gloomy outlook for farmers in California due to water shortages, carriers found higher spot rates this week in Fresno as rates increased by $0.05/mile to $2.30/mile excl. FSC after dropping for the three weeks prior. Loads moved to Boston jumped by 27% w/w, and reefer spot rates increased by $0.13/mile to an average of $2.19/mile excl. FSC. Rates on this lane typically trend upwards from now until July but are starting the produce season around $0.50/mile lower this year. Loads from Fresno to Hunts Point, NY, were also up last week, increasing by $0.13/mile to an average of $2.13/excl FSC, while loads moved north to Seattle were down by 2% w/w keeping spot rates flat at $3.49/mile excl. FSC.

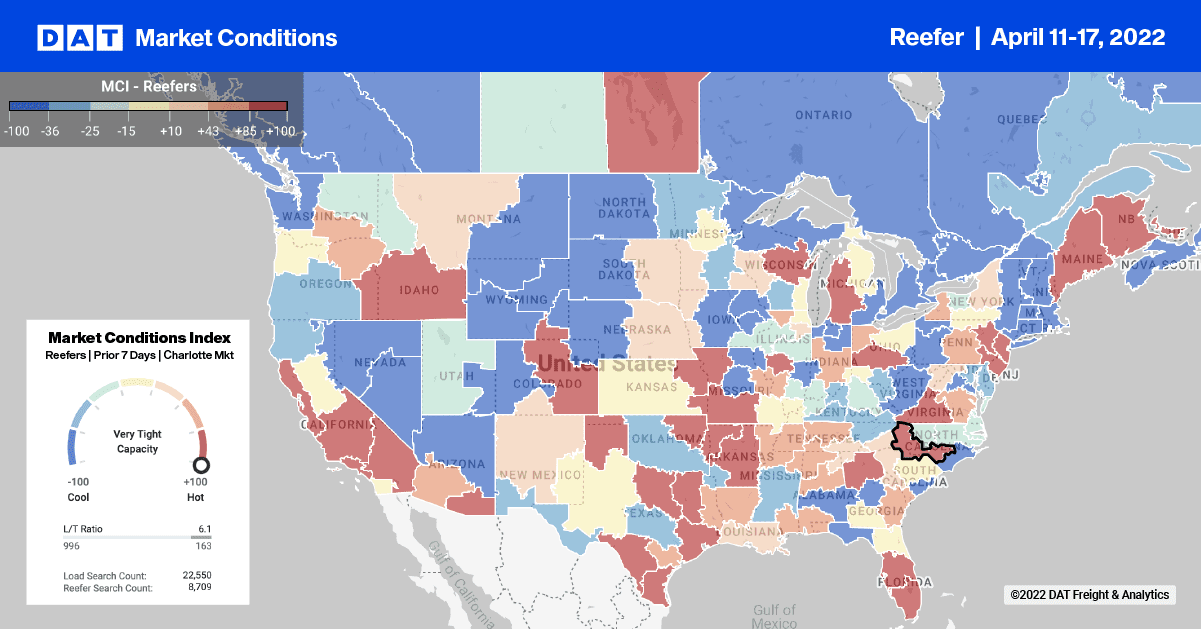

Available reefer capacity in Southern California has been loosening for the last month but could be reversing course following the previous week’s penny per mile overall increase. Even spot rates for loads from Los Angeles to Las Vegas increased by $0.18/mile to an average of $5.14/mile excl. FSC last week after dropping by just over $1.00/mile since the start of the year. Capacity on the East Coast continues to cool, though; loads from Atlanta to Orlando have dropped by $0.40/mile to $3.43/mile excl. FSC in the last four weeks and are now $0.14/mile lower y/y. While in Florida, spot rates increased by $0.06/mile to a state average of $1.79/mile excl. FSC last week and decreased slightly by $0.03/mile to $2.23/mile excl. FSC for loads to Boston.

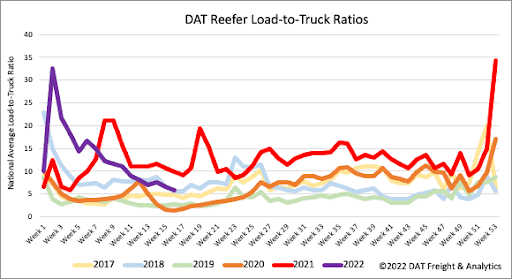

Reefer load post volumes have dropped by 27% in the last month following last week’s 12% w/w decrease. Reefer capacity had loosened the fastest over the same timeframe, with equipment posts now at 2019 levels when the freight market was also softening. Last week’s load-to-truck ratio (LTR) dropped 10% from 6.57 to 5.91 and is now almost exactly where it was in 2018.

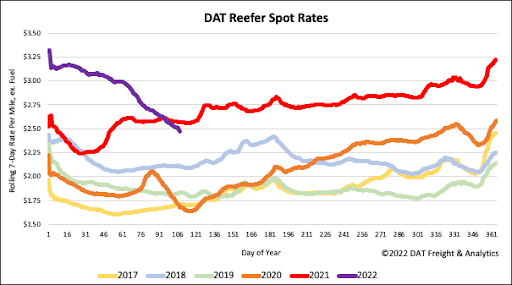

Reefer spot rates have dropped by $0.66/mile since the start of the year following last week’s $0.05/mile decrease. They are now around $0.10/mile lower than last year, with the previous week’s national average reefer rate at $2.51/mile excl. FSC. As you can see from the chart below, reefer spot rates are still $0.37/mile higher than in 2018 and $0.69/mile higher than the same time in the previous four non-pandemic years from 2016 to 2019.