Around 10% of all containers imported into the U.S. are refrigerated, unlike their non-refrigerated counterparts, which mostly come from Asia and arrive on the West Coast—quite the opposite. According to the latest data from IHS Markit/Piers, almost half of March refrigerated imports came from Central America; 25% were loaded with bananas, with just under 60% arriving on the East Coast. Guatemala tops the list of countries exporting goods to the U.S. with 20% of the volume, followed by Costa Rica (10%) and Panama (9%).

The most popular port for refrigerated containers is New York (13%), followed by Philadelphia (11%) and Wilmington (10%). The latest import data shows March volumes are down 14% y/y but up 5% m/m nationally. East Coast import volumes are down 16% y/y, 5% YTD y/y but up 1% m/m. Volumes at the top three ports are down 24%, 27%, and 9% y/y, respectively. The West Coast received 26% of imports in March, split almost evenly between the Port of Los Angeles and Port Hueneme. Compared to the same period last year, West Coast volumes are down 15% y/y.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Reefer capacity continues to tighten as Florida produce season continues to push higher volumes into the outbound spot market. According to the USDA, produce volumes are around 40% higher y/y, driven by substantially higher volumes of watermelons, where Florida is the leading producer in the nation. At $1.88/mile, Florida outbound reefer rates are identical to 2018 and 2022 levels, while on the high-volume north to Atlanta, at $1.61/mile, spot rates are almost $0.30/mile high than the March average. The volume of reefer loads moving on this lane increased by 7% in the prior month. Ratecast is forecasting an increase of a further $0.66/mile to $2.27/mile in the first week of May on this lane, coinciding with the annual peak in outbound shipping volumes.

On the West Coast, in the large Fresno produce market, reefer linehaul rates increased for the fourth week to $1.69/mile on 4% higher volumes. Cross-country loads to Elizabeth, NJ, at $1.50/mile, are $0.50/mile lower than the previous year, while loads to the nation’s largest produce market at Hunts Point in the Bronx were paying $1.58/mile. State average outbound reefer rates in California are $0.15/mile lower than in 2019 and close to 2020.

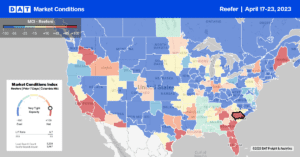

Load to Truck Ratio (LTR)

Reefer spot market load posts continue to track at around half what they were a year ago, following last week’s 7% increase. Impacting reefer volumes is the slower start to produce season than expected. National volume is 13% lower y/y, and while Florida volumes are around 40% higher y/y, the more significant California market is down 40% y/y. Reefer carrier equipment posts are identical to this time in 2019, resulting in the reefer load-to-truck (LTR) increasing from 2.54 to 2.80.

Spot Rates

Reefer linehaul rates have dropped by almost $0.50/mile this year following last week’s $0.03/mile decrease. At $1.90/mile, the national average is nearly identical to the average in pre-pandemic years and just $0.03/mile higher than in 2019.