Winter and citrus fruits are paradoxical, but here we are in peak season for oranges, grapefruits, tangerines, clementines, lemons, and limes as winter grips much of the nation. According to the USDA, truckload shipments of citrus fruits peak in November in California and Florida, accounting for 94% of domestic citrus production and 64% of total annual volume, including imported citrus. Mexico accounts for 18% of annual citrus volume, followed by Chile (6%), Peru (4%), and Morocco (3%). The commercial crossing zone in Pharr, TX, accounts for 71% of Mexican citrus imports, while 55% of South American imports enter the U.S. via the Marine Packer Terminal in Philadelphia.

The 2023 harvest season in California started a little later than usual due to the tropical storm that came through California in August. USDA data indicates year-to-date (YTD) harvest volumes are 65% higher than last year but 41% lower than the bumper crop in 2021. Casey Creamer, President and CEO of California Citrus Mutual, told AgNet West, “The delays in the season have not been too detrimental to California citrus as is the case for some other commodities. However, the late season has contributed to some higher-than-average pest issues. Citrus thrips have been a significant issue for growers this year.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

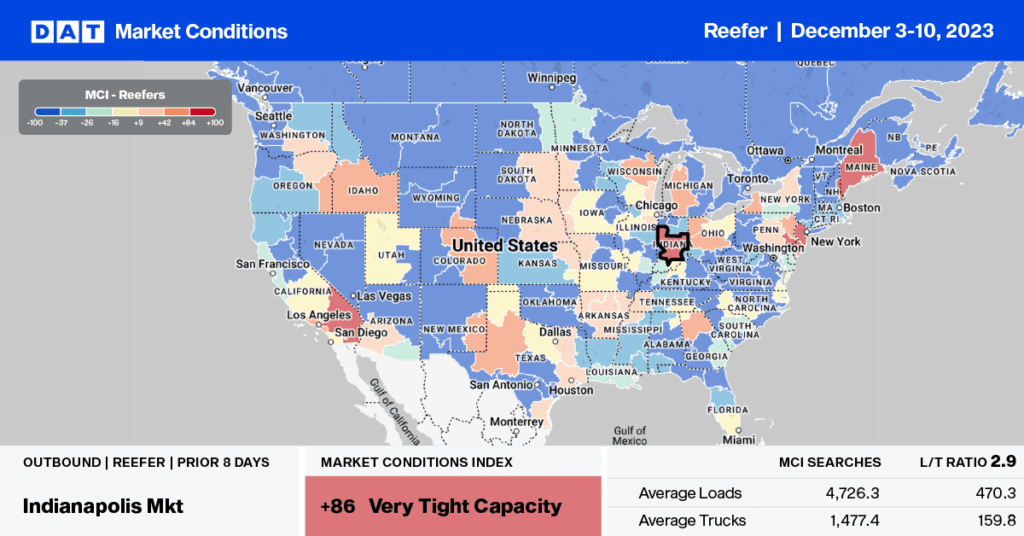

According to the USDA, reefer capacity tightened in several markets in the Pacific Northwest for the third week. Five of the 19 produce-growing regions covered by the USDA reported a slight surplus, and only McAllen in southern Texas reported a surplus of reefer trucks. Trucks are increasingly hard to find in the Pacific Northwest this time of the year for loads of Christmas trees and winter produce, with a shortage reported for loads of onions and potatoes in Idaho, Oregon, and Washington. Capacity was the tightest in the Columbia Basin in the Pendleton freight market.

Loads from Yakima Valley to Los Angeles paid carriers an average of $2.27/mile last week, with rates forecast to increase by another $0.10/mile by the end of the year, according to DAT’s Ratecast. At $1.95/mile, loads to Atlanta are around $0.18/mile lower than last year, while Dallas loads paid carriers $2.11/mile last week, almost identical to last year. Outbound Wahington reefer rates at $2.16/mile are $0.06/mile lower than last year but $0.10/mile higher than in 2019.

Load to Truck Ratio (LTR)

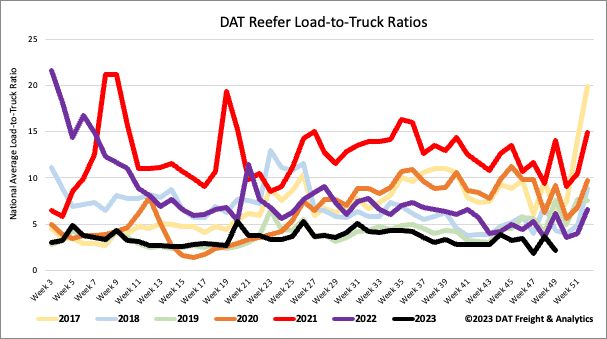

After doubling the week after Thanksgiving, reefer load post (LP) volume decreased 38% w/w, erasing most of the prior week’s gains. According to the USDA, the reefer spot market is influenced by lower Fall produce volumes, mainly in California, where volumes were 39% lower compared to 2022. Carrier equipment posts (EP) increased by 6% w/w, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing to 2.11.

Spot rates

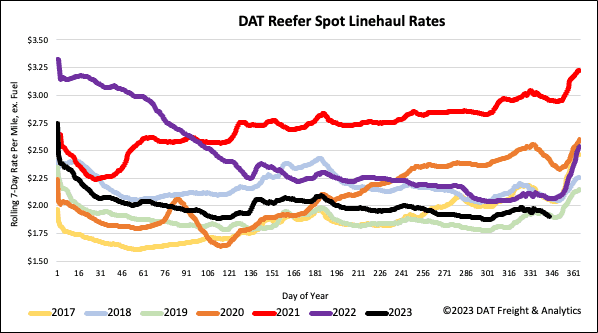

Reefer linehaul rates lost most of the ground gained in the three prior weeks following last week’s $0.05/mile decrease. At $1.94/mile, reefer linehaul rates dropped back to where they started in November, $0.16/mile lower compared to 2022 and only $0.02/mile higher than in 2019.