Even though last week’s domestic truckload volumes of produce were down 31% compared to last year, the USDA reported a shortage of reefer capacity in a number of markets.

The recent cold snap in the northern tier drove up demand for reefers to haul traditional dry van freight, as shippers add “protect from freeze” (PFF) to bills of lading. Unlike in summer when reefers are needed to keep freight cool, the opposite occurs in extreme cold when reefers are needed to keep certain commodities from freezing.

Trucks have been in high demand for loads of potatoes out of the San Luis Valley in Colorado, Twin Falls-Burley District in Idaho, Columbia Basin in Washington, Central Wisconsin and the Red River Valley in North Dakota. The same for loads of apples, pears, and onions in Washington’s Yakima Valley, where the recent three-day closure of I-90 over the Snoqualmie Pass severely disrupted the flow of trucks into the region. Trucks were also in demand for winter vegetables in Southern Texas and Central and South Florida produce districts.

Find reefer loads and trucks on the largest load board network in North America.

NOTE: Market rates reported below do not include fuel surcharges

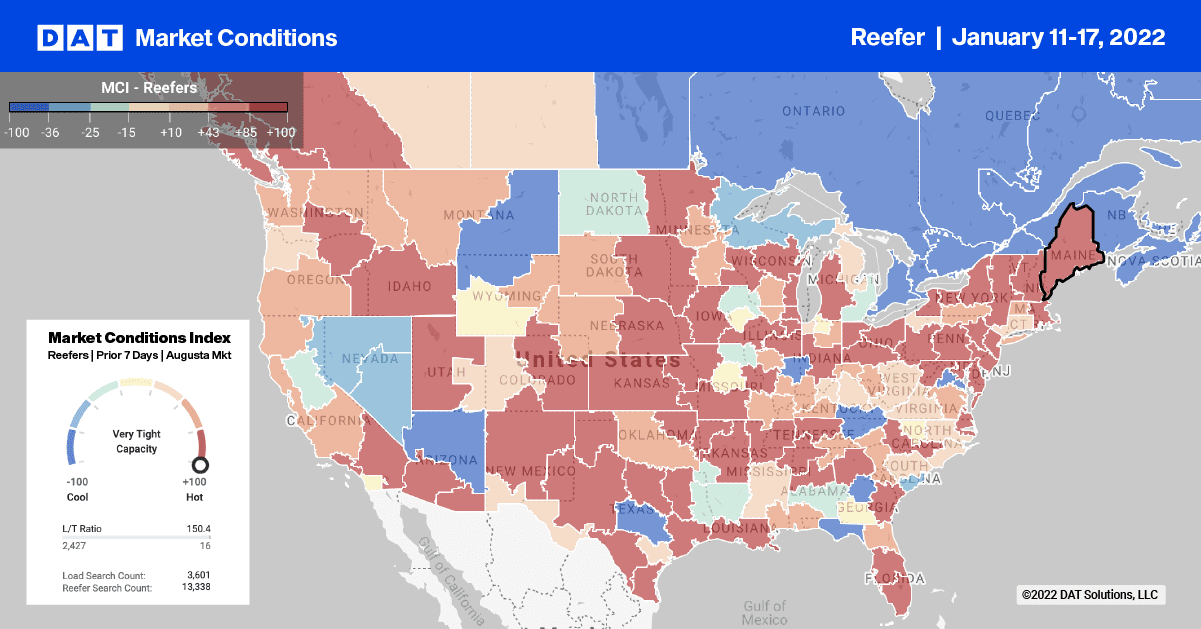

Extremely cold temperatures in the Great Plains and upper Midwest last week resulted in reefer capacity tightening as dry freight shippers looked to reefer carriers to keep their freight from freezing. Spot rates in these two regions increased 12 cents last week to an average of $3.13/mile. Reefer rates out of Twin Falls, ID, to Los Angeles have been climbing consistently since July, rising to an average of $3.40/mile.

On the East Coast in Elizabeth, NJ, spot rates reversed the recent downward trend and increased 25 cents to $3.25/mile for loads to Lakeland, FL. On the country’s busiest reefer lane between Atlanta and Orlando, spot rates were up slightly to $4.27/mile. Northbound rates on the same lane continue to climb, winter produce volumes continue to grow in Florida. Spot rates are now averaging $2.35/mile, which is up 77 cents since the 12-month low last September.

Load to Truck Ratio

Loads moved in the reefer sector increased by 17% last week, and like the dry van sector, are almost back to pre-Christmas levels. More carriers returned to the market last week, and even though there was a 28% w/w increase in equipment posts. As a result, the reefer load-to-truck ratio decreased from 32.58 to 21.63.

Spot Rates

Reefer spot rates did something last week they haven’t done since this time of year in 2018: They increased. The slight 1-cent bump put the national average reefer rate at $3.16/mile, 82 cents higher than the same period last year and 79 cents higher than the third week in 2018.