According to the Journal of Commerce, UK-based Amber Infrastructure Group is developing a $55 million cold storage warehouse near Maine’s Port of Portland. The warehouse will significantly impact transportation costs for Maine’s seafood and produce shippers, who rely heavily on the Port of Boston and out-of-state storage capacity for refrigerated cargoes. Nathaniel Shehata, vice president of Iceland-based ocean carrier and forwarder Eimskip, mentioned that many of Maine’s fishing and lobster businesses typically operate their small-scale cold storage, and those needing third-party cold storage must use warehouses in Everett and Peabody, Massachusetts, which are about three hours from Portland.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The 107,000-square-foot warehouse near Portland’s International Marine Terminal is expected to open in early 2025. Almost 90% of imported containers in Portland arrive from Reykjavik in Iceland, carrying ice-farmed salmon, other fish and byproducts (14% of volume), and laboratory equipment (7%).

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

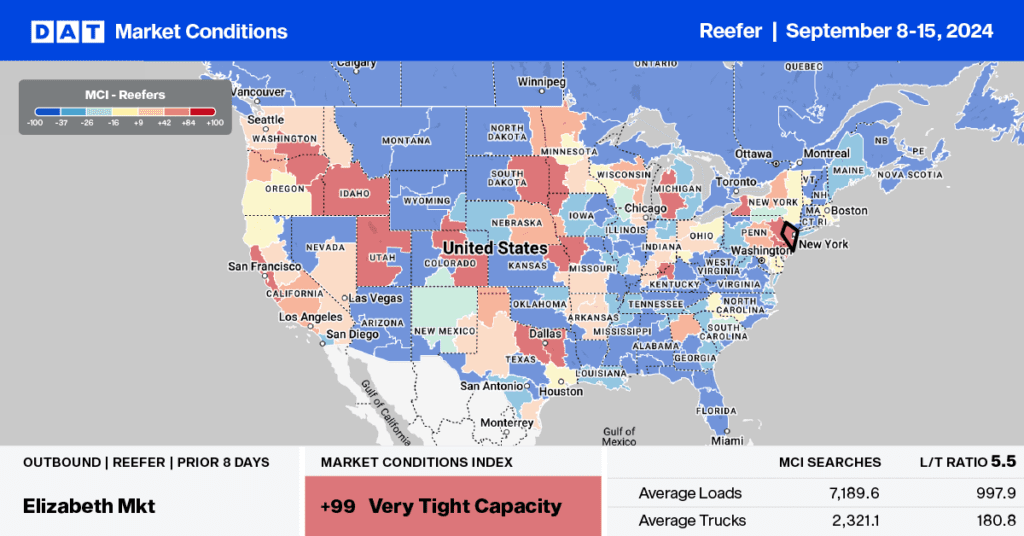

This week, let’s focus on the Twin Falls, ID market, where it’s potato harvest season. Potatoes are grown commercially in 30 states in the United States, but most potato farming is concentrated in the Pacific Northwest. According to USDA data, Idaho is the top potato-producing state, accounting for nearly 30% of the country’s total production and 41% of the year-to-date truckload volume of potatoes. Truckload spot rates are increasing, outbound capacity is very tight, and volumes are 2% higher than last year, even though the season has just started.

Reefer linehaul rates in Twin Falls are already rising as this market competes with other Fall Season produce and Christmas Tree markets, including neighboring Spokane and Oregon. Outbound Twin Falls rates have increased 14% in the last month to an average of $2.42 per mile and up 25% on the high-volume lane to Los Angeles. Spot rates on the Los Angeles lane typically peak around Thanksgiving, when rates are forecasted to peak at $2.66 per mile and $2.84 per mile at the upper end of the forecast range.

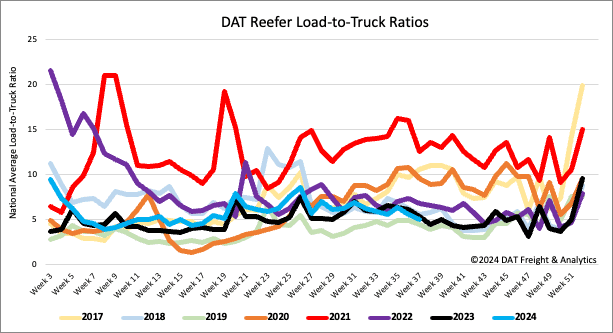

Load-to-Truck Ratio

Reefer load post volumes remained around 30% lower than the long-term average for Week 37, following last week’s 2% w/w decrease. Carrier equipment posts increased 8% w/w but remained 5% lower than the long-term average. As a result, the reefer load-to-truck ratio (LTR) decreased by 8% to 5.03, which is 19% lower than the long-term average for Week 37.

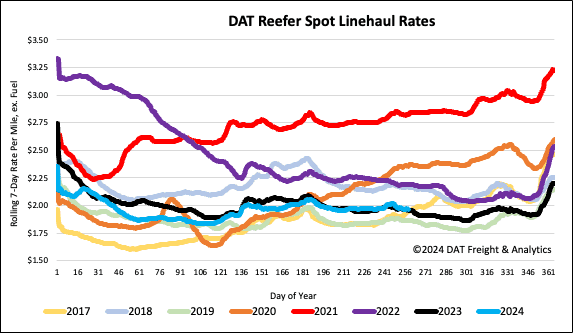

Spot rates

Reefer truck linehaul rates were flat last week at $1.99/mile, much the same as they’ve been since the July 4 peak ten weeks ago. The national average for last week is $0.02/mile higher than last year and approximately $0.04 per mile higher than the long-term average for Week 37, not including the years affected by the pandemic. At $1.99 per mile, reefer spot rates are the same as the average over the past three months.