Potato harvest season is around the corner and has started to dominate weekly truckload volumes in the produce sector. According to the USDA, potato shipments were the second highest commodity shipped, accounting for 10% of produce volume, surpassed by watermelons (14%) at the end of August. Idaho is by far the biggest producer of potatoes, followed by Washington and Wisconsin, with Colorado’s San Luis Valley rounding out the Top 10.

San Luis Potatoes states, “With 350 days of sunshine a year at an elevation of 7600 feet, summer temperatures remain mild – ideal for potatoes and potato farmers alike. Plus, the surrounding mountains provide abundant pure mountain water from the annual snowmelt.” So far this year, Colorado has shipped 735 loads compared to just 298 at the same time last year. According to Jessica Crowther, assistant director of the Monte Vista-based Colorado Potato Administration Committee, “Acreage is down a couple of thousand acres because some growers cut back on planting. However, early rain and warm days should boost volume.”

Find dry van loads and trucks on DAT One, North America’s largest on-demand freight marketplace.

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, let’s focus on the San Francisco freight market, home to one of the significant produce centers in the nation located in Salinas, CA.

According to the USDA, the average outbound truckload rate for produce loads at the start of October was $3.39 per mile, or an average of $6,300 per load (with a high of $6,737 per load and a low of $5,912). This is almost identical to last year. Over three-quarters of the produce loads shipped last week it included iceberg and romaine lettuce, strawberries, and celery. Although produce volumes were up 3% last week, they are slightly behind last year by just under 6% at the start of October.

Long-haul reefer loads from Salinas to Hunts Point, NY, the largest produce market in the nation, averaged $1.92 per mile or $5,773 per load last week, while carriers were paid an average of $1.86 per mile or $5,600 per load to Philadelphia. Salinas to Los Angeles, at $2.85 per mile, was the highest in 12 months, while Dallas loads averaged $2.12 per mile, the lowest since May this year.

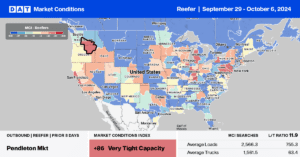

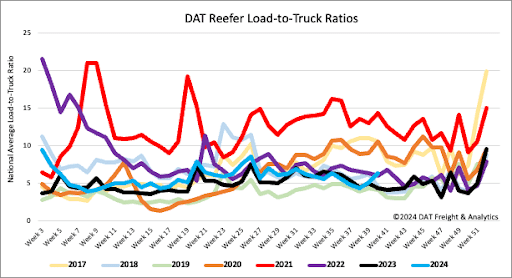

The number of national reefer load postings increased by 17% last week but was 15% lower than last month. The number of carrier equipment postings decreased by 6%, causing the reefer load-to-truck ratio (LTR) to increase by 23% to 6.31.

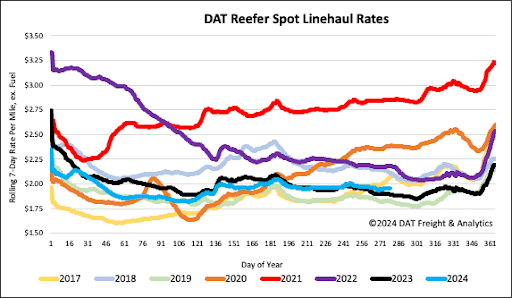

The national average reefer linehaul rate increased by one cent per mile last week to $1.97/mile with a 2% decrease in volume. In the Southeast, spot rates rose by $0.14/mile to an average outbound rate of $2.31/mile. In the larger Atlanta market, spot rates increased by $0.10/mile to $2.13/mile with a 7% decrease in volume. Reefer spot rates are currently at $1.97/mile, which is $0.06/mile higher than last year and nearly the same as the three-month trailing average.