Despite the current economic climate, consumers strongly feel an affinity for restaurants. A staggering 64% expressed their desire to dine at or order from restaurants daily if circumstances allowed. However, the ongoing battle with inflation has reduced their spending and staff gratuities. On average, consumers now allocate 30% of their individual or family food budgets to restaurants each month, a decrease from the 40% reported in May 2022. Interestingly, nearly 2 in 5 (38%) claim to be spending the same or more on restaurant meals than last year but are tipping less. These findings are based on a nationwide study by Popmenu, which surveyed 1,000 U.S. consumers in April 2024.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

As Brendan Sweeney, CEO and Co-founder of Popmenu, points out, the restaurant industry is experiencing healthy sales. However, the competition for guests has intensified in recent months. Consumers are becoming more discerning, with 80% conducting online research on restaurant menus to assess dishes, cost, convenience, and other factors influencing their dining decisions. Interestingly, more than half of consumers desire more significant portions, indicating a preference for restaurants that offer leftovers for another meal.

Popmenu, a leader in restaurant technology, conducted an anonymous, nationwide study of 1,000 U.S. consumers, ages 18 and older, from April 16 to April 17, 2024.

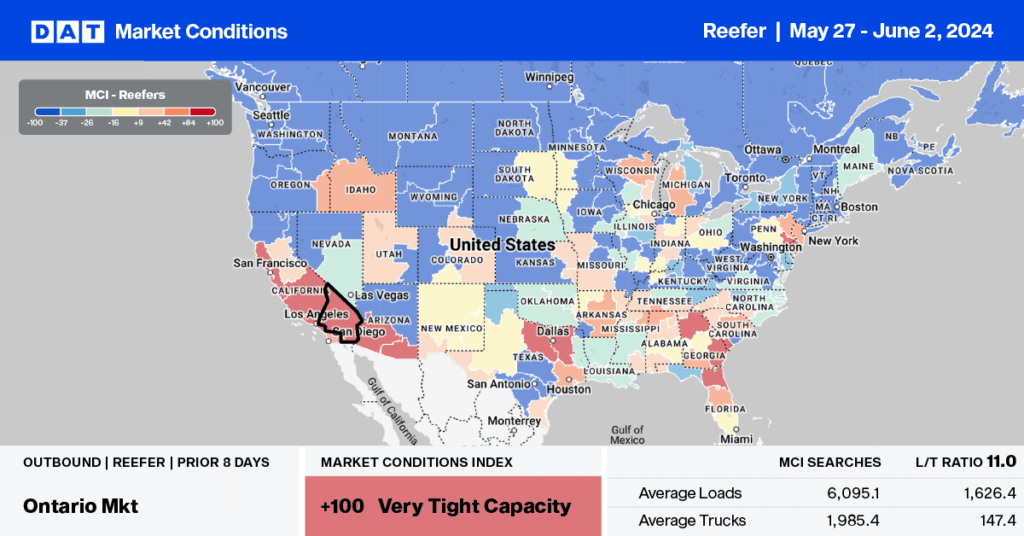

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

It’s watermelon season, and unlike last year when there was a shortage of trucks reported in Florida, this year, the USDA is reporting an adequate supply of trucks. Peak shipments for watermelon occur right before the July 4 celebrations, and so far, shipments are up 14% year-over-year (y/y) and on track to report another strong year. Watermelon shipments were the number one commodity hauled last week, accounting for 16% of truckload produce volume.

Watermelon production in Florida is 11% higher y/y, accounting for 53% of watermelon shipments last week, followed by Mexico (34% of volume), where production is 17% ahead of last year. Texas accounted for 13% of loads last week, reporting 19% higher volume. Reefer linehaul rates for outbound loads in Florida follow a seasonal pattern, which peaks each year in late May/early June. Spot rates from Lakeland to New York averaged $2.36/mile last week, around $0.30/mile lower than last year, while loads to Atlanta averaged $2.00/mile, $0.12/mile lower than last year.

Growers are reporting heavier plantings in Northern Florida, Georgia, and Indiana this year, which means the season could run through September when the fall crops start. Due to adverse weather, the season will also come into one with a very light supply out of Mexico, Guatemala, Costa Rica, and Honduras.

Load-to-Truck Ratio

With produce season generating fewer truckloads this season, we’re also seeing fewer overall spot market loads than last year—down 13% year-over-year (y/y). Carrier equipment posts were 27% lower than last year following last week’s 16% w/w decrease. The net result was that last week’s reefer load-to-truck ratio decreased slightly to 6.29.

Spot rates

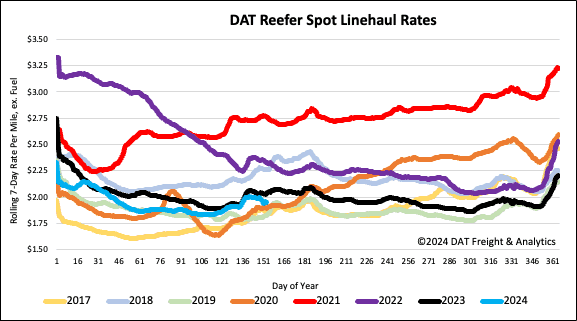

Following a month of elevated linehaul rates and shipping volume before key events, including Mother’s Day and Labor Day, spot rates cooled for the second week. The national average rate ended last week at $1.97/mile, down by just under a penny per mile. At this level, reefer linehaul rates are $0.09/mile lower on a 4% higher volume of loads moved than Week 22 last year.