There’s a chance your produce has traveled more than you have. Consider that 2.6 million registered truck tractors are on our roads daily, and 70% of all U.S. agricultural products are shipped by truck. The average food item travels approximately 5,120 miles through the supply chain to reach your store. National Geographic reporters followed a truck filled with strawberries from field to store to learn more about crops.

In May last year, the reefer truck was one of 590 loaded up at the Watsonville fields of Driscolls, a leading U.S. berry grower in the Salinas Reefer freight market. The truck’s cargo consisted of one pound of strawberries per box, eight boxes per case, 108 cases per pallet, and 26 pallets per trailer. Altogether 23,000lb cargo was worth $90,000. Once loaded, the truck took off across the U.S. toward his final destination, Washington, D.C. Along the way, the long haul truck drivers decide their route and where to stop to fuel up the 240-gallon diesel, which occurred three times for $900 each time.

The 80-hour trip would have required just over 400 gallons of diesel at a total cost of $2,300, representing 36% of the trip’s revenue of approximately $6,500 (DAT Reefer linehaul rate of $2.23/mile times 2,883 miles). The three-day trip was completed by two team drivers, who took turns sleeping, legally driving at most 11 hours daily. Specialist produce carriers on the West Coast aim to achieve a weekly round trip, amassing almost 290,000 miles per year per truck.

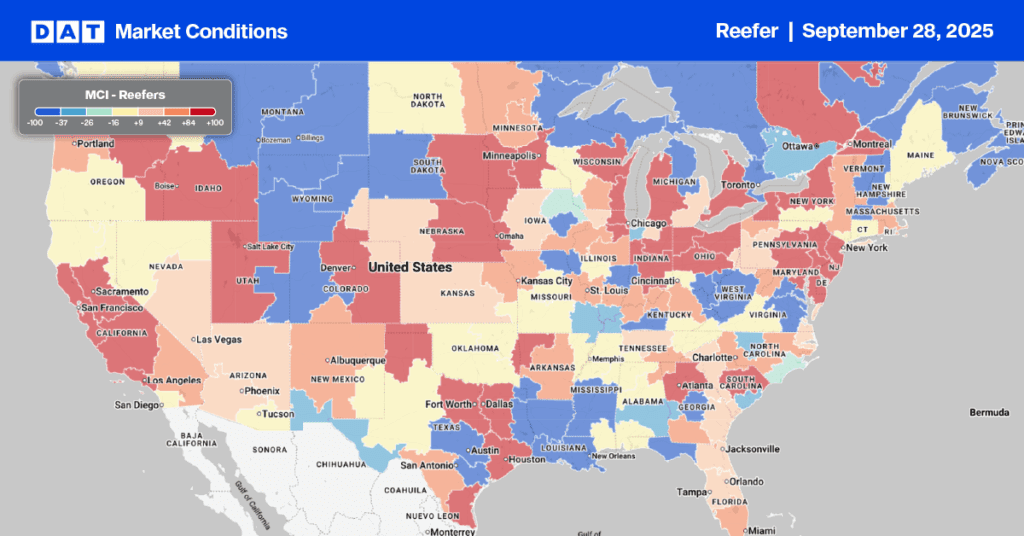

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

According to the latest data from the USDA, of the 20 reporting districts/regions, only two reported a slight shortage of trucks last week. They were in Central FL for winter vegetables, strawberries, and watermelons and for loads of sweet potatoes in Eastern North Carolina in the Raleigh market. Four regions reported a slight surplus of trucks – Nogales, AZ, Kern, Oxnard, and Santa Maria districts in California. Two districts report a slight surplus in McAllen for imports from Mexico in southern Texas and the Yakima Valley in the Pacific Northwest.

Significant rain in California last week played havoc with the transition of crops from the deserts of California and Arizona to the Salinas Valley, hard-hit by recent floods. There will be delayed shipments of strawberries, broccoli, and cauliflower in the Salinas Valley because of the frigid temperatures in February and recent rain making Florida vegetables an attractive alternative to Salinas for receivers until Florida starts winding down in April and May. At $2.06/mile, state-level reefer rates in California are tracking closely with 2019 levels following last week’s $0.02/mile decrease.

In Florida, where outbound state-level reefer rates increased by $0.05/mile to $1.53/mile last week, the further south carriers ventured, the lower the northbound rate. The lowest outbound rates were reported in Miami at $1.45/mile; in Jacksonville, outbound reefer rates averaged $1.83/mile. In Houston, the number four spot market last week reported a 28% w/w increase in volume resulting in a $0.04/mile increase in outbound spot rates to an average of $2.16/mile. Reefer capacity tightened for the fourth week in the McAllen market, the primary crossing point for produce imports from Mexico, where volumes are up 13.2% y/y as tomato season ramps up. Outbound spot rates increased by $0.02/mile to $2.36/mile, while on the 2,000-mile haul to Hunt’s Point, NY, rates averaged $2.34/mile.

Load to Truck Ratio (LTR)

Reefer volumes cooled off again last week, decreasing by just under 1% w/w to around half what they were this time last year. The slow start to produce season in crucial growing regions impacted by adverse weather contributes to lower volumes. Total produce truckload volume was down 11% y/y last week and tracking closely to 2017 levels. Reefer equipment posts were flat last week and around 4% higher than the previous year resulting in the reefer load-to-truck (LTR) remaining flat at 3.15.

Spot Rates

At $2.02/mile, the national average reefer linehaul rate is almost identical to levels reported in 2020, just two weeks before demand crashed resulting from the pandemic outbreak. Reefer spot rates decreased by just over $0.01/mile last week, with just over 60% of DAT’s Top 70 reefer lanes, based on the volume of loads moved, reporting lower rates last week.