This week, the strawberry shipping season ramps up in the Winter Strawberry Capital of the World, centered around Plant City, FL. Even though most U.S. strawberry production comes from California and Mexico (77% combined) over the course of the year, Florida produces the bulk of the winter strawberry crop for U.S. consumers, according to the Florida Strawberry Growers Association.

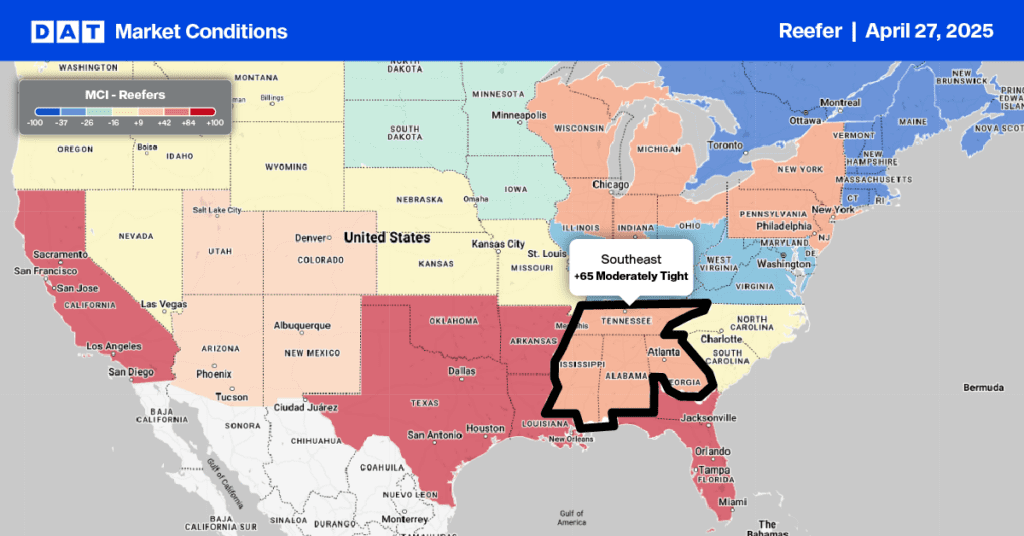

According to USDA data, the Florida growing season typically starts after Thanksgiving and runs to the end of March, with 81% of the annual volume shipped in the first three months of the year. That’s around 213 million total pounds or 400 truckloads per week of strawberries making their way north out of Florida. The highest number of daily loads shipped was on Valentine’s Day last year, which typically leads into the 11-day Florida Strawberry Festival from March 3 to March 13 in Plant City, FL. The event also marks the start of the Florida spring produce season, the warm-up act for the primary produce season beginning in Southern Georgia in April.

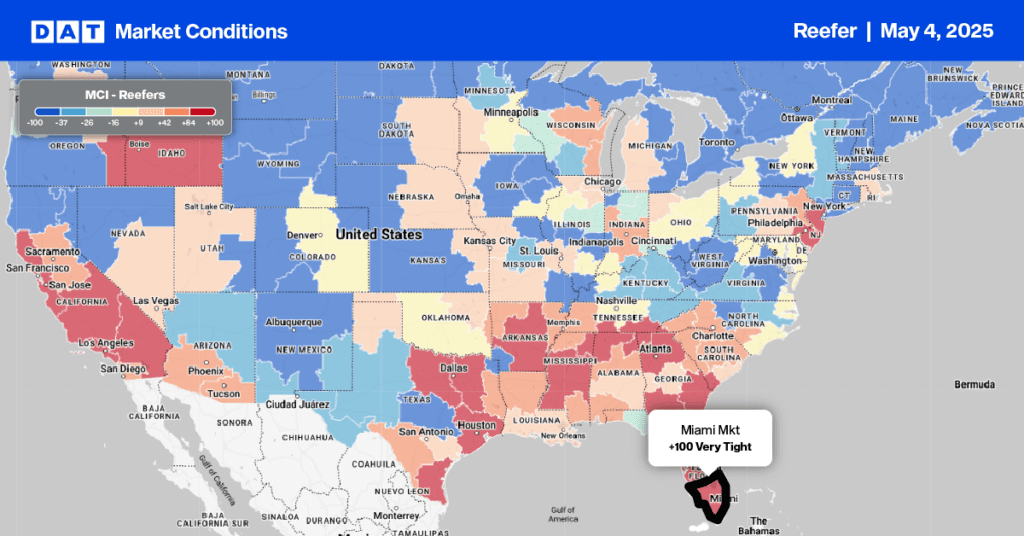

Available capacity in the Lakeland, FL, market has been relatively flat, hovering around the $2.00/mile mark for the past three weeks. Loads moved between Lakeland and Baltimore were up by 14% w/w, but spot rates went in the opposite direction by $0.12/mile to an average of $2.52/mile excl. FSC last week. Loads to Chicago followed a similar trend – loads moved were up by 17% w/w with spot rates down slightly at $1.76/mile excl. FSC. Capacity tightened in Miami as expected; spot rates were up by $0.15/mile to $1.93/mile excl. FSC. The volume of loads moved to Atlanta was up by 21% w/w, but shippers and brokers found plenty of available capacity, with spot rates dropping by $0.26/mile to an average of $1.79/mile excl. FSC.

A similar trend of higher volumes and lower rates was observed in West Coast markets last week. Loads moved from Ontario, CA, to Phoenix increased by 11% w/w, with spot rates dropping $0.34/mile to an average of $4.05/mile excl. FSC. Loads moved from Los Angeles to Phoenix were much the same – loads moved up by 9% w/w and rates down $0.30/mile to an average of $3.80/mile excl. FSC. On the number one volume lane between Los Angeles and Stockton, CA, loads moved dropped by 4% w/w with rates also dropping by $0.21/mile to $3.76/mile excl. FSC. After dropping almost $1.00/mile since the start of the year, reefer spot rates between Los Angeles and Las Vegas stabilized last week at $5.23/mile excl. FSC is still around $0.80/mile higher than the previous year.

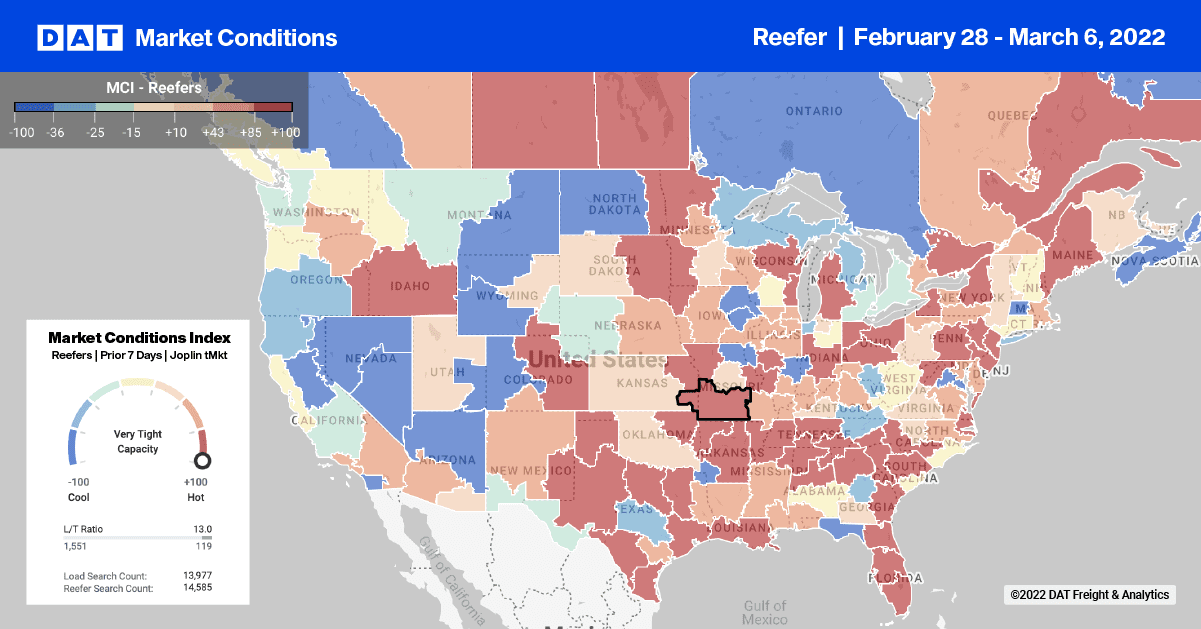

Load post volumes in the reefer sector have dropped 24% in the last four weeks and are about half the market volume recorded at the start of 2022. Last week’s reefer load post volumes were around 21% lower than the previous year as capacity continues to loosen. Carriers’ equipment posts increased for the fifth week in a row resulting in last week’s reefer load-to-truck ratio decreasing again by 5% w/w from 11.03 loads per truck.

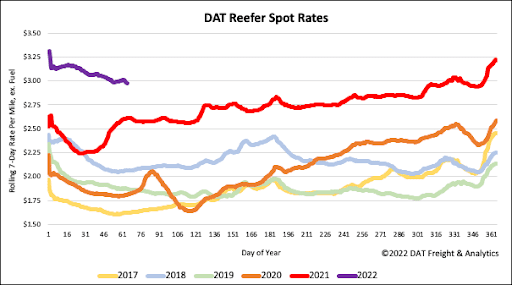

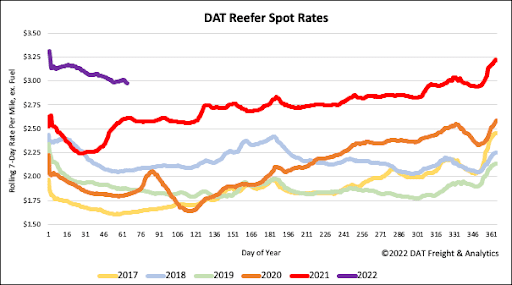

Reefer spot rates tracked closely with the dry van sector last week, remaining relatively flat. The reefer national average spot rate ended just under $2.98/mile excl last week. FSC, which is $0.36/mile higher than the previous year.