The ports of Savannah and Brunswick, Georgia’s deepwater ports, together with inland terminals in Chatsworth, Bainbridge, and Columbus, are Georgia’s gateways to the world. According to data from IHS Markit, Savannah exported the second-highest number of reefer containers in December last year (14% of the total) behind Oakland, CA (17%). Savannah ranks number four on the import side, accounting for 11% of import volume behind Los Angeles, New York, and Long Beach.

2022 was a record year for the Georgia Ports Authority (GPA), handling a record 5.9 million twenty-foot equivalent container units (TEU) in the calendar year, an increase of 5% over the previous year. According to GPA Executive Director Griff Lynch, “It was a challenging year, but collaborative effort across Georgia’s supply chain ensured cargo movement remained fluid.” The Port of Savannah achieved four of its top five months for container volume in 2022, with trade volumes peaking in August at an all-time high of 575,500 TEUs. For asset-based carriers who have been watching the coastal shift in imports to the East Coast in preference to West Coast ports, there is no doubt some of this volume shift will stick, especially as importers move away from China and more towards Southeast Asia manufacturers.

Ocean carriers routing vessels via the Suez Canal to the East Coast in preference to the Panama Canal from the West Coast are expected to push higher TEU volume into East Coast port markets in 2023. In addition to record container cargo in 2022, GPA achieved a 16% increase in breakbulk tonnage to nearly 3.3 million tons last year, an improvement of 443,000 tons compared to 2021. In Roll-on/Roll-off cargo, Colonel’s Island Terminal in Brunswick handled 651,101 units of autos and heavy machinery. Ocean Terminal in Savannah moved another 19,630 Ro/Ro units, for a total of 670,731, an increase of 0.4%.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

According to the USDA’s Truckrate Report, only two produce markets reported a slight shortage of trucks last week – Nogales, AZ, for loads of winter vegetables and Eastern North Carolina for sweet potatoes. State-level reefer linehaul rates in North Carolina increased by $0.10/mile last week to $2.14/mile, the second-highest in seven years driven by solid gains on long-haul lanes from Raleigh, N.C to Lakeland, FL, and Stockton, CA. Loads west to Stockton were paying $1.22/mile, and while that’s $0.12/mile higher than in December, linehaul rates are $0.20/mile lower than the previous year. On the 650-mile haul south to Lakeland, loads were paying much higher at $3.20/mile, although that’s $0.50/mile lower than the previous year.

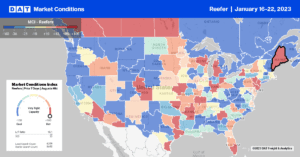

On DATs highest volume reefer lane, linehaul rates for loads from Atlanta to Orlando continue to cool and, at $3.01/mile, are $1.20/mile lower than the previous year. Rates on the northbound return journey are even lower at $1.18/mile, making an average round-trip rate of $2.10/mile for carriers who run that lane continuously. In the Northeast, reefer capacity tightened in Connecticut and Massachusetts, where rates increased by $0.06/mile to $2.16/mile for outbound loads. Gains were strongest in the Springfield, MA, market, where outbound rates averaged $4.32/mile, up $0.72/mile w/w driven by a spike in rates on the regional haul lane south to Harrisburg. Rates on the 300-mile lane increased to an average of $3.55/mile last week, which is $0.63/mile higher than in December and just $0.14/mile lower than the previous year.

Load to Truck Ratio (LTR)

Reefer volumes in the spot market continue to trend down, driven by lower produce volumes in key Winter markets. In Florida, Arizona, and California, major producers of domestic winter produce, volumes are around 40% lower y/y for the middle of January. In Yuma, AZ, the Winter Salad Bowl, volumes are up 4% y/y, while Florida is still feeling the effects of a slow start to the produce season following Hurricane Ian. Volumes are down 30% y/y in the Sunshine State, and in California, after weeks of much-needed yet devastating rain, volumes are currently about a third of where they usually are for this time of the year.

Carrier equipment posts remained at their highest level in seven years resulting in last week’s reefer load-to-truck (LTR) dropping from 4.80 to 3.03.

Spot Rates

After ending 2022 on a high, national average reefer linehaul rates have dropped by 13% or $0.33/mile since the start of the year. Following last week’s $0.09/mile decrease, linehaul rates averaged $2.18/mile last week, which is just over $1.00/mile lower than the previous year. Cooling reefer rates in the early part of the first quarter are not unusual, with the national average still $0.25/mile higher than the average in pre-pandemic years.