By Christina Ellington

Memorial Day is the kickoff for grilling season. According to PIERS data, the US imports over 1 billion pounds of grills and related accessories every year. According to the Hearth, Patio & Barbecue Association (HPBA)’s latest consumer research, grill sales and grilling out are at or near all-time highs. In the most recent State of the Barbecue Industry Report, 80% of all homeowners and 70% of all households in the U.S. own at least a grill or smoker, matching the highest percentage in the study’s history.

As we march closer to the biggest grilling day of the year, July 4th, pitmasters are honing their skills in upcoming barbeque competitions. The Giant National Capital Barbeque Battle celebrates its 30th anniversary this year and will occur on June 25-26th on historic Pennsylvania Avenue in Washington, DC. The most popular types of meat for barbeque are beef and pork. The most sought after regions for their cult-like following of barbeque cuisine are: Texas is most famous for its dry rub beef brisket; Memphis is known for its spicy rubs on pork ribs and pulled pork; Kansas City, pegged as the barbeque capital of the world, made burnt ends (brisket) such a craveable dish; North Carolina is known for its sweet and spicy pulled pork; South Carolina loves all things pork from the whole hog to sausage with a mustard-based sauce.

According to the weekly meat production report from the USDA, the weeks leading up to memorial day saw a 3.2% w/w increase and a 1.7% y/y increase in beef production for the week ending May 21st. Pork production saw a 1.8% w/w increase and a 2.9% y/y increase for the week ending May 21st. Beef production YTD is trending flat with 2021 and is up 0.9% y/y; however, pork production is declining YTD and is down 4.3% y/y. One possible reason for the decline in pork production is reduced pork exports.

According to the latest report from the U.S Meat Export Federation, the first-quarter pork exports fell 20% from a year ago to 629,928 mt, valued at $1.71 billion (down 17%). The pork exports are also following a record year of growth, and China’s zero-COVID policies have in some cases, led to restricted sales of imported cold chain food. First-quarter exports to China/Hong Kong dropped significantly and are down 56% y/y. Looking at PIERS data, meat exports as a whole are down 26% y/y for Jan-Apr, and the largest export ports volumes were also in decline, Oakland (-26%), Long Beach (-15%), and Los Angeles (-27%).

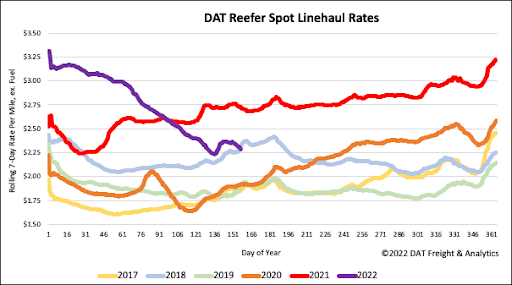

All rates cited below exclude fuel surcharges unless otherwise noted.

According to the USDA, even though volumes are trending upwards, weekly truckload volumes of produce out of California are down by 20,000 loads compared to last year’s same week. Spot rates excluding fuel have also been steadily rising to a state average of $2.54/mile the previous week, but spot rates are almost $1.00/mile lower on key lanes to Chicago out of Fresno than the last year. At $2.35/mile, loads from Fresno to Hunts Point, NY, are averaging $2.35/mile this week, which is $1.09/mile lower y/y. Linehaul rates from Fresno to Lakeland are following a similar trend and are averaging $2.26/mile this week, down $0.88/mile y/y.

Following the late May surge in produce imports from Mexico, reefer linehaul spot rates in Laredo jumped by $0.20/mile last week to an average outbound rate of $2.73/mile. Loads 1,200-miles east to Atlanta were paying $2.84/mile or about $0.10/mile lower than the same week last year, while loads north to Chicago decreased $0.05/mile to $2.37/mile. Outbound capacity also tightened further east in the Houston market, where spot rates increased by $0.25/mile last week to $2.56/mile. Loads to Denver were up by $0.16/mile the previous week to $2.59/mile or around $0.50/mile lower than the last year. In the Macon market, home to Georgia Peach production, reefer spot rates increased by $0.13/mile to an outbound average of $4.01/mile this last week. Loads north to Boston were up for the eighth week following last week’s $0.40/mile increase to $3.44/mile.

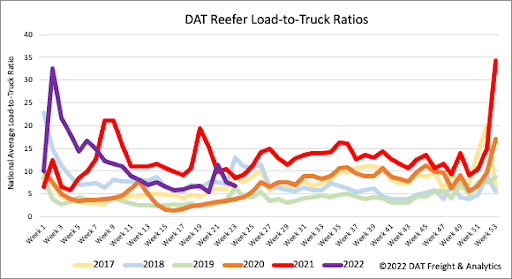

A much cooler start to the 2022 produce season will hopefully be offset by a hot grilling season this year. With grill sales and grilling-out expected to be at or near all-time highs this summer, there’s still time for reefer volumes to pick up. Last week’s short workweek resulted in 20% fewer load posts and 9% fewer carriers posting their trucks for loads, resulting in the reefer load-to-truck (LTR) ratio decreasing from 7.63 to 6.77.

According to the USDA, produce volumes are down by 16% compared to last year. That means carriers are moving around 30,000 fewer loads of fruit and vegetables now – 20,000 fewer loads out of California alone. The reefer linehaul national average ended last week at $2.33/mile, down $0.03/mile w/w and $0.84/mile since the start of the year but almost identical to where reefer spot rates were in 2018.