Hurricane Hilary, the first tropical storm to hit Southern California in 84 years, flooded roads and toppled trees, prompting flood watches and warnings in half a dozen states. The storm hit parts of California’s San Joaquin Valley, bringing rare August downpours that could significantly affect the region’s crops. California’s Central Valley supplies 8% of the country’s agricultural output and 40% of its fruits and nuts – much of which is grown in the massive agricultural corridor between Bakersfield and Fresno. With several harvests that rely on typically bone-dry conditions through August, grapes, almonds, spinach, tomatoes, and other local crops are especially vulnerable, according to AgShared, an agricultural services company in Bakersfield.

“Coming right when pistachio, almond, and corn harvests are due, the economic impact to California farmers could be significant,” the company wrote in a social media post. Shipper and carrier delays were reported by DAT Freight & Analytics customers, with significant travel delays reported on Interstate 10 north of Los Angeles. Further north in Parma, Idaho, Hilary destroyed over 100,000 acres of crops – primarily onions, potatoes, and wheat – following three inches of rain (half the annual average rainfall), according to Shay Myers (@shayfarmkid on social media) at Owyhee Produce.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

In the Fresno produce market, capacity was tight for regional loads to Phoenix, paying carriers $3.34/mile ($0.46/mile higher than the July average) and $0.05/mile higher than last year. On the Fresno-Dallas lane, reefer capacity was mainly flat last week, with spot rates averaging $2.22/mile, or $0.01/mile lower than in 2022. In the Pacific Northwest (PNW), loads from Pendleton, OR, to Los Angeles are $0.19/mile higher than last year at $1.35/mile. On the long-haul lane from Pendleton to Atlanta, outbound reefer rates averaged $2.00/mile, which was $0.14/mile higher than last year. In the overall Pendleton market, capacity continues to tighten following last week’s $0.04/mile increase to $1.79/mile.

A similar trend was reported in nearby Twin Falls, ID, where outbound reefer rates averaged $1.96/mile last week, up $0.13/mile in the previous month. In the broader PNW region, reefer rates averaged $1.85/mile last week, identical to 2018 and on track to increase by an estimated $0.40/mile during the Fall produce season between now and year-end.

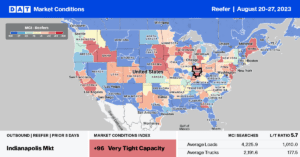

Outbound reefer rates in the Midwest meat patch increased $0.10/mile last week to a regional average of $2.52/mile. Outbound capacity was incredibly tight in Iowa, where rates surged, rising by $0.39/mile to an average of $3.08/mile. Illinois reefer rates averaged $2.62/mile, with solid gains recorded in Chicago, where reefer loads paid carriers an average of $2.31/mile, up $0.07/mile in the last week.

Load to Truck Ratio (LTR)

After dropping for the previous three weeks, reefer spot market volumes reversed course ahead of Labor Day, increasing by almost 6% w/w. Carrier equipment posts were down by 2% last week, resulting in last week’s reefer load-to-truck ratio (LTR) increasing slightly from 4.07 to 4.39, identical to 2019.

Spot Rates

After remaining flat the previous two weeks, reefer linehaul spot rates increased by $0.02/mile to an average of $1.97/mile last week. Reefer spot rates have dropped $0.11/mile since the July 4 break, which aligns with the historical cooling of rates between Independence Day and Labor Day. Reefer rates are now $0.29/mile lower than last year and $0.09/mile higher than 2019.