Fall is the busiest time of the year in Central California; workers at the vineyards and wineries hurry to pick grapes. The peak season lasts from August until October, but some grape varieties can be harvested as late as December. But this season may be a little different – grape prices are expected to be much higher following the estimated 25 million boxes of grapes lost due to Hurricane Hillary. The impact on reefer truckload volume is already evident. According to the USDA, the total truckload volume in California is the lowest in seven years and is already around 7% lower than last year.

This is worth watching for reefer carriers, especially those relying on California loadings of grapes during peak loading season from now to the end of November. Unlike the first four months of the year, when just under half of the grape production comes from Chile and Peru via the Port of Philadelphia, a similar volume was produced in California in the fall of 2022. Almost 100% of grape production came from the San Joaquin and Coachella valleys in August, September, and October last year. The USDA is reporting an adequate supply of trucks in both regions, but with the remaining four produce-growing regions in California reporting a slight surplus of trucks last week, capacity could loosen in the grape-growing regions, forcing spot rates down even further.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

After dropping for the prior three weeks, outbound reefer rates in Laredo, the largest border-crossing market along the southern border, increased by $0.06/mile last week to $1.62/mile, boosted by a 32% w/w increase in load post volume. In the larger reefer spot market in McAllen, in the Rio Grande Valley, load post volumes jumped by 22% w/w, but with a surplus of available capacity, outbound rates decreased by $0.10/mile to $1.61/mile last week.

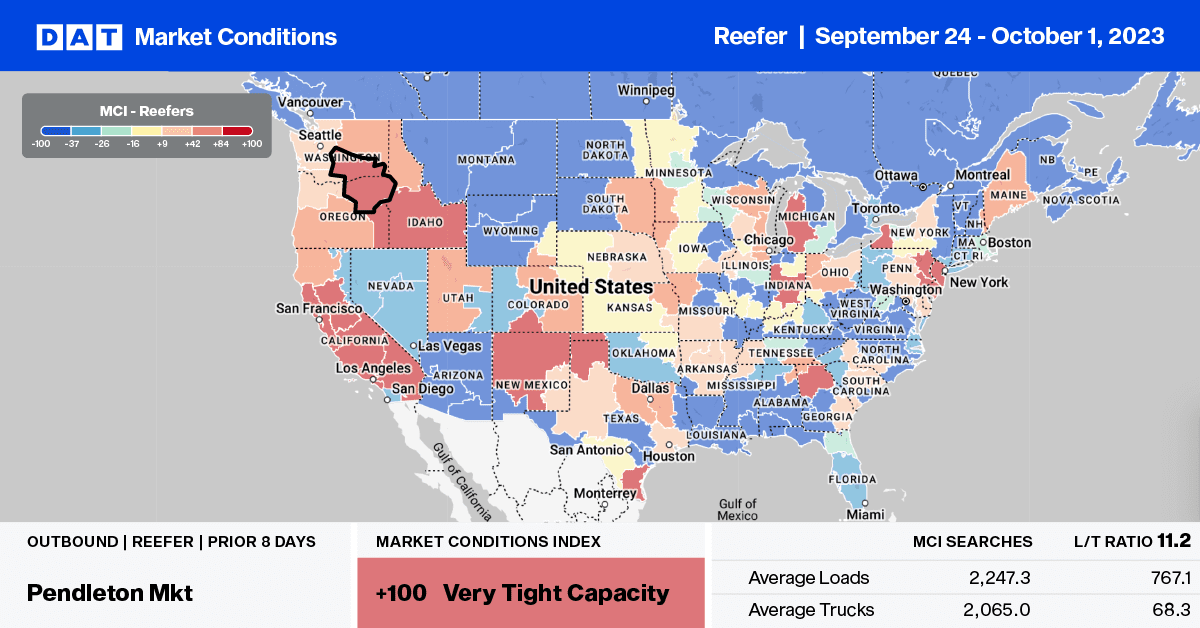

In the Pendelton, OR, reefer market, spot rates increased for the fourth week to $1.93/mile following last week’s $0.02/mile increase, even though load post volumes were flat last week. In Twin Falls, ID, the second-largest reefer spot market in the Pacific Northwest (PNW), spot rates dropped $0.08/mile to $2.07/mile on an 8% lower load post volume last week. In the Midwest’s Joliet and Chicago markets, reefer loads paid carriers an average of $ 2.38/mile, down $0.15/mile in the last two weeks following last week’s $0.04/mile decrease.

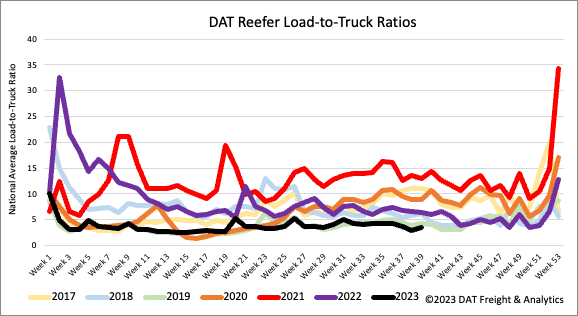

Load to Truck Ratio (LTR)

Even though reefer load posts (LP) volume increased by 3% last week, they were still 23% lower than last month, influenced by declining national produce volumes, which were down 8% last week. Carrier equipment posts decreased by 11% w/w, resulting in last week’s reefer load-to-truck ratio (LTR) increasing by 18% to 3.49, almost half last year’s LTR.

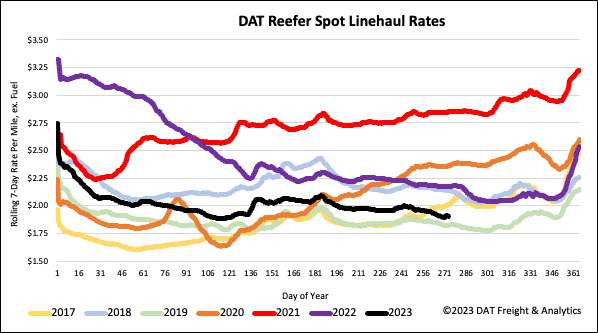

Spot Rates

At $1.94/mile, reefer linehaul spot market rates are $0.28/mile lower than last year and $0.08/mile higher than in 2019, following last week’s $0.01/mile increase. Reefer spot rates have dropped $0.18/mile since the July 4 produce season high, which aligns with pre-pandemic years, when rates decreased by $0.13/mile on average over the same timeframe.