Watermelons grow well in the widespread hot and dry weather prevalent this summer, and these conditions are bringing on the melons faster with a sweeter profile. According to USDA data, Florida is the largest watermelon growing region, followed by Georgia, Texas, and California. YTD volumes are currently down 4% y/y; however, 2021 had the 2nd highest volumes in the last ten years. Georgia’s season is peaking, and volume is up 29% y/y, while Texas and California are showing a slow start to the season.

In California, y/y volume is currently down 7%; Bryan Van Groningen, whose family sells watermelons outside of Stockton, CA, said, “I’d say our fields are producing a decent crop at this point.” Van Groningen said harvest began June 20. He was aiming to have melons moving through his Manteca packing shed sooner than that, but cooler spring weather delayed his plans. Juan Anciso, a professor and horticulturist with the Texas A&M AgriLife Extension, advised Texas melons will be extra sweet this season, despite lower yields overall; currently, the Texas crop volume is down 15% y/y. “There were a lot of reasons why some growers kind of delayed their harvest, and a big part of that reason was labor to go harvest these watermelons. Some fields were a week to 10 days late in getting in there and harvesting.”

Based on prior years’ data from the USDA, July harvests should peak in Georgia, the Carolinas, Missouri, and Delaware for reefer drivers looking to capitalize on these heavy produce loads. In addition, the Texas and California harvests are ramping up and should peak in August.

All rates cited below exclude fuel surcharges unless otherwise noted.

Despite higher volumes of watermelons, reefer spot rates in Florida continue to cool after dropping by $0.11/mile last week to a state outbound average of $1.45/mile, down $0.31/mile in the previous month. Reefer capacity was, however, tighter in Mobile, AL, last week, where spot rates jumped by $0.39/mile to $2.19/mile. Loads 1640 miles west to Phoenix were up $0.09/mile last week to an average of $1.89/mile, which is just $0.11/mile lower y/y. On the regional-haul lane to Orlando, spot rates increased by $0.35/mile above the June average to $3.38/mile last week.

Reefer spot rates continue to climb in Chicago, averaging $2.56/mile for outbound loads following last week’s $0.05/mile increase. Chicago reefer rates have increased by $0.18/mile in the previous month due to load post volumes surging by 46% over the same time frame. Capacity also tightened on the 1,200-mile lane to Orlando, where rates averaged $2.15/mile last week, representing the first time rates had increased since January when they were $2.00/mile higher at $4.15/mile. From Chicago to Seattle, capacity tightened also following a $0.07/mile increase to an average of $1.72/mile, which is $0.14/mile lower than the previous year.

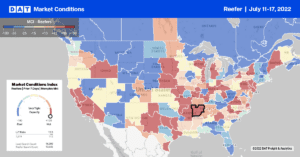

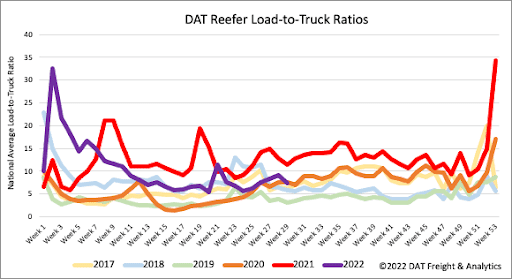

USDA long-haul produce volumes were down by just over 13,000 truckloads last week compared to the previous year but up slightly compared to the first week of July, contributing to the 1% w/w increase in reefer load posts. Like dry van, carrier equipment posts are at record-high levels for this time of the year, now 2% higher than the over-supplied 2019 reefer market. As a result, the reefer load-to-truck (LTR) ratio dropped back to 7.38, almost identical to this time in 2020.

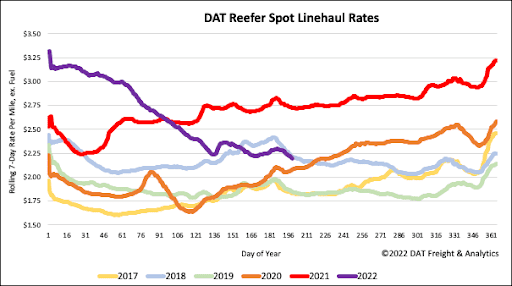

Reefer linehaul spot rates are now $0.02/mile lower than this time in 2018, following last week’s $0.03/mile decrease to a national average of $2.24/mile. Compared to the previous year, reefer spot rates are $0.54/mile lower but still $0.28/mile higher than the pre-pandemic average for this time of the year.