The Winter Salad Bowl in Yuma, AZ, produces close to 90% of all leafy greens consumed in the U.S., with the current shortage of romaine lettuce sending retail prices soaring. Typically, DAT Freight & Analytics report increasing spot rates and volumes throughout January but not this year due to heavy rain and freezing temperatures resulting in “widespread lettuce ice damage,” according to Mark Shaw, vice president of operations at Markon Cooperative Inc.

“The impact on desert row crop quality and yields was broadly felt on most head and leaf products through the majority of January,” Shaw said.

As temperatures dropped so did spot rates, decreasing by $0.26/mile in the last month. Yuma reefer spot rates to all destinations are averaging $3.23/mile excl. FSC this week, but in the last two weeks, spot market load post volumes have increased by 18%. This could be a sign lettuce production is returning to seasonal levels with higher spot rates most likely to follow in the second half of February. A popular destination for loads out of Yuma is Denver, where spot rates have decreased by $0.25/mile from the 12-month high of $4.64/mile excl. FSC in January, but that’s still just over $1.00/mile higher than this time last year.

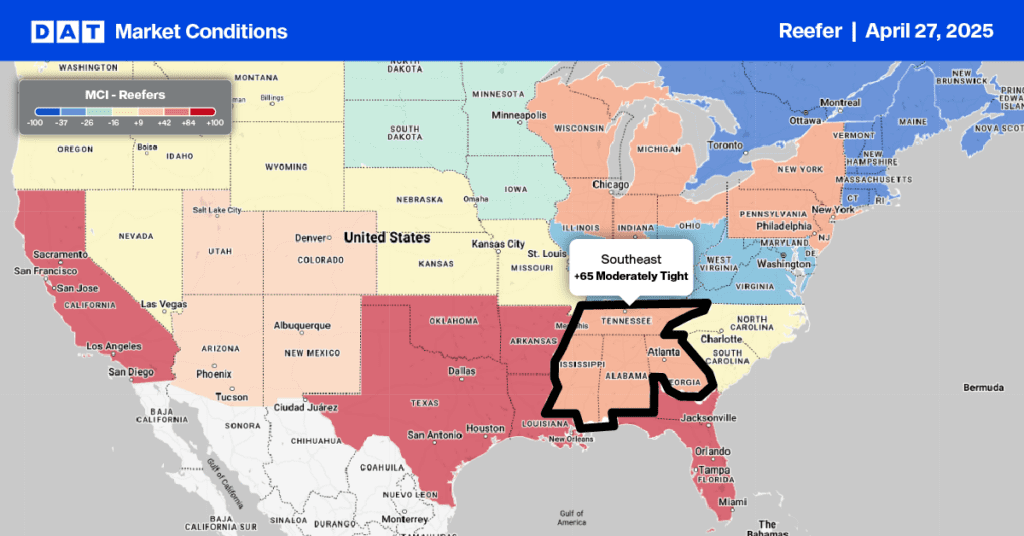

Last week, the USDA reported a shortage of trucks in Eastern North Carolina for sweet potatoes, Upper Valley/Twin Falls Idaho for potatoes, Central and South Florida for winter vegetables and strawberries, San Luis Valley in CO, and the Red River Valley ND/MN for potatoes. In North Carolina, reefer spot rates were up $0.10/mile last week to an average of $2.65/mile excl. FSC, while in the Upper Midwest in Sioux Falls, SD market, reefer capacity was very tight, pushing spot rates up by $0.26/mile in the last week to $4.24/mile excl. FSC for outbound loads.

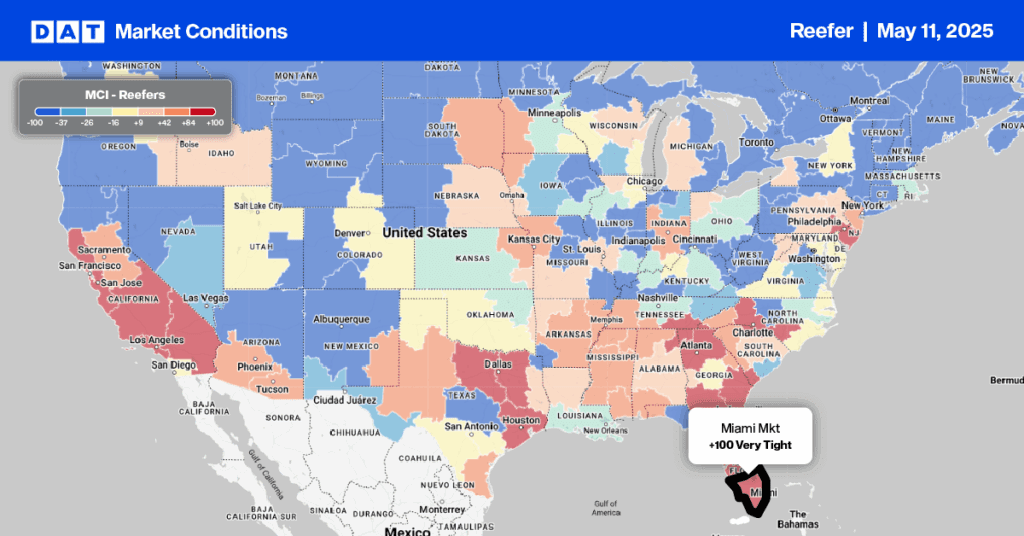

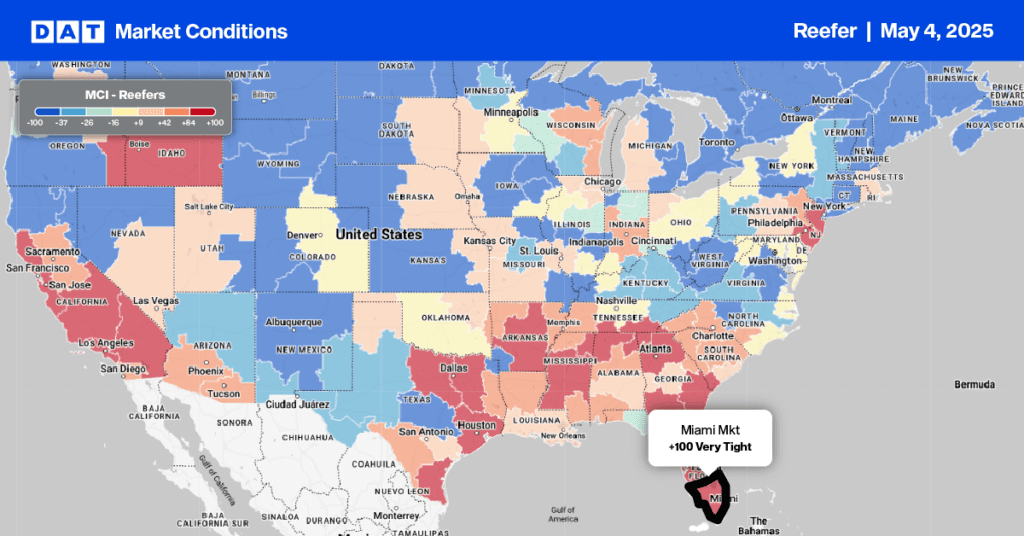

Capacity continued to tighten in Florida ahead of Valentine’s Day – spot rates were up $0.20/mile in Miami to an average outbound rate of $2.11/mile excl. FSC. Loads to Atlanta were up $0.34/mile y/y to an average of $2.14/mile excl. FSC, while loads further north to Hunts Point, NY, dropped back slightly to $2.63/mile excl. FSC. That’s $0.33/mile higher than this time last year but $0.11/mile lower than the previous month’s average rate.

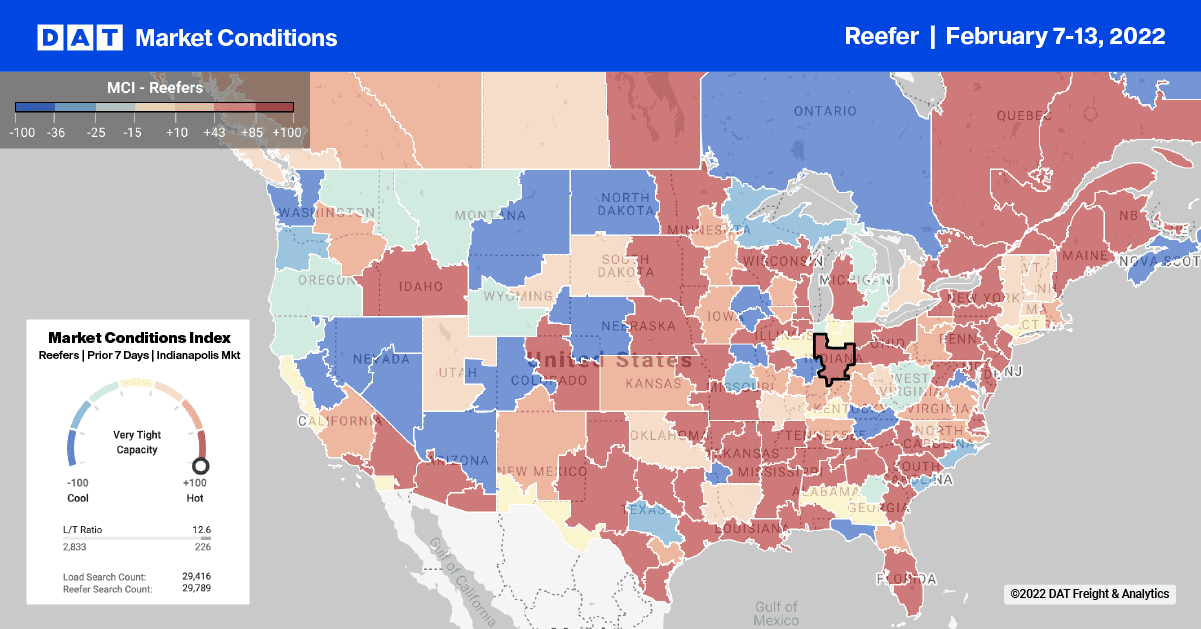

Available capacity remained tight in Chicago last week, where spot rates increased by $0.05/mile to an average of $3.93/mile excl. FSC but capacity eased slightly on the 716-mile haul south to Atlanta. After reaching a 12-month high of $4.69/mile excl. FSC in January, last week’s average spot rates dropped by $0.14/mile to $4.55/mile excl. FSC. That’s still $1.16/mile higher than the same time last year.

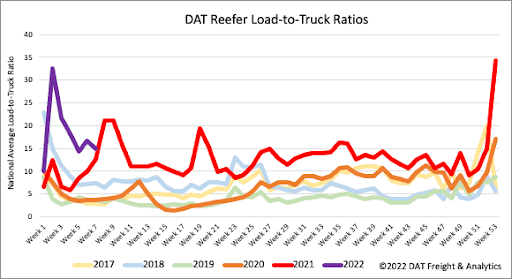

Following the prior week’s surge in load post volumes, last week’s reefer load post volumes decreased by 3% w/w but remained 33% higher compared to this time last year. Equipment posts were up by 8% last week, resulting in the reefer load-to-truck ratio decreasing by 11% w/w from 16.71 to 14.93.

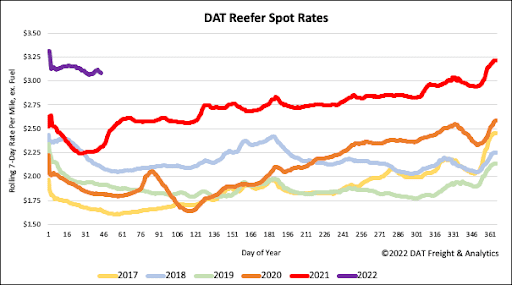

After dropping by $0.09/mile in the last four weeks, reefer spot rates were flat last week even though the volume of loads moving in DAT’s freight network increased by 3% w/w. The volume of spot market reefer freight has been steadily rising for the last four weeks and is now up by 25% m/m. The national average reefer spot rate ended last week, where it started at $3.07/mile excl. FSC. Reefer spot rates are still $0.77/mile higher than the same time last year.