The first major truck show of the 2025 season is taking place this week in Louisville, KY. Truckers, fleet owners, media representatives, equipment manufacturers, and industry suppliers will gather for the world’s largest and longest-running heavy-duty trucking show.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Starting this Thursday, March 27th, truckers and their families will constitute the majority of attendees over the three-day event. Many truckers have been preparing their show trucks for weeks. Some were even at the Mid-America Truck Show (MATS) last Saturday, “clocking their wheels,” removing stones from tire treads, cleaning the undersides of their trucks, and applying the final coat of wax to the exterior. Attendees should be prepared for unpredictable weather, as they often experience all four seasons during the transition from winter to spring. Recent years have seen truckers facing rain, snow, sleet, and sunshine within the span of just a few days, so getting sunburned is also a possibility!

The largest annual trucking event in the world was founded by Paul K. Young (PKY), former President of the Kentucky Motor Transport Association, tire salesman, and a few industry colleagues who had a vision. They aimed to create a show in the eastern United States, similar to the then-largest heavy-duty show, the International Trucking Show in California, and more accessible than the North American Truck Show that had been held in Boston for many years.

DAT Freight & Analytics will be presenting their annual freight market update in addition to their popular booth in the South Wing – booth number 37415.

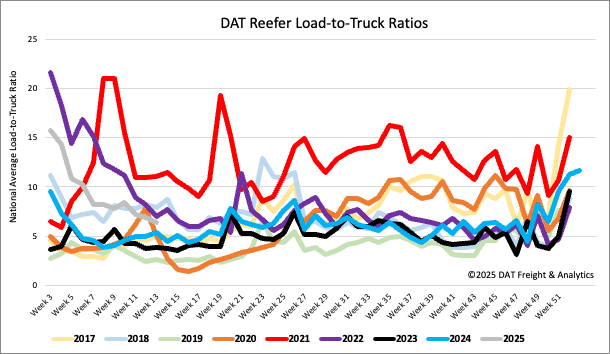

Load-to-Truck Ratio

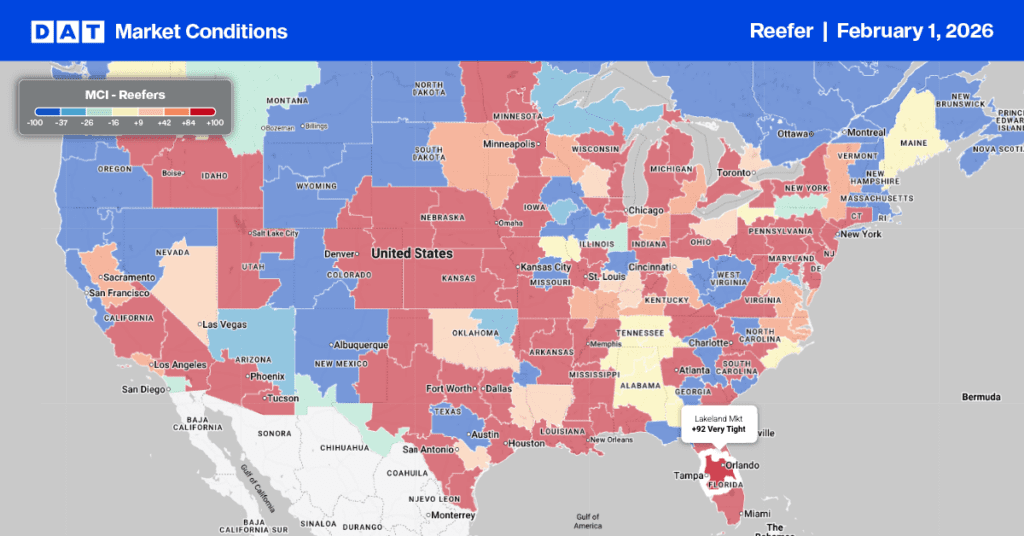

Reefer load post volumes decreased for the third week following last week’s 11% decline. Last week’s reefer load-to-truck ratio (LTR) was down slightly at 6.41.

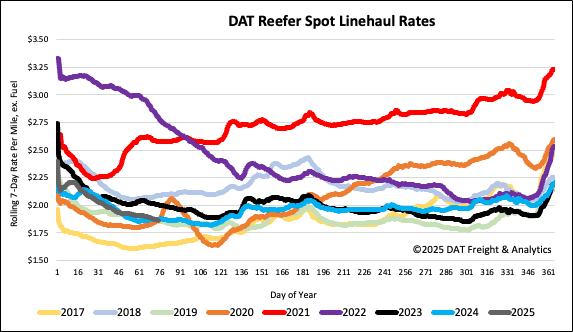

Spot rates

Reefer linehaul rates decreased by $0.02/mile last week, paying carriers an average of $1.89/mile on a 3% lower volume. After being higher than last year since the end of January, reefer spot rates are now $0.01/mile lower than last year and identical to 2019. According to the USDA, North American produce volumes dropped 23% last week, erasing the gains from the last week of February. U.S. truckload produce volumes are 6% higher than last year, while cross-border produce volume from Mexico is down 6% w/w following the pre-tariff surge in February.

Weekly reports