Peak blueberry shipping begins next month, with South American shipments arriving from Peru, Chile, and Colombia, mainly at the Port of Philadelphia. This also coincides with the start of the Pacific Northwest season, which runs from July to the end of September. Imported blueberries account for 75% of annual production, with Peru (36%) the number one exporter to the U.S., followed by Mexico (16%), Chile (13%), and Canada (7%). Washington State, Michigan, and Oregon account only for a combined 8% of total blueberry production, including imports, but are the largest producers in the U.S. (excluding imports).

The Pacific Northwest blueberry season clashes with the potato, onion, pear, apple, cherry, and peach seasons, typically resulting in tighter refrigerated capacity in the region. Although load post volumes have not yet seen any dramatic swings – load posts are down 3% over the last week and outbound spot rates are down $0.02/mile w/w to a regional average of $1.70/mile. On some high-volume reefer lanes, including Pendleton, OR, to Atlanta, spot rates are around $1.88/mile, the highest since the start of the year and but about $0.12/mile lower than in 2022.

Linehaul rates out of this region typically peak closer to Thanksgiving when added volume from Christmas tree production drives up demand for long-haul reefer loads. At $1.66/mile, Oregon state-level rates are currently down $0.11/mile from 2022, although they are expected to climb another $0.50 to $0.60/mile by the end of the year based on last season’s rates, which increased from $1.79/mile in August to $2.36/mile just after Thanksgiving.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Only two of the 19 produce-growing regions reported a slight shortage of trucks last week, according to the USDA. Delaware, Maryland, and the eastern shore of Virginia reported a slight shortage of trucks for the second week for watermelon loads, while in southwest Indiana and southeast Illinois, trucks were in demand for loads of watermelons and cantaloupes. Outbound reefer rates averaged $2.46/mile in this region following last week’s $0.03/mile increase.

Outbound spot rates surged in the “Meat Patch” last week in Kansas and Nebraska, where rates were up $0.26/mile to $2.58/mile. In the Hutchinson, KS, market, reefer spot rates averaged $2.63/mile last week, up $0.47 in the last month, with loads to Atlanta paying carriers $2.58/mile. Regional loads south to Dallas averaged $3.36/mile, the highest since January.

Capacity continues to tighten in Wisconsin, where the potato harvest is underway – outbound loads averaged $2.62/mile in Madison, up $0.10/mile w/w. Milwaukee reefer rates averaged $2.05/mile last week, while in Green Bay, spot rates averaged $2.36/mile. Solid gains were reported in Eau Claire following last week’s $0.13/mile increase to an outbound average of $2.46/mile.

Load to Truck Ratio (LTR)

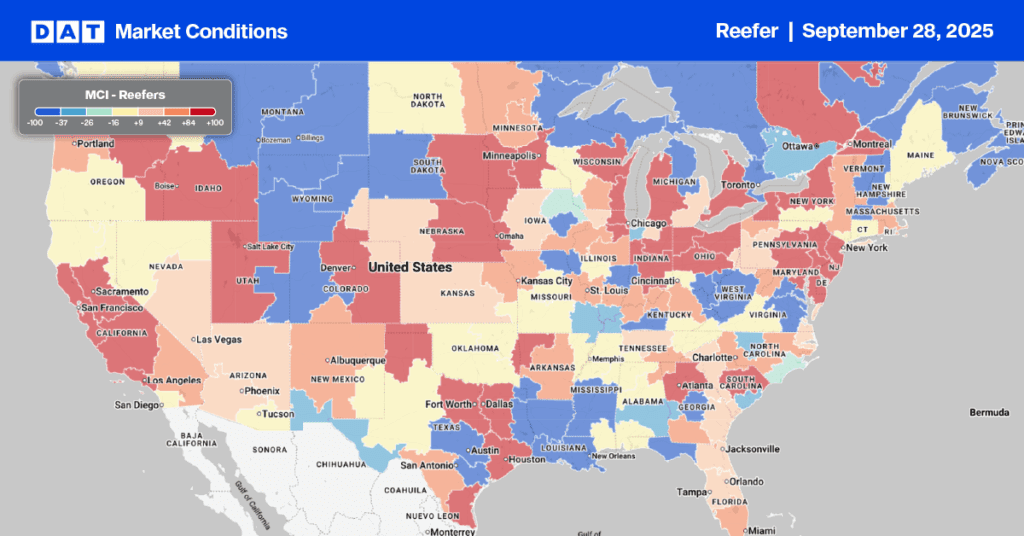

After surging the week prior, reefer spot market volumes dropped by 16% last week and are now just 2% higher than in 2019. Carrier equipment posts were mostly flat last week, resulting in last week’s reefer load-to-truck ratio (LTR) reducing from 5.04 to 4.30, identical to 2019 LTR levels.

Spot Rates

After remaining flat the prior week on higher volumes, reefer linehaul rates dropped just over $0.02/mile to a national average of $1.95/mile. Reefer spot rates are $0.34/mile lower than in 2022 and only $0.07/mile higher than in 2019 – the gap is closing.