The Philadelphia freight market is home to the largest third-party reefer terminal in the United States, the Packer Avenue Marine Terminal. Offering over four million cubic feet of refrigerated cargo space and 2,200 reefer plugs, the terminal offers 200,000 square feet of on-dock storage space for auto, steel, and project cargo. Located right under Interstate 76, the terminal has direct access to two class-one railroads, the CSX and NS.

Philadelphia is the second-largest reefer spot market in the DAT freight network, representing 3% of weekly volume, with nearby Wilmington, Delaware, in the Baltimore market accounting for another 2% of weekly volume. Both markets and ports are located on the Delaware River, ideally for refrigerated imports from South America. In 2022, 44% of refrigerated produce imports from South America arrived in Philadelphia-Camden (27%) and Wilmington (17%) ports, bananas (48%), pineapples (13%), grapes (9%), cantaloupe (4%), and other tropical fruits (4%) accounting for three-quarters of the volume.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

For spot market reefer carriers, top destinations include Boston, Toronto, and Detroit, where load moved volume is up 19% (year-over-year) y/y and rates are down 10% y/y. At $2.79/mile, reefer linehaul rates have been consistently lower for all of 2023 compared to the soft 2019 freight market. This starkly contrasts with average rates of $5.25/mile to these destinations recorded on March 4, 2022.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

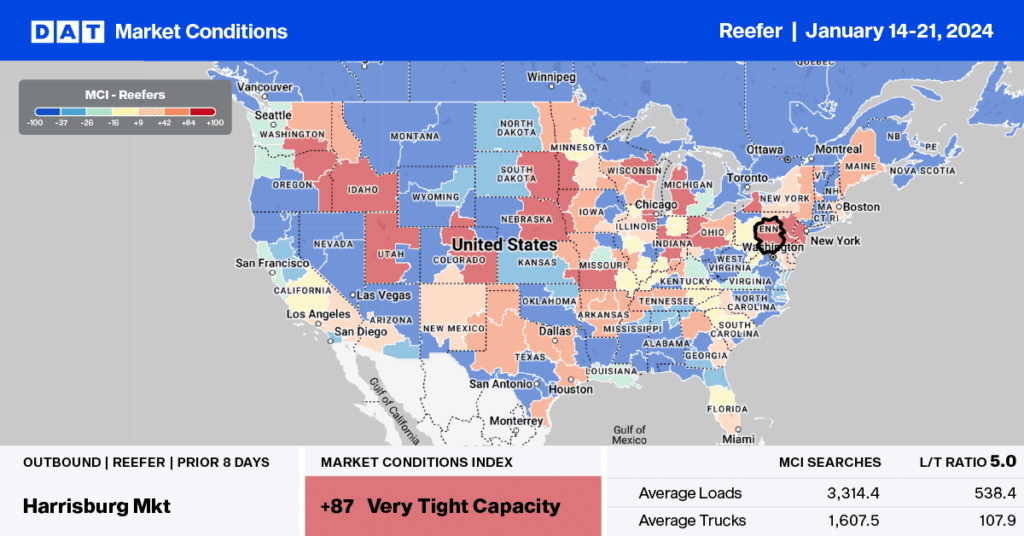

The USDA reported an adequate supply of refrigerated trucks in most markets at the start of last week. However, a slight shortage of trucks was reported in the Pacific Northwest (PNW) in Idaho, Washington, and Oregon, where ice accumulations were significant. PNW outbound reefer spot rates jumped by $0.22/mile last week, averaging $2.49/mile and identical to this time in 2021. In Washington state, the volume of reefer loads moved was down 6% w/w, while spot rates increased by 11%.

After dropping by $0.40/mile in December, linehaul rates for reefer loads from Spokane to Los Angeles increased by $0.35/mile in the last week to an average of $2.34/mile. Loads to Dallas paid carriers $2.51/mile, the highest in 12 months, while Atlanta loads were the highest in 12 months at the same rate per mile.

In Nebraska, reefer linehaul rates spiked by $0.37/mile to an outbound state average of $2.98/mile, while in the Omaha market, volumes plunged by 31%, and rates increased by 15% last week. Loads from Omaha to Chicago paid carriers $3.09/mile, almost $1.00/mile lower than the surge in rates during the 2021 Polar Vortex.

Load to Truck Ratio (LTR)

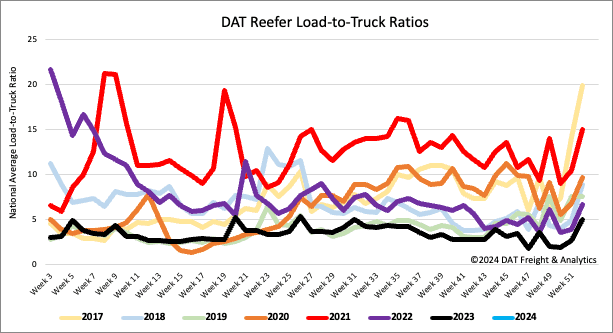

Last week, the cold temperatures across the U.S. sent shippers looking for refrigerated equipment to stop loads from freezing in transit. Adding “Protect from Freeze” to bills of lading adds a premium to loads that would typically move in dry vans. Reefer load post (LP) volumes surged last week, increasing by 25%, while the cold weather slowed down truckers, resulting in 12% fewer equipment posts. The net result was the reefer load-to-truck ratio (LTR) spiked by 41% w/w to 4.92.

Spot rates

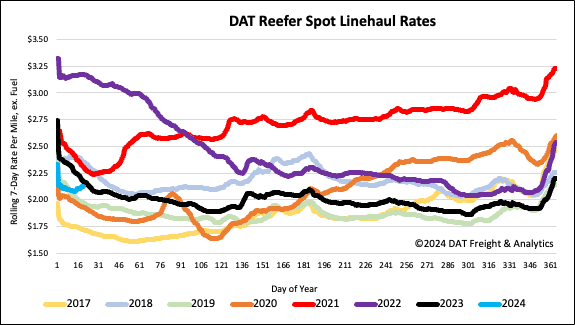

Reefer capacity was in high demand last week as shippers sought equipment to keep traditional dry van freight from freezing. After dropping by $0.10/mile over the first two weeks of the year, reefer linehaul spot rates increased by $0.06/mile last week to a national average of $2.14/mile. Reefer spot rates are $0.04/mile lower than last year, and compared to the start of 2020, when the market was oversupplied, linehaul rates were $0.20/mile higher last week.