One of the more critical dates on the annual produce calendar is the Vidalia onion “pack date,” signaling the start of the produce shipping season. Each year Vidalia onion devotees eagerly await the announcement of the pack date or time shoppers will soon be able to purchase the product, which is only available for a limited time each year. The date is determined each year by the Vidalia Onion Committee (VOC), composed of industry members, agriculture scientists, and the Department of Agriculture, based on soil and weather conditions in 20 South Georgia counties. This year’s pack date is April 17 and usually runs through to early September.

According to Georgia Agriculture Commissioner Tyler Harper, “It’s an exciting time for farmers and producers in our state and for consumers across the country as we look forward to enjoying the sweet onion once again. The Vidalia onion has become a sought-after ingredient by professional chefs and home cooks alike, and we’re proud to grow them right here in Georgia.” The pack date is determined by soil and weather conditions during the growing season, contributing to high-quality Vidalia onions.

From a freight market perspective, the 2023 produce season begins in Florida with fruits, including strawberries and winter vegetables. Then it moves north to Georgia and parts of South Carolina where onion and peach growers compete for available capacity starting a chain reaction increasing reefer demand from April through July 4 each year.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

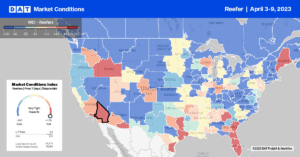

Early signs that produce season volumes will impact national spot rates emerged last week in two key markets – California and Florida. For the first time in five weeks, outbound linehaul rates in California increased following last week’s $0.03/mile gain to a state average of $2.04/mile. That’s identical to this time in 2019. Fresno spot market volumes were up 8% w/w, making it four weeks of gains reversing the three-week slide in spot rates, which increased by a penny-per-mile. In Ontario, rates have been rising for the last month following last week’s $0.03/mile increase to $1.92/mile.

In Florida, where produce season is fully underway, outbound reefer linehaul rates jumped by $0.19/mile to a state average outbound rate of $1.63/mile. According to the USDA, weekly truckload volumes of produce in Florida are 14% higher y/y, with solid gains reported in Lakeland, the largest produce market in the state, where rates increased by $0.15/mile to $1.43/mile reversing a three-week slide. Miami outbound rates at $1.54/mile were up $0.18/mile after being flat for the prior two weeks.

On the southern border in McAllen, reefer rates increased by $0.03/mile to $2.34/mile following a 5% w/w increase in volume. According to the USDA, weekly truckload produce volumes between Mexico and Texas are up 24% y/y, with most of that volume crossing in the McAllen market. Loads to Atlanta were flat at $2.60/mile, while loads north to Dallas were down slightly at $2.96/mile.

Load to Truck Ratio (LTR)

Reefer load posts have dropped 15% in the last month following another 2% w/w decrease and are now 20% below 2020. After being primarily flat for the previous month, carrier equipment posts increased by 2% last week, pushing down the reefer load-to-truck (LTR) from 2.70 to 2.61, almost identical to LTR observed in 2019 and 2020.

Spot Rates

At $1.98/mile, the national average reefer linehaul rate was flat last week as early-season regional produce volumes in Florida and California show signs of influencing capacity nationally. Spot rates are 25% lower than last year and remain $0.11/mile higher than in 2019.