By Christina Ellington

Huy Fong Foods, the maker of the popular Sriracha hot sauce, sent a letter to its suppliers advising that all orders after April 19, 2022 will not be fulfilled until after Labor Day, and they will not accept new orders until September. Huy Fong Foods warned its customers of potential interruptions in July 2020, highlighting ongoing shortages of chili pepper inventory. Unfortunately, due to weather conditions affecting the chili crop, they are now experiencing an extreme shortage. Donna Lam, executive operations officer for Huy Fong, said the Irwindale, Calif.-based company sources chiles from multiple suppliers in different regions of Mexico. The chiles are grown during both the fall and spring seasons. “It’s a crop thing and something that we can’t predict,” she said. “It’s been happening since last year, and this year is a lot worse, and that’s what put us back. Lam also said the supply was a “very reduced amount” but not totally wiped out. Huy Fong’s Sriracha is an American-made spicy sauce with Thai roots, invented by Chinese-Vietnamese refugee David Tran in 1980. The company uses more than 50,000 tons of jalapenos each year to produce Huy Fong Foods’ legendary hot sauce, known for its spicy kick, vinegary tang, and garlic aftertaste.

According to the latest USDA data, Mexico’s import volume of “Peppers Other,” with crossings in CA and AZ, is down 17% y/y for Jan-May. The highest volume of pepper imports crosses through Nogales, AZ, where volume is down 10% y/y; the second-highest crossing is in Otay Mesa, CA, and its volume is down 29% y/y. Pepper imports through Pharr, the Rio Grande, and Roma, near McAllen TX, are up 2.6% y/y. Chili peppers are the second-most-cultivated vegetable in Mexico, behind tomatoes. They also account for 20% of Mexico’s national vegetable production. Chihuahua and Sinaloa lead the chili pepper production, accounting for 47% of the yearly output.

All rates cited below exclude fuel surcharges unless otherwise noted.

California shipped almost 43,000 fewer truckloads of produce last month compared to the previous year, and according to growers, the drought is impacting crops planned and yields more so this year than ever. According to Tim Johnson, president and CEO of the California Rice Commission, Sacramento Valley rice growers are expected to grow 250,000 acres of the crop this year, which is half of the 500,000 acres that are typically grown. The last time rice growers produced such an amount was 1956. The Sacramento Valley is one of the state’s growing regions for processing tomatoes. The food and agriculture board heard from Yolo County farmer Frank Muller, who said the California Tomato Growers Association expects the season’s processing tomato crop for the state to be lower than the 11.7 million tons projected by the U.S. Department of Agriculture’s National Agricultural Statistics Service. California produces 96% of the U.S. tomato supply and roughly 32% of the world’s tomato supply.

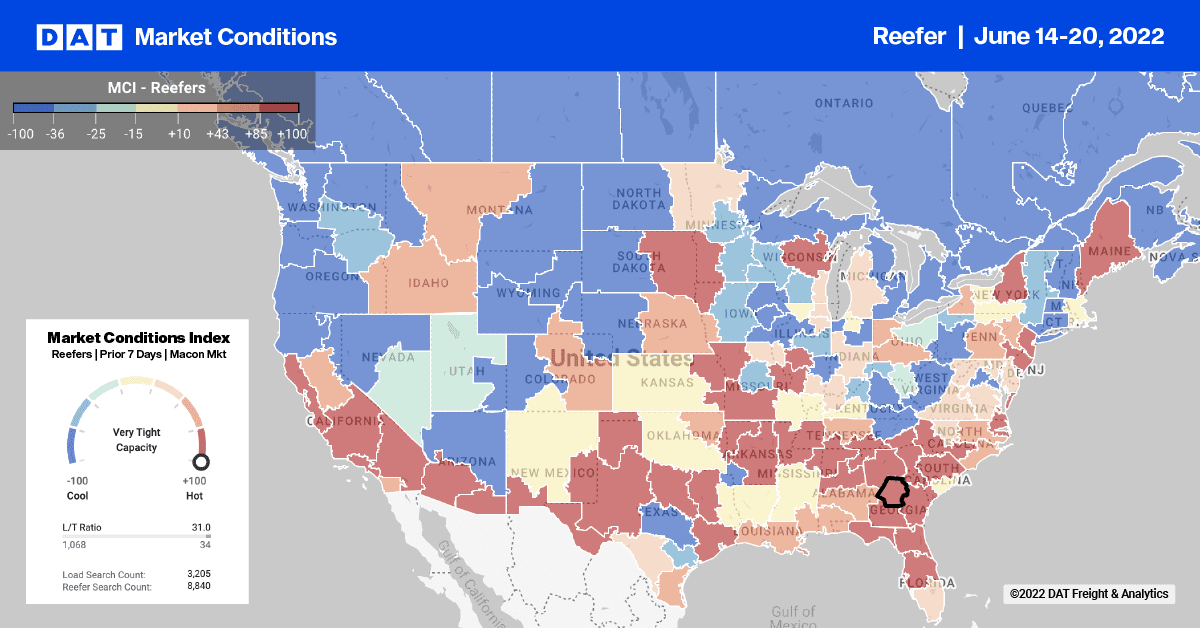

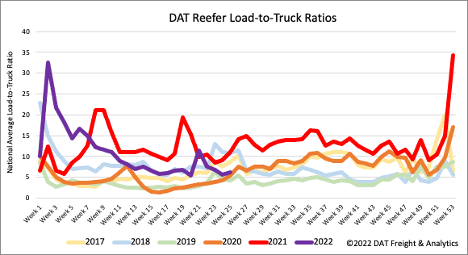

Californian produce truckload volumes are the lowest in seven years and are contributing largely to the season’s decline in spot rates for truckload carriers. In Fresno, the largest of the reefer market in the state, loads moved to Chicago in the 10-week period beginning April 1, 2022 are down 25% compared to the previous year. Reefer linehaul rates on that lane are currently $0.99/mile lower y/y. To underscore just how hot the 2021 produce market was, in the same 10-week period, weekly truckload volumes between Fresno and Chicago almost doubled last year; this year the increase is much lower at 65%. Reefer linehaul rates from Fresno to Hunts Point, NY, are averaging $2.12/mile this week or $1.32/mile lower than the previous year. This week’s capacity is tighter for loads 900 miles to the north in Seattle. Reefer linehaul rates are averaging $3.79/mile this week, which is $0.37/mile higher than the May monthly average, reflecting the $0.05/mile m/m drop in spot rates for lower volumes on the return journey.

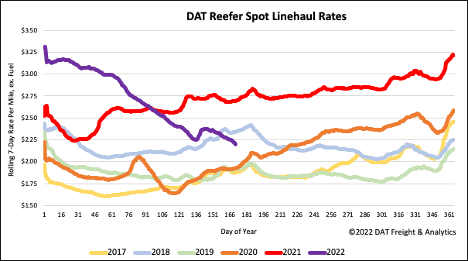

More produce volume in the market last week compared to prior weeks tightened capacity and slowed down the rate of decrease in spot rates. The reefer linehaul rate decreased by just over a penny per mile last week compared to the $0.07/mile drop the previous week. At $2.24/mile, reefer linehaul rates have dropped 29% or $0.92/mile YTD and are now down $0.13/mile m/m. Reefer spot rates are currently $0.50/mile lower than the previous year and $0.14/mile lower than where reefer spot rates were in 2018.