With the start of fall and Halloween just a few weeks away, we are officially in the pumpkin spice season. According to the AG MRC, the U.S. annual per capita use of pumpkin was 6.44 pounds per person in 2020. The addiction to all things pumpkin is primarily a North American tradition, with the earliest known pumpkin pie recipe published in 1793. Pumpkins are grown in just about all states, but according to the USDA, the majority of pumpkins are harvested in Illinois, Indiana, Michigan, Virginia, California, and Texas. Illinois remains the leading processed pumpkin-producing state, producing more than the other five leading states combined and about half the national total.

Libby’s, the 150-year-old canned food company in Morton, IL, processes 120,000 tons of pumpkins each year, or about 85% of the world’s total canned pumpkins. “Libby’s typically contracts around 6,000 to 7,000 acres of commercial pumpkins near its canning plant in Morton each year. Yield averages increased to around 27 tons per acre in recent years, but could be down a touch this year to around 25 tons,” said David Uhlman, a contracted farmer for Libby’s. “I spoke with the harvesting crew, and they’re noticing no record-breaking yields this year,” he said. “But they are pretty comfortable there are enough acres contracted to be able to meet the demand of the market.”

The Texas pumpkin market, primarily in Lubbock, is experiencing a poor harvest as drought conditions have created lower yields. Pumpkins represent a small amount of acreage in Texas when it comes to crop production. Still, many Texas growers continue to produce high-demand heirloom and jack-o’-lantern standard varieties. Their harvest is shipped throughout Texas, Oklahoma, and as far east as Mississippi. Pumpkin producer Cris Hacker of Hacker Farms said demand and prices have been better than ever, but unfortunately, his production was about 50% of what it should be.

All rates cited below exclude fuel surcharges unless otherwise noted.

Following Hurricane Ian, outbound spot rates from Florida increased $0.07/mile to an average of $1.29/mile last week. Florida’s outbound load posts were up by 5% last week following a 24% gain in the week prior, as shippers rushed to shift loads before the hurricane made landfall. Inbound load posts increased by 22% w/w. In the hardest-hit freight market in Lakeland, inbound load posts increased by 27% last week, with most of that volume coming from Atlanta – loads moved on that lane were up by 3% w/w. In contrast, spot rates increased to $3.33/mile, $0.18/mile higher than the average for September but more than $1.00/mile lower than the previous year.

Along the southern border, where imported produce volumes are down by almost 3% y/y, truckload capacity was tighter last week following a 1% increase in load posts and a $0.07/mile increase in reefer spot rates. Outbound loads averaged $2.10/mile in Laredo and McAllen markets, while loads to Lakeland and Miami averaged $2.71/mile and $2.38/mile, respectively. Both lanes were up by around $0.20/mile last week compared to the average linehaul rate in September. In Chicago, capacity was tighter the previous week, even though load posts only increased by 1% w/w. Chicago’s outbound reefer spot rates were up by $0.08/mile to an average of $2.83/mile and slightly higher at $2.87/mile in nearby Joliet.

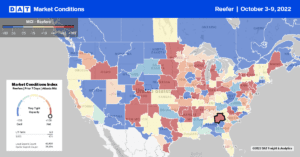

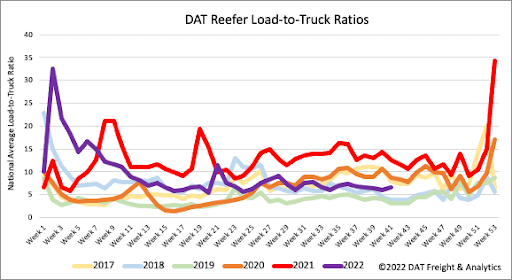

Reefer load posts increased by 10% last week but remained down by 41% y/y and 13% compared to 2020 levels at the start of October. Like dry van, load posts had averaged over 700,000/week since June 2020, almost double the pre-pandemic average going back to 2016. Carrier equipment posts were flat last week but still at their highest levels in the previous six years and 3% higher than in 2019 when capacity was very loose. As a result, the reefer load-to-truck (LTR) increased slightly from 6.06 to 6.61 last week.

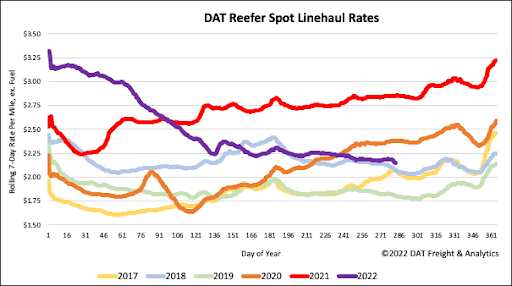

Reefer linehaul rates were mostly flat again last week, remaining at a national average of just under $2.19/mile, $0.71/mile lower than the previous year. Reefer spot rates have decreased by 31% since the start of the year and at the start of October, are just $0.07 higher than this time in 2018. However, last week’s average spot rate is still $0.23/mile higher than the pre-pandemic average for this time of the year.