While overall produce volumes are down just under 15% this season, carriers hauling fruit and vegetables out of major growing regions into major capital cities are having a great year. According to the USDA, truckload rates during the last week of June were $0.21/mile higher at $4.38/mile incl. FSC compared to $4.17/mile a year ago.

The rates are averaged over nine regional crop origination markets, including Arizona, California, Florida, the Great Lakes (Michigan, Minnesota, and Wisconsin), imports across the Mexico-Arizona border, imports across the Mexico-Texas border, New York, the Pacific Northwest (Idaho, Oregon, and Washington) and the Southeast (North Carolina, South Carolina, and Georgia).

In the nation’s largest produce region of California, spot rates in June averaged $4.38/mile, or 8% higher than the previous year, while in Florida, produce spot rates were the same compared to 2021 at $3.38/mile. In the Mexico-Texas region, spot rates average $3.29/mile in June compared to $3.05/mile in 2021. In the Pacific Northwest, where produce season is ramping up, spot rates are currently averaging $3.39/mile, which is 7% higher than the previous year.

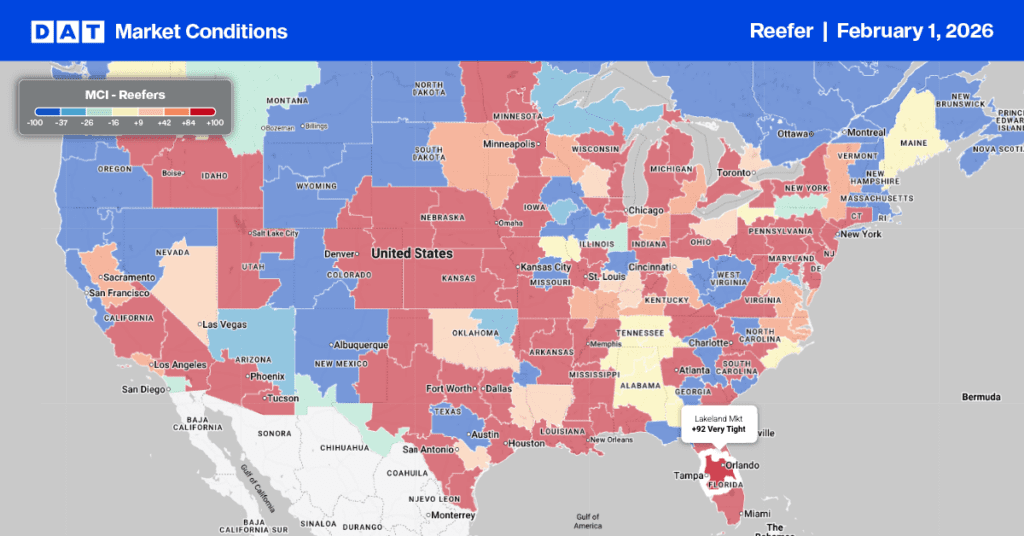

According to the USDA, in the week ending July 6, there was a shortage of trucks reported in Florida West and South Carolina Districts for loads of tomatoes, grapes, and watermelons, Southeast Missouri for watermelons and sweet potatoes in Eastern North Carolina.

All rates cited below exclude fuel surcharges unless otherwise noted.

Reefer capacity tightened in the Ontario market last week for the fourth week. Spot rates have increased by $0.21/mile m/m to an average outbound rate of $2.90/mile this week, while on the short-haul lane from Los Angeles to Las Vegas, rates were flat at $5.25/mile last week. In the Pacific Northwest, load post volumes in Seattle have surged, increasing by 76% in the previous six weeks, pushing up spot rates by $0.23/mile to an outbound average of $1.47/mile. Average spot rates on the 1,500-mile haul to Phoenix were up $0.02/mile to $1.11/mile last week to compensate for decreasing rates in the opposite direction. In the overall Phoenix market, rates were down considerably last week, dropping by $0.13/mile to $2.78/mile, while loads east to Los Angeles were down $0.68/mile to an average of $2.43/mile last week.

In the Southeast Region, the USDA reports a shortage of trucks for loads of sweet potatoes, pushing up regional reefer rates. In Raleigh, NC, reefer rates increased by $0.43/mile to $2.67/mile last week, and on the 580-mile west to Bowling Green, KY, spot rates were up $0.33/mile to $2.58/mile, the second-highest reading in the last 12-months. Reefer capacity was tight in the Houston market the previous week, where spot rates increased by $0.13/mile to an average of $2.28/mile. On the 1,200-mile lane to Denver, rates increased by $0.19/mile to $2.62/mile or $0.40/mile slower than the previous year.

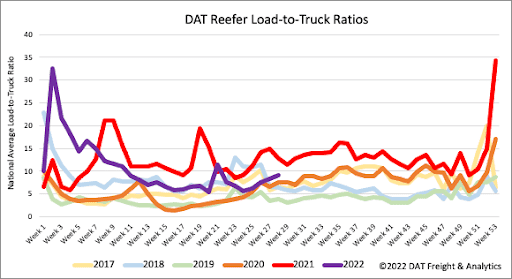

According to the latest data from the USDA, the volume of long-haul produce is around 15% lower than the previous year and at the lowest level since 2015. In California, volumes are the lowest in 20 years, contributing mainly to decreased national reefer demand this year. Like dry van, reefer volumes and equipment posts were down by 8% and 15%, respectively, resulting in the reefer load-to-truck (LTR) ratio increasing slightly to 9.04.

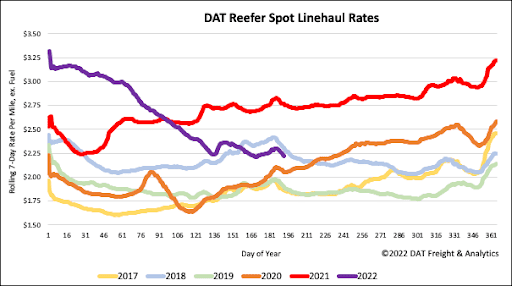

The typical seasonal spike in reefer rates driven by peak produce volumes failed to deliver this year. Reefer linehaul rates have dropped by almost $0.90/mile this year following last week’s $0.05/mile decrease. As we start the second half of 2022, reefer spot rates currently average $2.27/mile. At this level, rates are now $0.54/mile lower than the previous year but $0.26/mile higher than the pre-pandemic average for this time of the year.