Along with the reduced estimate for citrus production in California this season, the stone fruit season will likely also see a drop in volume. According to Jon McClarty of HMC Farms in Kingsburg, California, “peach shipping will begin early to mid-May, but we were coming off a big crop last year, so the industry was already down a little bit in volume. But there has also been some frost and hail, so there’s also going to be a bit of a decrease in volume due to natural weather events. I think the industry will be 15-20% off of last year’s volume overall.” McCarty noted that weather events impacted many other crop estimates this season, suggesting demand will remain strong even though volumes will be lower.

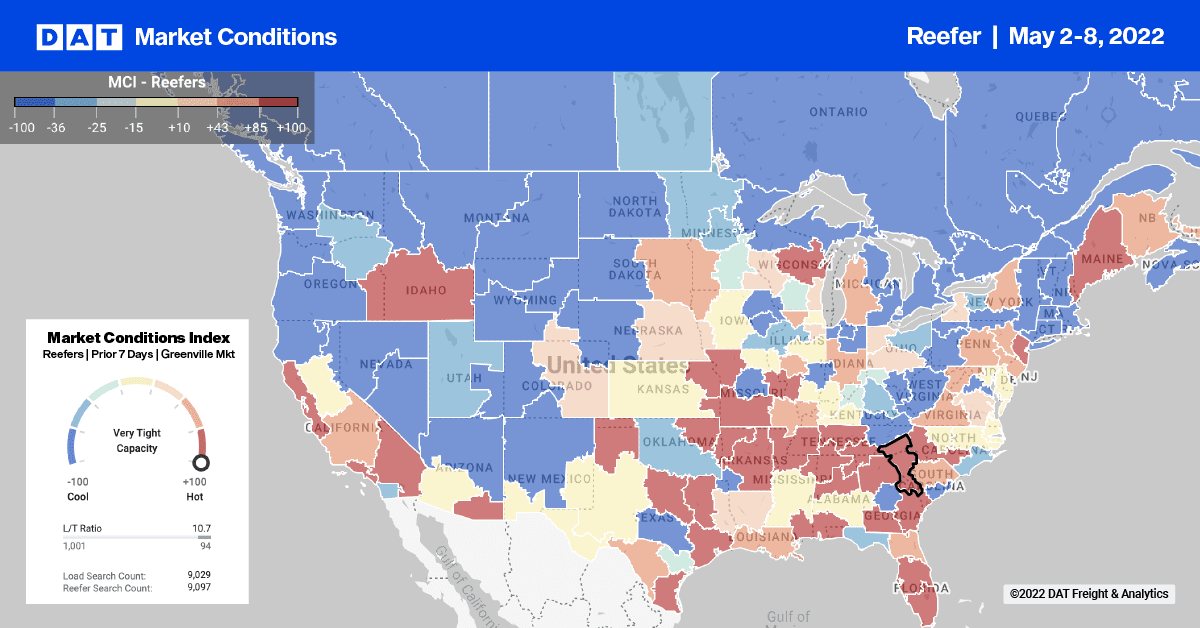

Nationally, growers and brokers are seeing truck availability ease rapidly across most markets. According to the USDA, of the 23 producing growing districts in the U.S., just two were reporting a shortage of trucks (#5 ranking), and another two reported a slight shortage (#4 ranking) last week. The remaining 19 districts reported an adequate supply of trucks (#3 ranking). Compared to the same week last year, 12 districts reported a shortage of trucks (5) while another 6 reported a slight shortage (4). Over the last 10-years, the average ranking for all districts is 3.5 (adequate supply) yet some markets including Indiana have been consistently short trucks with a 4.22 long-term average. The Southeast district ranks second at 3.63 followed by the Mid-Atlantic District at 3.62.

According to the USDA, trucks were in adequate supply in all but two produce regions last week – Eastern North Carolina (sweet potatoes) and Central and Southern Florida (vegetables), where trucks were in short supply. A slight shortage was reported in the San Luis Valley in Colorado (potatoes) and Michigan (apples), with 19 regions reporting an adequate supply. For the first time this year, there was a slight surplus of trucks reported on the southern border in Texas. Import volumes from Mexico were down 2% last week.

Spot rates for loads between Pharr, TX, and Chicago dropped to a new 12-month low of $2.21/mile excl FSC, which is $0.24/mile lower than the previous year. Loads east to New York City filled a similar trend dropping $0.30/mile below the April average spot rate to $2.53/mile excl. FSC. That’s also around $0.30/mile lower than the same week in 2021. On the 1,700-mile haul north from Nogales, AZ, to Seattle, capacity was flat last week at an average of $2.48/mile excl. FSC, which is $0.42/mile lower y/y. After remaining flat for the prior two months, reefer capacity eased for loads between Nogales and Los Angeles, with rates dropping by $0.10/mile below the April average to $2.42/mile excel. FSC last week.

Reefer load post volumes increased by another 5% last week, boosted by the Cinco de Mayo and Mother’s Day celebrations. That makes it five weeks in a row of successive reefer load post gains but remained 51% lower y/y. Carrier equipment posts were up slightly, which increased the reefer load-to-truck ratio (LTR) by slightly from 6.55 to 6.74. Reefer LTRs are just 7% higher than the same week in 2018.

Not even higher reefer volumes before Mother’s Day were sufficient to halt reefer rates plunging even further last week. Spot rates decreased another $0.05/mile last week to a national average of $2.34/mile excl. FSC. Reefer spot rates have dropped by $0.22/mile in the previous month and 26% or $0.82/mile since the start of this year. The current national average is still $0.42/mile higher than the same time in the previous four non-pandemic years from 2016 to 2019.