Avocados From Mexico wants to make a touchdown on Sunday, February 9, 2025. The Super Bowl is the most significant occasion for Avocados from Mexico, with peak-shipping season coinciding with the NFL end-of-season event in New Orleans at Caesars Superdome. Over the course of a year, U.S. truckload carriers will move around 95,000 truckloads of avocados, with 97% crossing the southern border in Texas. The commercial zone crossing in Laredo accounts for 55% of the volume, followed by 42% in Pharr, TX. According to the USDA, import volumes of avocados are tracking around 19% lower than last year.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to Avocados From Mexico, the brand has almost doubled the volume of Mexican avocados imported to the U.S. in seven years to meet the growing demand. Today, 8 in 10 avocados in the U.S. come from Mexico, with a new record of almost 2.5B lbs of Mexican avocados imported to the U.S. in 2023. That’s the equivalent of almost 60,000 refrigerated truckloads!

According to Avocado from Mexico, they’re responsible for approximately 95% of avocados sales in the U.S. during the Super Bowl week, with 250M pounds of avocados sold. That’s enough to fill approximately 30M football helmets with guacamole or almost 6,000 truckloads.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

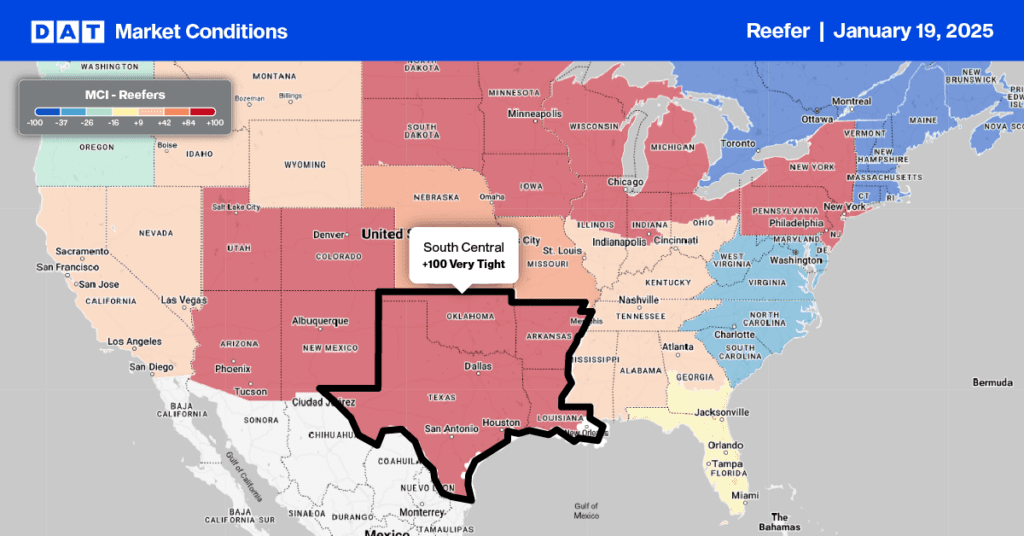

This week, we focus on the South Central Region, where the USDA reported a slight shortage of reefer trucks in South Texas last week. Around 42% of annual imported produce from Mexico crosses into the U.S. in the McAllen freight market, where outbound reefer spot rates jumped by $0.74/mile to $3.00/mile over the Christmas/New Year holiday break, the second-highest during the winter peak in spot rates in the last five years (surpassed only by December 2022).

Compared to late 2023, carriers on the high-volume lanes north to Dallas and Ft. Worth were paid an average of $3.37/mile and $3.25/mile, 25% and 16% higher y/y, respectively. Loads from McAllen to New Orleans ended 2024 at $603/load, higher than the previous year, paying carriers an average of $2,536/load. According to DATs Ratecast, spot rates are expected to cool between now and game day in New Orleans, paying carriers an average of $2,346 in the first week of February, $180/load lower than last week’s average.

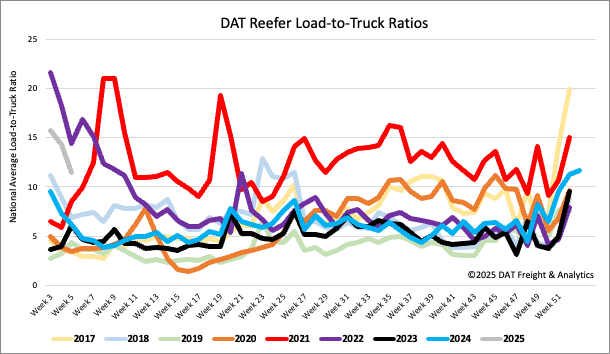

Load-to-Truck Ratio

Reefer load posts were down 24% last week and 21% lower than last year. Directionally, volumes are on track to continue declining until we get into the Spring as produce starts to ship meaningful volumes nationally (and available capacity begins to tighten). Last week’s reefer load-to-truck ratio (LTR) ended at 11.43.

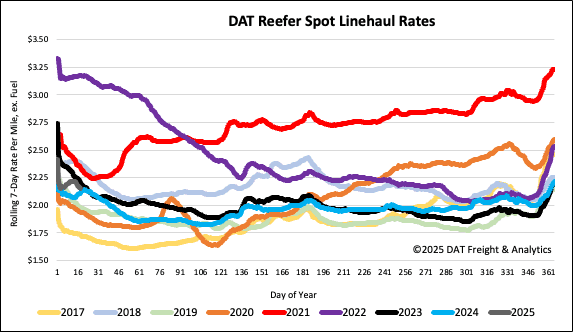

Spot rates

Reefer spot rates began to cool following last week’s $0.05/mile decrease to a national average linehaul rate of $2.16/mile. Compared to last year, reefer linehaul rates are $0.04/mile (2%) higher. Looking back to 2016 and excluding the pandemic-influenced freight markets, last week’s 7-day rolling average reefer rate was $0.15/mile higher than the long-term Week 3 average of $2.01/mile.