You might be surprised to find some winter vegetables in tight supply this Thanksgiving weekend. The list includes celery, broccoli, cauliflower, and lettuce. Supplies of lettuce, in particular, have been impacted by both a change in seasons and Impatiens Necrotic Spot Virus (NSV), which kills lettuce when it’s in its mature stage, just before harvest. According to, Munger Mark Munger, senior director of marketing for Castroville, Calif.-based Ocean Mist Farms, “It’s really knocked the leaf lettuce down. In Salinas, it’s been a rough end to the season,” impacting the Salinas Valley growing region.

According to Mark McBride from Salinas, Calif.-based Coastline Family Farms, “we’re experiencing reduced lettuce yields due to soil diseases with lettuce fields showing seedstem formation because of hot temperatures, necessitating early harvest while the plants are immature. This is prolonging the reduced overall supply and may lead to lower supplies in the coming weeks, including Thanksgiving.” Celery production is also impacted, and according to Stephanie Cantero, communications and marketing coordinator at Salinas-based The Nunes Co., “broccoli and cauliflower could be in short supply due to cooler than normal weather.”

Led by grapes, berries, citrus, and avocados, U.S. fresh fruit imports have surged in the last year, according to fresh USDA statistics. USDA reports U.S. fresh/frozen fruit imports totaled $19.4 billion for the period October 2021 through September 2022, up 16% from the previous year. U.S. fresh vegetable imports for the same period totaled $11.2 billion, up 7% from the previous year’s period.

The effect of Hurricane Ian will be felt in Florida this fall and winter. Florida’s November tomato crop, which usually begins to ramp up in November, will be smaller than normal because of the hurricane. The flow-on effect for truckload carriers will be lower weekly volumes, which are already down 34% y/y. According to the USDA, total volumes of Florida produce are down 52% y/y.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Longer-haul shippers of Christmas Trees into warmer states often require a refrigerated trailer, which at this time of the year pushed up reefer linehaul rates in Idaho, Washington, and Oregon by $0.20/mile last week to an average of $2.23/mile. Compared to the previous year, this regional rate is almost $1.00/mile lower and identical to 2018. Reefer rates for loads from Portland to Los Angeles surged last week to $2.40/mile, up $1.00/mile compared to the October average and $0.45/mile higher than the previous year.

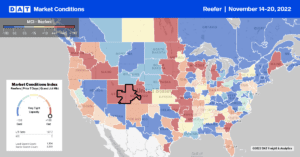

In nearby Pendleton, OR, capacity also tightened last week following a $0.65/mile m/m increase to $2.58/mile for loads to Los Angeles, while loads to Phoenix were flat at $2.17/mile. In Louisiana, reefer spot rates increased by $0.55/mile last week to an average of $2.48/mile but remained lower by almost the same amount as the previous year. New Orleans to Atlanta reefer rates settled at $2.10/mile last week, which is $0.37/mile higher than the October average and almost $1.00/mile lower than the previous year. Reefer capacity tightened again in Texas last week; spot rates at $2.16/mile for outbound loads are up $0.07/mile w/w. On the southern border in the Laredo and McAllen markets, reefer rates increased for the fourth week to $2.13/mile, up $0.11/mile m/m. At $1.81/mile, long-haul reefer rates from Laredo to Los Angeles are $0.15/mile higher than the previous year after increasing by $0.30/mile in the last two months. Loads east to Lakeland from Laredo at $2.62/mile are up $0.11/mile above the prior six-month average of $2.51/mile but remained $0.46/mile lower y/y.

Load to Truck Ratio (LTR)

It was no surprise to see reefer load posts take off last week with all the turkeys and Christmas Trees moving. Volumes increased by 13% w/w as shippers positioned inventory into retail markets and had as many trees in parking lots by Cyber Monday as possible. Volumes are precisely half what they were the previous year, while carrier equipment posts are 11% higher over the same timeframe. Last week’s reefer load-to-truck (LTR) increased by 18% from 4.44 to 5.26.

Spot Rates

Going against seasonal trends, reefer linehaul rates were flat last week at a national average of $2.08/mile. The typical pre-Thanksgiving November increase in reefer spot rates has averaged $0.13/mile the previous five years – this year, reefer rates have remained flat for the first three weeks of the month. Last week’s reefer linehaul rate was 32% or $0.94/mile lower than last year and $0.15/mile lower than in 2019.