Almost every week, the USDA reports a slight shortage of trucks to haul sweet potatoes in Eastern North Carolina despite the season being well past the shipping peak in November each year. According to the USDA, the coastal plains region of North Carolina produced around 67% of total annual sweet potato production in the last 12 months, followed by Mississippi (16%) and Central California (12%). The Sweet Potato Council reports that approximately 3.4 billion pounds of sweet potatoes are produced annually in the United States. That’s approximately the equivalent of almost 80,000 truckloads.

Once harvested, sweet potatoes are stored on farms at 58 degrees and 85% humidity for shipping year-round. The product harvested first in the field is also shipped first before being washed and graded by size and packed for shipping. North Carolina’s dominance in producing sweet potatoes is due to the hot, moist climate and rich, fertile soil ideal for cultivating sweet potatoes.

Besides the well-documented nutritional value of sweet potatoes, there’s also some confusion about the name. Some mix up sweet potatoes with yams, which are, in fact, a type of sweet potato. The U.S. Department of Agriculture requires labels with the term ‘yam’ to be accompanied by the term ‘sweet potato.’ Despite the label regulations, most people still think of sweet potatoes as yams regardless of their true identity.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

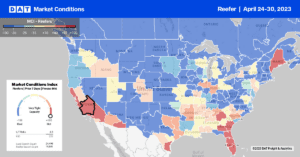

Reefer capacity tightened considerably last week, coinciding with the annual 75 Chrome Shop truck show in Wildwood, Florida. Many reefer carriers take the week off, resulting in fewer available trucks to move loads, which were up 19% last week in Lakeland. Outbound reefer rates increased by $0.12/mile the previous week, and on the high-volume Detroit lane, loads from Lakeland were paying $1.83/mile last week, which is almost $0.40/mile higher than in March and $0.13/mile higher than the previous year. State-level Florida outbound reefer rates, at $2.00/mile, were almost identical to last year.

On the southern border in McAllen, reefer volumes were up 24% last week, pushing up outbound spot rates by $0.07/mile to $2.20/mile. At $2.10/mile, Texas reefer rates are just $0.08/mile lower than in 2018. Loads from McAllen to Oklahoma City retreated from last month’s surge in spot rates ending the previous week at $2.63/mile, which is $0.55/mile lower than in March. Loads to Hunts Point in New York City at $2.19/mile were $0.11/mile lower than in March. At $2.04/mile, California outbound reefer rates are $0.10/mile lower than in 2019, while in Los Angeles, rates increased for the third week to $1.89/mile.

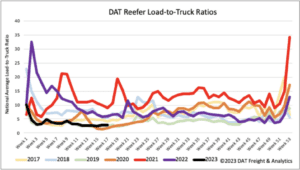

Load to Truck Ratio (LTR)

Even though reefer spot market load posts increased by 9% last week, they continue to track at around half what they were a year ago. Produce season is starting much slower, with weekly truckload volumes around 14% lower y/y and the lowest level since 2016. Reefer carrier equipment posts are around 7% higher than in 2019 following last week’s 5% gain, resulting in the reefer load-to-truck (LTR) increasing from 2.80 to 2.93.

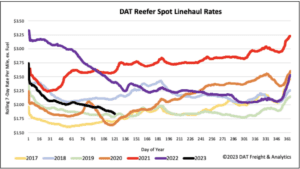

Spot Rates

Reefer linehaul rates were flat last week at $1.90/mile and just $0.04/mile higher than in 2019. Compared to the same time the previous year, spot rates are $0.56/mile lower and nearly identical to the average in pre-pandemic years for Week 17.