As winter sets in, shippers have been increasingly adding freeze protection or protect-from-freeze (PFF) to bills of lading to traditional dry freight.

PFF is quite common in the less-than-truckload sector from November through May, with freight maintained at the shipper’s desired temperature by using heated trailers, heat shelters, pallet covers and blankets. Styrofoam coolers are also an option for smaller consignments, but in the case of full truckload, the refrigeration motor on the front of the trailer is ideal for maintaining a constant temperature. Recently a DAT customer requested this for a load of soda.

While the start of the cold weather varies across the country, it typically runs from October to March. Some of the coldest temperatures occur in the Northeast, Upper Midwest, Pacific Northwest and Canada, where reefer spot rates are on the rise.

The list of commodities that are susceptible to freezing in winter include certain dried goods like coffee and flour, chemicals, paints, glues, liquids, wine, alcohol, perishable food and batteries – all need to maintain an above-freezing temperature throughout transit to maintain quality. For shippers, carriers and brokers, the cost difference between a dry van and a reefer moving freight at a different temperature to ambient can be substantial. Not all carriers have suitable cargo liability coverage, so our best advice is to communicate the requirements for the freight and make sure those requirements are listed on the bill of lading.

NOTE: Spot rates reported below do not include fuel surcharges unless otherwise noted.

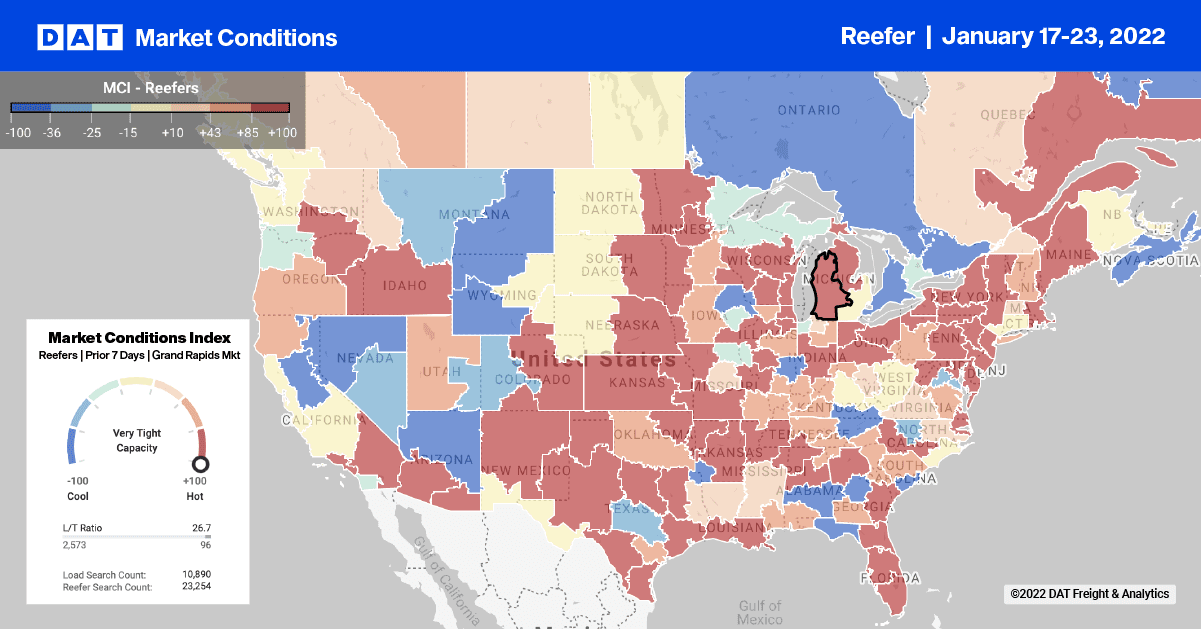

Reefer capacity was understandably tight last week, as the arctic air plunged into the Midwest, pushing up spot rates to an average of $3.92/mile (including FSC) – the highest of the five regions tracked by DAT Trendlines. In the Upper Midwest including markets in Iowa, Illinois, Joliet and Wisconsin, spot rates jumped 25 cents last week to an average outbound rate of $3.94/mile after decreasing for the three weeks prior.

Loads from Chicago to Atlanta hit a new 12-month high last week, averaging $4.75/mile, following a 25% w/w increase in loads moved. Spot rates for loads from Chicago to Dallas are up 6 cents m/m to an average of $3.63/mile. Capacity for short haul loads to nearby Minneapolis eased despite a 11% w/w increase in loads moved. Spot rates are currently averaging $3.28/mile on this 409-mile haul, which is 63 cents lower than the December average.

Reefer capacity in Philadelphia was also tight. Spot rates have now been increasing steadily for the last three weeks to an average outbound of $3.26/mile. This is typical for this port market where a lot of imported winter produced lands, especially from Chile. Just under 50% of January’s import volumes from Chile have arrived in Philadelphia so far, with grapes, blueberries and cherries accounting for 80% of total volume.

Out West on the 270-mile haul from Los Angeles to Las Vegas, capacity eased. Spot rates dipped under $6.00/mile for the first time in two months, averaging $5.88/mile this week.

Load to Truck Ratio (LTR)

Reefer load posts on the DAT Load Board dropped by 32% in the last two weeks following last week’s 17% w/w decrease. With slightly fewer equipment posts also last week, the reefer load-to-truck ratio decreased by from 21.63 to 18.16.

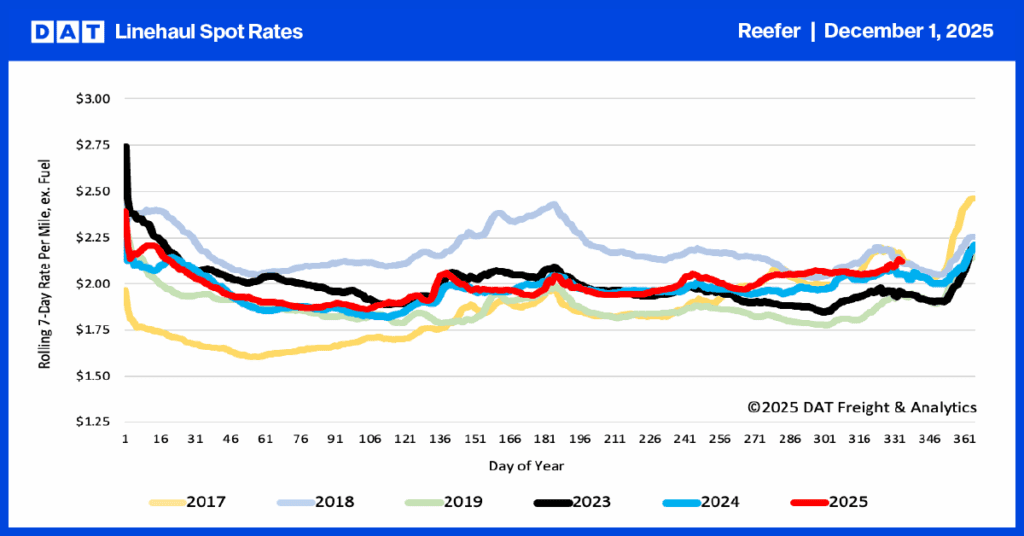

Spot Rates

Reefer spot rates have been around the same level for the last three weeks, which is unusual considering they normally cool off in January. Last week, reefer spot rates decreased by just under a penny per mile to maintain an average of $3.16/mile.

To put the current tight capacity market into context, reefer spot rates plunged 36 cents in the first three weeks of last year. Last week’s national average reefer spot rate was 90 cents higher than the same period last year and 85 cents higher than week three in 2018.