By Christina Ellington

The cherry season in California reaches its peak this week before winding down quickly. The harvest contributes around 20% to the national annual volume in a very short 6-week season, which starts mid-April and runs through mid-June.

Over 9 million cherries are harvested in California, with approximately 60% sold domestically and 40% exported. Nearly all cherry production centers around Lodi, CA, in the Stockton freight market, home to the famous Bing Cherry. According to California Cherries, the popular cherry is grown in Lodi because of the ideal climate that provides cold winter temperatures and warm, not too hot, temperatures in the spring and summer months.

As California enters peak season, the season is just starting for cherry growers in the Pacific Northwest. However, due to an unseasonably cold spring, the Pacific Northwest crops are expected to have a slow start to the season. Wenatchee, Wash.-based Stemilt Growers Inc. has the nation’s longest cherry season, said Brianna Shales, director of marketing. “The company started its California harvest in mid-April, which was slightly earlier than usual, and planned to get underway in Washington in mid-June, a tad later than usual.”

According to USDA refrigerated truck data, we are seeing a strong start to the California cherry season. Year-to-date volumes are up 19.5% y/y with another 3-4 weeks of shipping left based on historical data. Other crops where current volumes are up in California are Avocados (53% y/y); Strawberries (17% y/y); Spinach (15% y/y); Onions (7% y/y); Raspberries (5% y/y); and Broccoli (2% y/y).

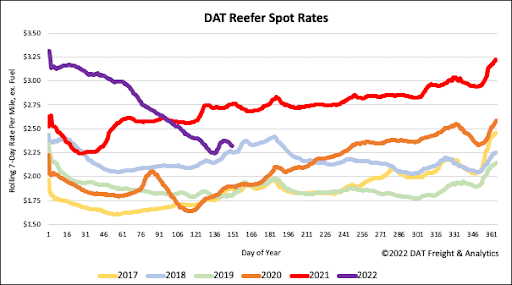

All rates cited below exclude fuel surcharges unless otherwise noted.

For reefer carriers looking to load fresh cherries, transit schedules are very tight as cherries ripen on the tree, have a short shelf life, and must be transported carefully to reduce damage. Currently, spot rates out of Stockton to all destinations averaged $2.45/mile, up $0.09/mile in the last week. Cross-country linehaul rates from Lodi to Baltimore are averaging $2.44/mile, which is up $0.57/mile since March, and on the 800-mile run north to Seattle, loads are paying $3.53/mile, which is up $0.20/mile in the last four weeks.

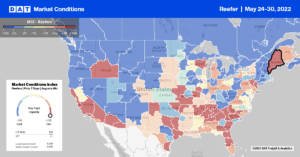

In the border freight market in McAllen, TX, reefer capacity was very tight last week, driving up spot rates by $0.18/mile to an average of $2.67/mile after dropping three weeks prior. Last week’s rate increase was confined to short-haul lanes, including Ft. Worth, where rates averaged $3.44/mile, up $0.05/mile compared to the April monthly average. In Tifton, GA, spot rates increased by $0.50/mile to an outbound average of $2.95/mile due mainly to the very tight capacity of the short-haul lane north to Atlanta. Spot rates for the 180-mile haul are averaging $5.90/mile this week, where they were this time the previous year.

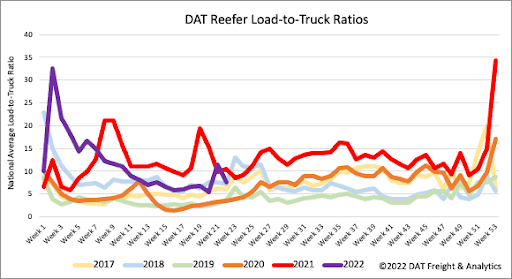

Reefer volumes dropped back ahead of this week’s Memorial Day celebrations decreasing by 20% w/w following the prior week’s surge in volume. Carriers came back to the market following last week’s 20% w/w increase in equipment posts resulting in the reefer load-to-truck (LTR) ratio decreasing from 11.5 to 7.63.

Steadily increasing reefer volumes last week helped push rates up slightly following the previous week’s penny per mile increase. The reefer linehaul national average ended the week at $2.36/mile, down $0.81/mile since the start of the year, and $0.04/mile in the last month.