Idaho is generally considered the French fry capital of the world, particularly the city of Blackfoot. Blackfoot is a hub for potato farming and processing, reflecting Idaho’s reputation as a leader in potato production. Blackfoot is located in the Twin Falls, ID, freight market but competes with Othello, WA, for the title.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Located in the Pendleton, WA, freight market, Othello is known as the French Fry Capital of the World because its three potato processing plants, run by J.R. Simplot Co and McCain’s, produce 1.5 billion pounds of frozen French fries, tater tots, and hashbrowns every year—the equivalent of almost 35,000 refrigerated truckloads annually.

According to Dale Lathim, executive director of the Potato Growers of Washington, “French fries are big business. About 40 billion pounds of frozen potato products are produced worldwide each year, and of that, North America produces about 16 billion pounds, and the Columbia Basin produces 6 billion pounds. Lathim said that Othello, with a population of 8,700, produces about 15% of the French fries in North America.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

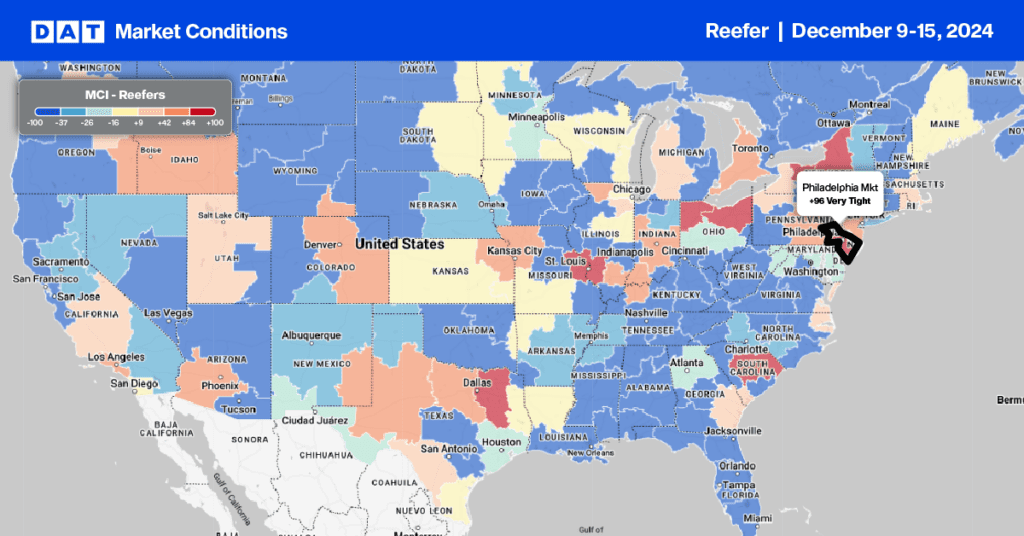

This week, we focus on the Philadelphia market, the second-largest reefer spot market in winter. It specializes in perishable goods and handles a significant portion of South American imports. Chile’s counter-seasonal growing cycle aligns perfectly with North America’s winter, making it a top source of fresh produce, including fresh fruits, particularly grapes, cherries, blueberries, apples, and avocados. Peru is known for exporting asparagus, avocados, blueberries, mangoes, and citrus fruits, while Ecuador is the major exporter of bananas and plantains year-round.

Most South American produce is transported via refrigerated breakbulk cargo ships, not in refrigerated containers, allowing for easy transloading of pallets into 53-foot reefer trailers. Just under a third of the U.S. and almost 70% of the Canadian population is within a day’s drive by truck, making Philadelphia an ideal port for the distribution of winter produce. Major truckload destinations include Boston and Chicago, where monthly volumes have risen 6% and 10%, respectively. Capacity is tightest on the Philadelphia to Boston lane, where spot rates have jumped by 10% ($0.36/mile) in the last month to an average of $4.15/mile.

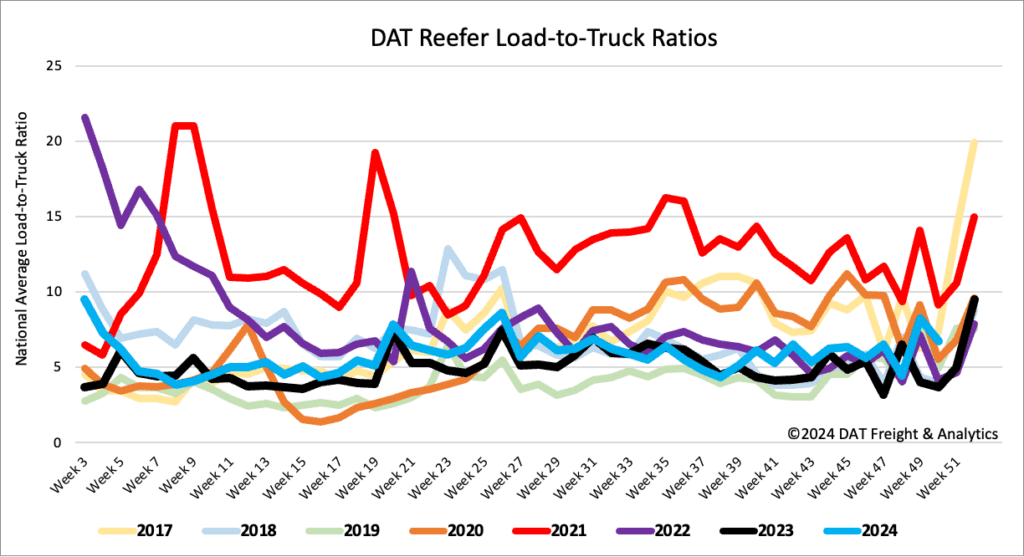

Load-to-Truck Ratio

Compared to last year’s pre-Christmas shipping surge, load post volumes were 15% higher last week and just 6% lower than the long-term average for Week 50. Reefer carrier equipment posts were 37% lower over the same timeframe, resulting in a 82% year-over-year increase in last week’s reefer load-to-truck ratio (LTR), which stands at 6.73. Last year, the reefer LTR was 3.70.

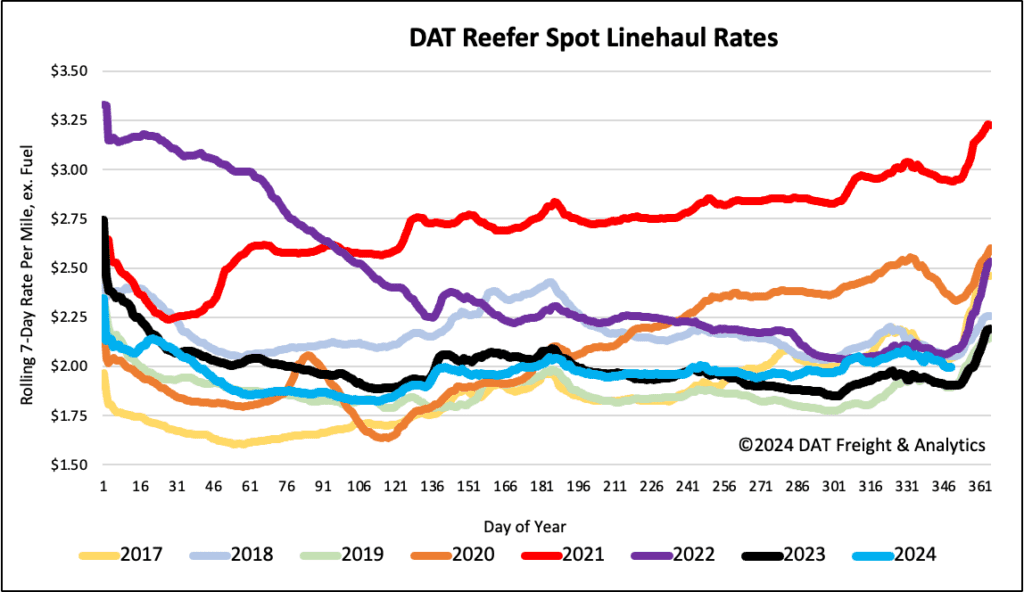

Spot rates

Reefer rates cooled last week, decreasing by $0.04/mile to a national average of $2.01/mile. At that level, reefer linehaul rates remained $0.09/mile higher than last year and $0.08/mile lower than in 2022. Reefer linehaul rates are $0.07/mile lower than the three-month trailing average.