The U.S Bureau of Reclamation is insisting that western states take more drastic measures to conserve water. The latest conservation efforts focus on the agricultural industry in Arizona and Southern California, which rely heavily on the Colorado river for irrigation. This region is known for supplying around 90% of the U.S. leafy green produce. According to data from the USDA, lettuce varieties are ranked third in refrigerated produce volume each year. Most leafy greens come from California from May to October, and production increases out of Arizona from November to April.

Tackling water conservation efforts in these agricultural regions is complex due to farmers’ long-standing senior water rights, particularly in California, have. California has the most significant water entitlement of any state on the Colorado River, totaling 4.4 million acre-feet. The federal government has advised that the states along the Colorado river need to reduce the annual water usage by 2 to 4 million acre-feet to prevent Lake Mead and Lake Powell from approaching “dead pool” levels, which means water can no longer pass downstream through the dams. The majority of the state’s water allotment is used for agriculture in the Imperial valley.

Farmers in Arizona have been operating with less water since 2019; however, California has not taken any reduction of water from the Colorado river due to their senior water rights. Voluntary talks have been ongoing for the water districts impacted and so far have yet to meet the demands of the Bureau of Reclamation. However, it appears that it’s only a matter of time before California is forced to take cuts. The federal government declared a Tier 2a shortage on the river, issuing further reductions to Arizona, Nevada, and Mexico for 2023. Mandatory usage cuts would have included California if reservoir levels had been even 5 feet lower. Decisions need to be made soon so farmers can plan how much produce they can plant this winter.

All rates cited below exclude fuel surcharges unless otherwise noted.

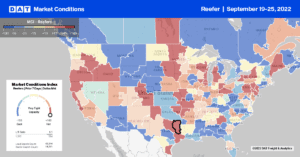

Load posts in DAT’s Top 10 reefer freight markets, representing 23% of total load posts, increased by 13% last week, which was insufficient to impact outbound capacity significantly. Spot rates in the Top 10 markets remained flat last week at $2.27/mile. In Elizabeth, NJ, the number one load post-market, spot rates increased by a penny per mile to an outbound average of $1.87/mile last week. Still, on the southbound lane to Atlanta, linehaul rates dropped $0.02/mile below the August average to $2.14/mile the previous week. Rates on this lane are almost $0.80/mile lower than the last year.

Loads west to Chicago followed a similar trend at $1.64/mile last week or almost $0.70/mile lower than the previous year. After decreasing for the prior two weeks, outbound spot rates in Atlanta increased by $0.02/mile last week to an average of $2.04/mile. In contrast, rates dropped on the number one volume lane to Lakeland, FL, where rates averaged $3.08/mile last week, $0.20/mile lower than August, and $1.20/mile lower than the previous year. After decreasing for the prior three weeks, outbound spot rates in Fresno, CA, the largest produce market in California, increased by $0.01/mile to $2.14/mile last week. Spot rates for loads 600 miles east to Phoenix were down slightly at $3.20/mile and just over $1.00/mile lower than the previous year. In the Pacific Northwest (PNW), reefer capacity tightened for the third week, with spot rates increasing from $0.03/mile to an average regional outbound rate of $2.02/mile. Spot rates in the largest PNW market in Pendleton, OR, increased by $0.05/mile to $2.10/mile, while loads to Phoenix were flat at $2.04/mile but up substantially on the 1,200-mile haul to Los Angeles. Rates on this lane at $1.86/mile are around $0.13/mile higher than the previous year after increasing by $0.70/mile since the start of June.

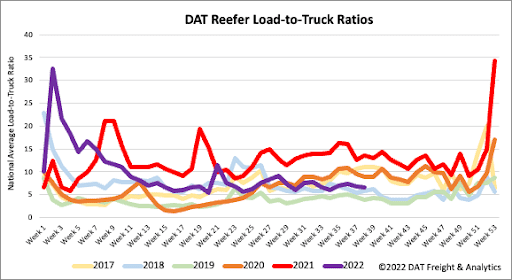

Reefer load posts decreased by 6% last week, 44% lower than the previous year. Produce national season volumes are also lower by almost 10% compared to the end of September last year, contributing to the lower spot market volumes the previous week. Carrier equipment posts are still at their highest levels in the last six years and even 13% higher than in 2019 when capacity was very loose. As a result, the reefer load-to-truck (LTR) decreased slightly by just over 3%, from 6.54 to 6.34.

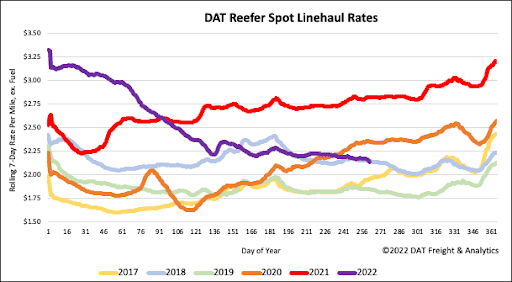

Last week’s reefer linehaul rate decrease of just under $0.03/mile left the national average at $2.18/mile, 25% or $0.71/mile lower than the previous year. Reefer spot rates have decreased by 31% or almost $1.00/mile since the start of the year, leaving the flatbed linehaul rate just $0.01/mile lower than in 2018. However, last week’s average spot rate is still $0.20/mile higher than the pre-pandemic average for the third week of September.