Nebraska is the leading state in the U.S. for commercial red meat production, with the meatpacking industry playing a crucial role in Omaha’s economy. Historically, Omaha has been a significant center for meatpacking since the late 19th century, when it became one of the largest livestock and meat processing hubs in the country. Today, it continues to be a key location for beef and pork processing, featuring operations from major meatpacking companies.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The state of Nebraska employs approximately 27,000 workers in the meatpacking sector, many of whom are based in Omaha. Companies such as Greater Omaha Packing process around 2,400 head of cattle daily, distributing beef not only across the U.S. but also to over 70 countries. Nebraska produces more than 8 billion pounds of red meat each year, with a substantial portion originating from Omaha-area plants, translating to about 180,000 refrigerated truckloads annually, or approximately 700 per day.

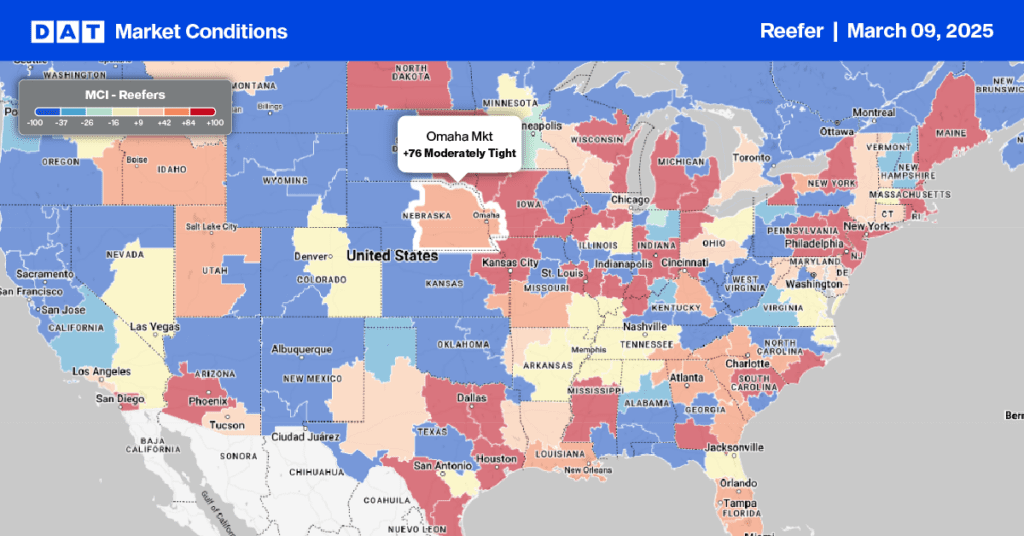

Omaha’s meatpacking activities generate high freight volumes, with thousands of refrigerated truckloads transporting beef, pork, and other meats across the nation and to export markets via major interstates like I-80 and I-29. For truckload carriers, Omaha represents a strong backhaul market, with nearly two outbound loads for every inbound load. This market imbalance has typically led to outbound rates being nearly 50% higher than inbound rates over the past year. As we enter March, outbound refrigerated truckload volumes from Omaha are 29% higher than last year, averaging $2.55 per mile, which is $0.15 per mile higher than in 2024.

Figure 2: Omaha Outbound Reefer 8-Day MCI Forecast

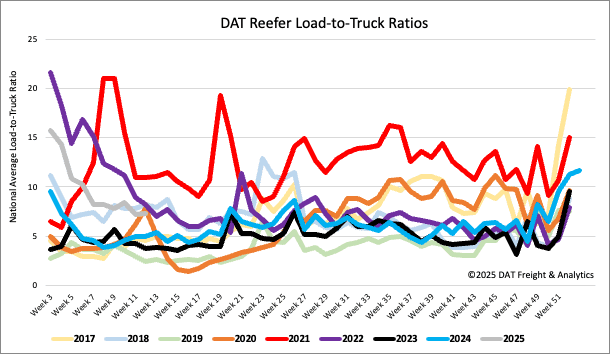

Load-to-Truck Ratio

Reefer load post volumes decreased by 3% last week, almost identical to last year. Last week’s reefer load-to-truck ratio (LTR) ended mainly unchanged at 7.26.

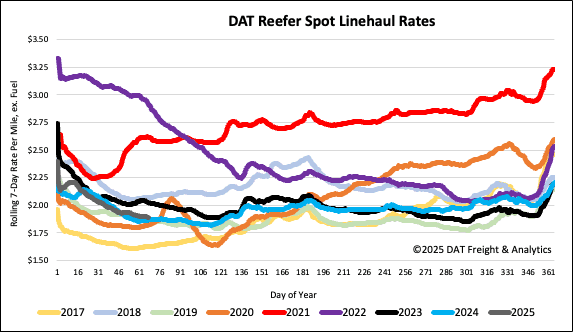

Spot rates

Even though the volume of loads moved decreased by 4% last week, reefer linehaul remained flat at $1.91/mile. Reefer spot rates are $0.02/mile higher than last year and $0.04/mile higher than the long-term Week 109 average (excluding the years impacted by the pandemic). According to the USDA, produce volumes bounced back last week, increasing 19% w/w with the average produce load paying an average of $3.25/mile, 4% lower than last year.