Washington State is by far the largest producer of onions nationally (25% of annual volume), followed by Mexico (18%) and Idaho (11%). Yerington in the Mason Valley is not so well-known and widely regarded as one of the country’s most extensive onion-growing operations. It is located 70 miles south of Reno, NV, and 370 miles north of Las Vegas. The valley is home to three large onion growers and has been dubbed by many as the “Onion Capital of the West.”

The Nunes Company, Inc. and Peri & Sons completed Yerington’s 2020 Walker River Cooling Facility expansion. The expansion added extra cooling capacity, warehouse space, and six additional loading docks to facilitate shipping 90 million pounds annually (or ~2,100 truckloads) of leafy greens and organic vegetables. By tripling the size of the cooling facility, the region loads more trucks directly to the eastern part of the United States from Nevada without making the additional 600-mile round-trip into and out of California.

Although not a large produce freight market for reefer carriers, Reno, NV volumes have increased 10% in the last year. Spot rates have also increased almost 30% over the same timeframe to an average outbound rate of $2.88/mile.

Find reefer loads and trucks on North America’s largest on-demand freight network.

All rates cited below exclude fuel surcharges unless otherwise noted.

The Pacific Northwest produce market has been strong this season for reefer carriers, with outbound volumes 17% higher than last season in Washington state. Apples have been in high demand, up 36% y/y and making up 65% of outbound loads. State average reefer linehaul rates are around 7% higher than last year, averaging $1.55/mile, up $0.05/mile last week in Seattle.

In the Pendleton market, spot rates averaged $1.88/mile, up $0.14/mile from last year, due to a 15% higher volume of loads moved. Last week, loads from Pendleton to Los Angeles paid carriers $1.53/mile on an 18% higher volume. Further south in Fresno, the load volume was up 10% last week, with reefer linehaul rates up $0.04/mile to $1.72/mile for outbound loads.

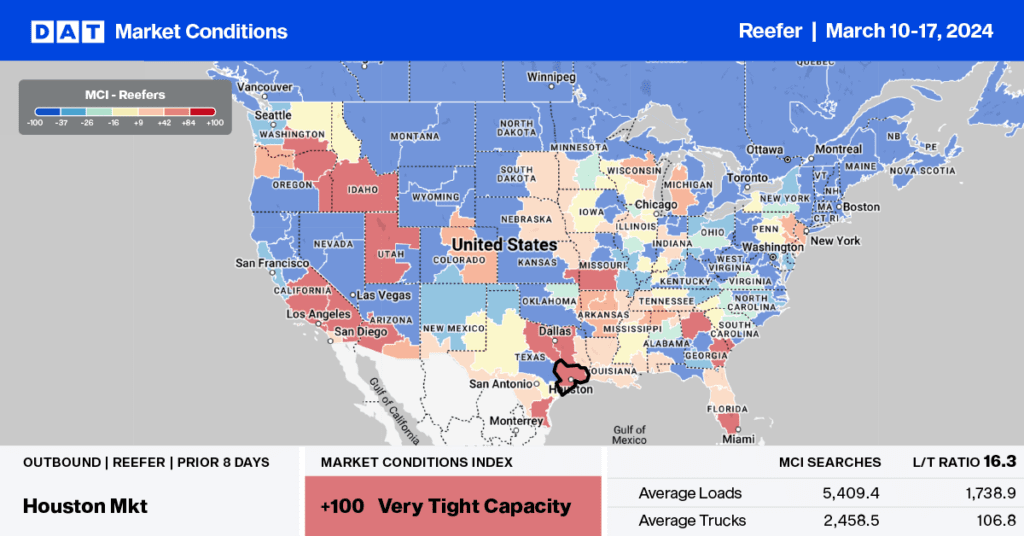

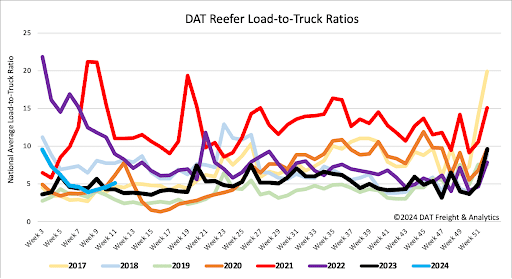

Reefer load post volume increased for the fourth week following last week’s 5% gain, trailing last year by 8%. Available capacity decreased following last week’s 7% drop in equipment posts, increasing the load-to-truck ratio by 13% to 5.14.

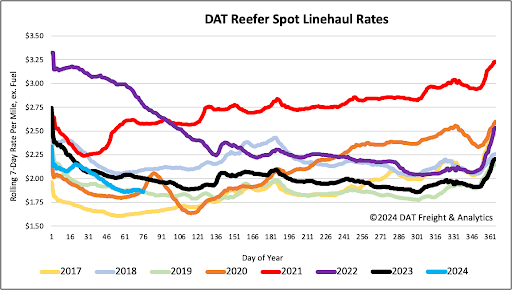

According to the USDA, produce volumes have increased by 16% in the last three weeks, trailing last season by just 2% as we approach the official start of the 2024 produce season and seasonal rise in reefer spot rates. The volume of reefer truckloads moved for all commodity types increased by 11% last week, and in a sign that capacity is beginning to tighten, spot rates were flat for the fourth week at around $1.89/mile. Compared to last year, reefer linehaul rates are $0.14/mile lower and $0.01/mile higher than in 2020.