In Stockton, home to the largest cherry-producing country in Lodi, CA, growers know that Washington, the following critical cherry-growing region on the West Coast, is early this year. While some light harvesting began at the end of April, heavier harvesting began in late May and continued through this week in CA. According to the USDA, the seasonal peak in CA shipping volumes is this week; truckload volumes are just half what they were a year ago.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Cherry season in Washington State has already started. Compared to California’s shorter season, which accounts for 18% of national cherry production, Northwest-grown cherries are harvested by more than 2,500 growers across Washington, Oregon, Idaho, Utah, and Montana, who together make up over 70% of the fresh cherries found in stores from mid-June through early September.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

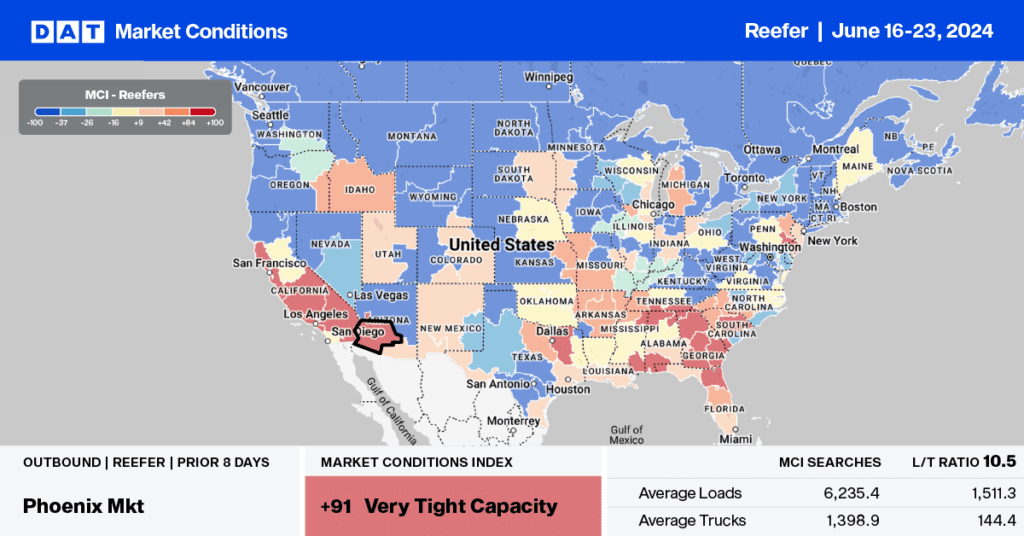

Truckload capacity was tight for loads of tomatoes in North and West Florida last week, according to the USDA, the only region needing to report an adequate supply of trucks. Even though spot rates for regional loads from Tallahassee to Atlanta have increased by 73% since March to $3.34/mile, they are still $0.40/mile below last year’s June average. Capacity was also tight for long-haul loads from Tallahassee to Chicago last week, with spot rates up $0.15/mile over the last month to $2.20/mile, almost $0.20/mile higher than last year.

Even though the USDA reported an adequate supply of trucks in central California, reefer rates from Fresno to Boston have steadily increased. They reached $2.20/mile last week, identical to last year’s June average. Two weeks remain until the seasonal July 4 spot rate peak, but according to Ratecast, spot rates have already peaked on this lane. Fresno to Chicago loads at $2.10/mile also look to have peaked and are identical to last year. Carriers were paid an average of $3.07/mile last week for loads between Atlanta and Orlando, $0.22/mile higher than last year.

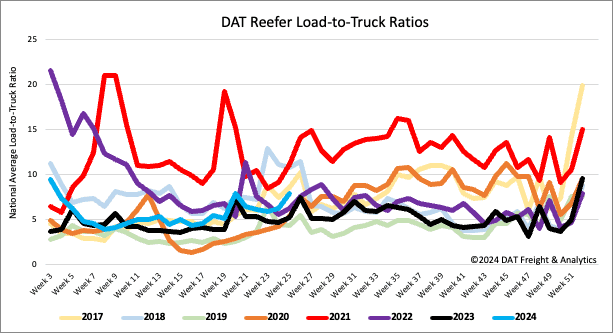

Load-to-Truck Ratio

Reefer load post volumes decreased by 12% last week and 6% year-over-year (y/y). Compared to non-pandemic-influenced years going back to 2017, last week’s average is 3% lower. Carrier equipment posts were 10% lower last week, increasing the reefer load-to-truck ratio (LTR) by 25% w/w to 7.84, the highest LTR since 2021.

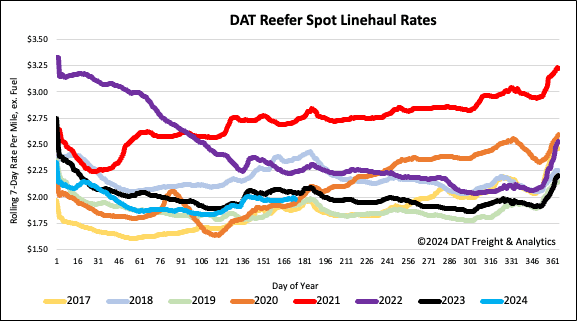

Spot rates

After remaining flat for three weeks, the national average reefer linehaul rate increased by $0.03/mile, averaging $2.02/mile; the first-time reefer spot rates have been above $2.00/mile since the Polar Vortex event in January this year. At this level, reefer linehaul rates are $0.06/mile lower on almost an identical volume of loads moved in Week 25 last year.