According to the USDA truck volume data, the produce season for Q122 is off to a slow start. Including imported truckloads, volumes are down 29% y/y. The closest volume comparison point for this year’s Q1 performance was back in 2017. If history repeats itself, Q217, compared to Q221, was down just 8%, which hopefully, a similar pattern develops for 2022, and produce shipping volumes will pick up significantly in the short term. Cold weather in early March preceded by exceptionally warm temperatures early this winter has slowed crop growth for blueberries in Georgia.

The Georgia blueberry harvest season starts each year in mid to late April in the southernmost part of Georgia, and the harvest continues throughout July. According to Zilfina Rubio, assistant professor at the University of Georgia’s horticulture department, said: “it will take days or even weeks to fully assess the extent of the damage from the early March cold temperatures.” The Georgia peach season, which runs from May to June, has also been impacted by the cold temperatures. Lee Dickey of Dickey Farms in Crawford county thinks they’ve lost about 30-40% of his early-season crop but remains hopeful his mid-season and late-season crops will come through for a productive year.

Even though import volumes of produce from Mexico are trending upwards towards their April/May peak, they remain down by close to 4% y/y while domestic volumes continue to slide (down 22% y/y as of last week). The overall consumer trend back to eating out and cooking less at home contributes to the decline. According to Brick Meets Click, total U.S. online grocery sales dropped to $8.7 billion from $9.3 billion in March 2021 — a 6% m/m decline. Total sales for 2022’s first quarter are 2.5% lower than a year ago, with the ship-to-home segment experiencing the most significant sales drop. In March, ship-to-home grocery sales plummeted more than 30% y/y from $2.1 billion to $1.4 billion, following a 13% m/m drop in orders.

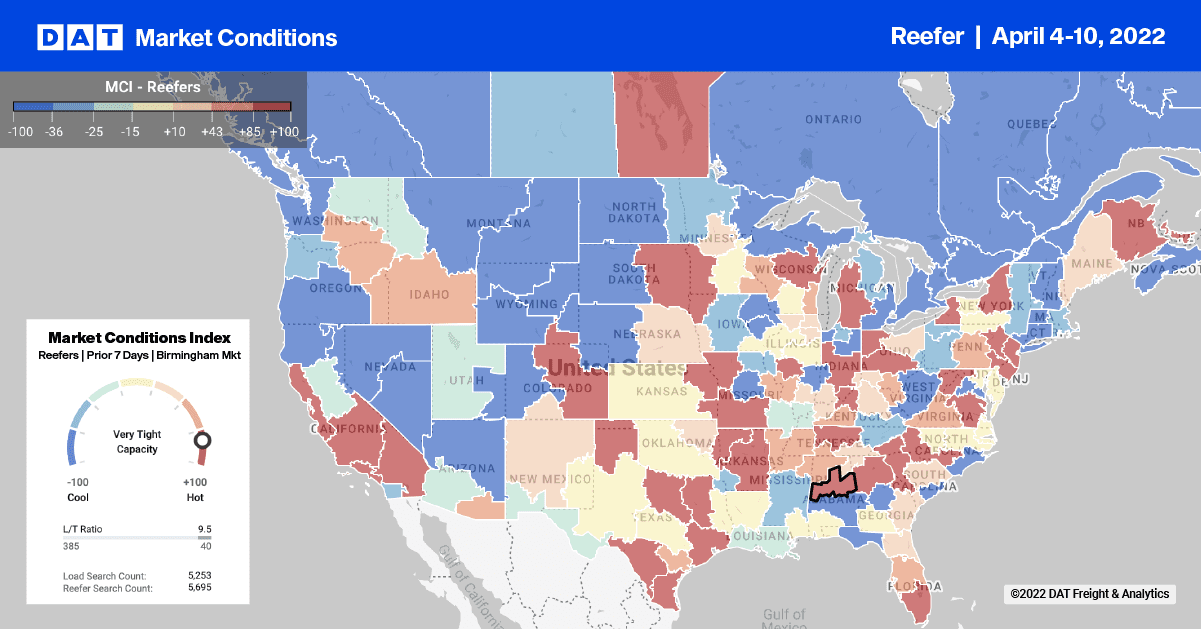

Available reefer capacity in Texas for cross-border loads in Laredo, El Paso, and McAllen markets continues to tighten. Outbound regional spot rates increased by $0.07/mile to an average of $2.90/mile excl. FSC last week and are up by just over $0.40/mile since February for loads from Laredo to Los Angeles. The same trend is observable for loads from Laredo to Phoenix, averaging $2.43/mile excl. FSC compared to $0.60/mile lower at $1.83/mile excl. FSC this time last year. Capacity tightened last week as Lent started in the Pacific Northwest, and demand for Alaskan Pollock jumped, pushing up Seattle reefer spot rates by $0.20/mile to an average of $1.84/mile excl. FSC. Shippers found plenty of capacity on most outbound lanes as spot rates dropped, except for loads from Seattle to Phoenix, where rates increased by around $0.07/mile to an average of $1.83/mile excl. FSC.

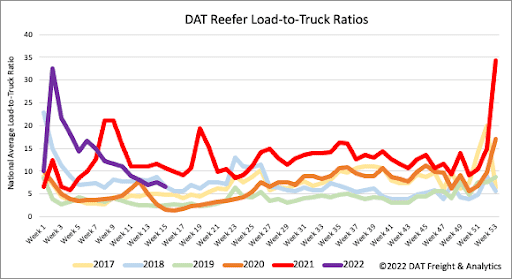

Like dry van, reefer loads posts were down 7% last week, and equipment posts were up by the same amount leaving the reefer load-to-truck ratio (LTR) unchanged. Reefer LTRs are almost exactly where they were in 2018 at 6.57 loads per truck and are now down by 38% y/y. A colder start to the produce season in the Southeast is undoubtedly playing a role in lower volumes and according to the USDA, produce truckload volumes were down 22% y/y last week.

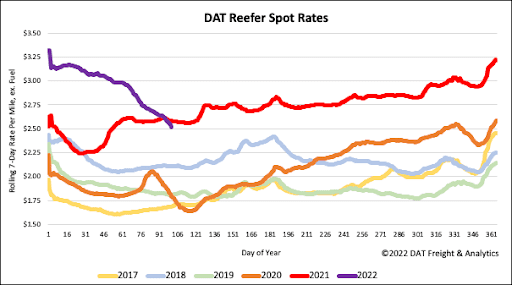

Reefer spot rates have dropped by $0.32/mile in the last month, following last week’s $0.07/mile decrease. Spot rates are now down $0.60/mile YTD ending last week at a national average of $2.56/mile excl. FSC. For context, that’s $0.69/mile higher than the same time in the previous four non-pandemic years from 2016 to 2019.