It’s sweet potato season, meaning reefer capacity could tighten in North Carolina, the leading producer in the United States, accounting for 76% of annual tonnage. For the last eight weeks, the United States Department of Agriculture (USDA) has also reported a slight shortage of trucks in Delaware, Maryland, and the eastern Virginia region, one of only 20 produce-growing regions tracked weekly by the USDA to report a shortage of reefer equipment. California, Mississippi, and Louisiana also account for 36% of annual sweet potato production.

In the U.S., sweet potatoes are generally harvested in September and early October. However, it can take up to eight weeks of curing and storage after harvest before sweet potatoes sweeten and develop the texture we are accustomed to, putting the root’s peak seasonality right around Thanksgiving. November accounts for around 15% of annual tonnage, although sweet potatoes will be in season in most parts of the U.S. through early spring.

Tonnage could be down this year, although North Carolina sweet potato growers are hopeful that a continuing drop in acreage will lead to tighter supplies and more robust markets and help them cope with inflation and skyrocketing costs. Jeff Thomas, marketing director for Lucama, N.C.-based Scott Farms, said, “Everything from packaging to fuel to fertilizer has gone up. Meanwhile, sweet potato prices have stagnated, prompting some growers to transition to more lucrative crops, like tobacco, soybeans, peanuts, cotton, or corn.”

According to USDA, increased competition from growers in South Africa and Egypt contributed to North Carolina’s sweet potato acreage dropping from about 105,000 acres in 2021 to 84,000 in 2022.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

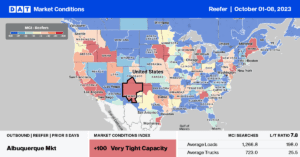

Outbound reefer capacity began to tighten slightly in Fresno last week, even though California produce volumes are 17% lower than last year, according to the USDA. Reefer rates averaged $1.92/mile for outbound loads after losing $0.07/mile over the prior three weeks. After dropping since June, spot rates paid carriers $2.81/mile last week for loads from Fresno to Twin Falls, ID, up $0.13/mile w/w. Phoenix loads averaged $2.74/mile, while long-haul loads to Hunts Point, NY, the nation’s largest produce market, averaged $1.77/mile after dropping $0.54/mile since the peak in produce season shipping around July 4.

California state average rates at $2.24/mile are around $0.12/mile higher than in 2019, but follow cooling seasonal trends before picking up in November heading into Halloween, Thanksgiving, and the Xmas shopping season. In Philadelphia’s largest reefer import market, rates increased by $0.05/mile last week, averaging $1.90/mile, reversing a three-week decline.

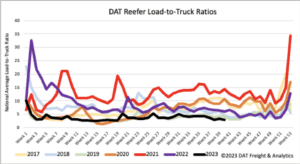

Load to Truck Ratio (LTR)

The volume of Reefer load posts (LP) decreased by 13% last week, influenced by the 5% w/w decrease in national produce truckload volume. Spot market volumes are around half what they were a year ago and also compared to the pre-pandemic average for Week 40. Carrier equipment posts increased by 4% w/w, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing by 16% to 2.83.

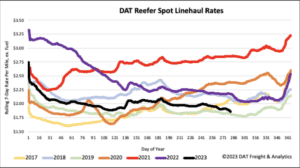

Spot Rates

At $1.90/mile, reefer linehaul spot market rates are $0.32/mile lower than last year and just $0.04/mile higher than in 2019, following last week’s $0.04/mile decrease. Impacting the soft reefer market is the 17% lower truckload produce volume originating in California, and although we’re in the transition period between summer and fall produce seasons, volumes in the cooler northern tier of the country are insufficient to impact national reefer demand.