Church Brothers Farms produces salads and vegetables from April through November in Salinas, CA, and the San Juan Valley of California for the spring and summer seasons. Then, from November through April, they shift their entire processing operation to the “Winter Salad Bowl” in Yuma, Arizona, and California’s Imperial Valley for the winter season. They uproot their entire farm team and salad plant twice yearly to ensure they consistently produce their salads at the source.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

“3,000 people were uprooted within 24 hours mid-November using 60 trucks to relocate the salad processing plant almost 600 miles from Salinas to the desert”, according to Ernst van Eeghe, VPO Business Development at Church Brothers Farms. They make this transition because farming conditions are slightly better during this time in the winter in Yuma, while the fields in Salinas sit idle for a couple of months before they start planting again for the spring crop.

These desert regions have warm climates during the winter, making them ideal for growing lettuce, spinach, kale, and other leafy greens when colder areas are dormant. Yuma, Arizona, is known as the “Winter Lettuce Capital of the World,” supplying about 90% of the leafy greens consumed in the United States during winter.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

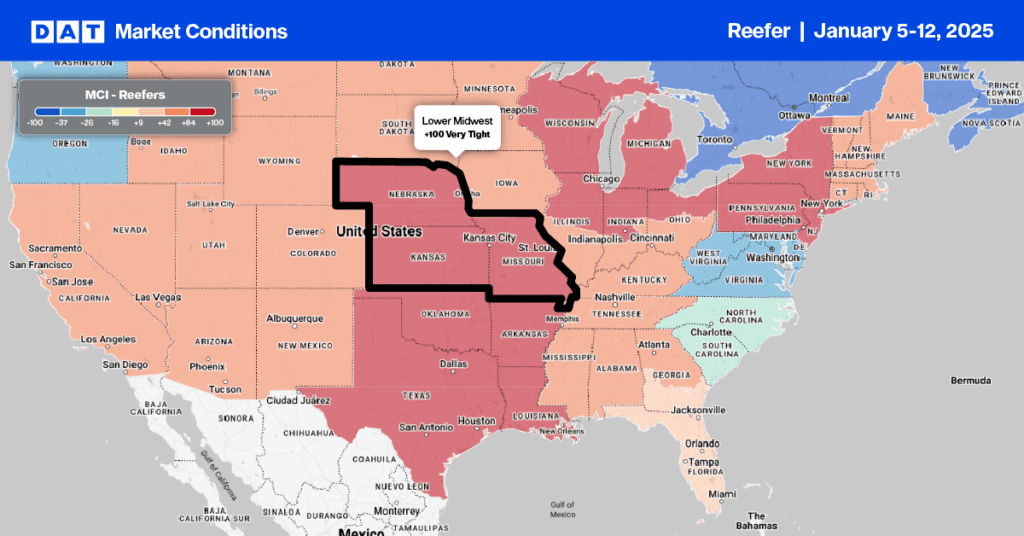

This week, we focus on the Lower Midwest Region freight market, a meat and poultry production hub. The region includes Missouri, Illinois, Indiana, Kentucky, and parts of Kansas and Oklahoma. It is a significant beef cattle producer known for large ranches and feedlots, especially in Missouri and Kansas. States like Iowa (which borders the region) and Indiana are national leaders in pork production, with large-scale hog farms and processing facilities. Chicken and turkey production is also a primary focus, particularly in Arkansas, Missouri, and Kentucky.

Most roads in NE Kansas were closed early last week due to recent blizzard conditions. Closures include a large portion of I-70. Network velocity slowed significantly due to capacity tightening and linehaul rates increasing by $0.02/mile to an outbound average of $2.67/mile, $0.13/mile higher than last year. Inbound regional capacity was the tightest, though, as linehaul rates jumped by $0.15/mile to an inbound average of $2.37/mile.

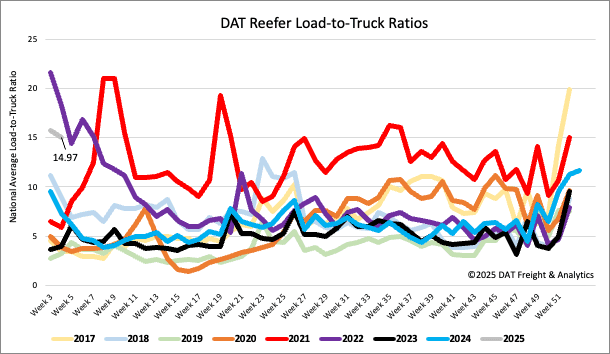

Load-to-Truck Ratio

Reefer load posts were around 30% higher than last year as network velocity slowed due to Winter Storms Blair and Cora last week. Equipment posts were down also, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing by 5% to 14.97, just over double last year.

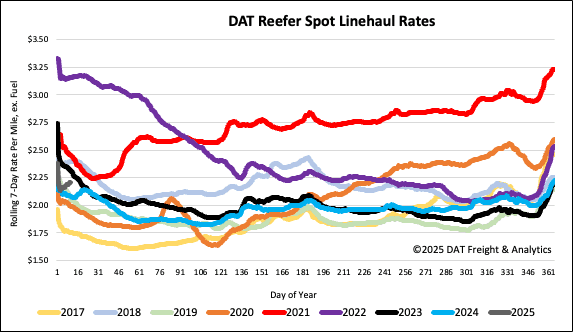

Spot rates

At a time when reefer spot rates usually are cooling off, reefer capacity tightened slightly last week, with the national average linehaul rate remaining mostly unchanged at just above $2.22/mile. Regional reefer rates in the Lower Midwest surged, increasing by $0.19/mile to $2.88/mile in Nebraska and Kansas as Winter Storm Blair arrived. At $2.22/mile, the national average is $0.12/mile higher than last year.