Hunt’s Point Produce Market (HPMM), the largest produce market in the U.S., has outgrown the facilities’ storage, using diesel-powered reefer trailers as extra storage. Around 1,000 of them, to be precise. Old reefers being used as storage at produce markets across the county is not new, but at this scale, it starts to cause significant congestion for truckers trying to unload on already crowded docks in the dark. According to a 2017 study, there were 15,000 daily truck trips at HPPM, of which 80% (12,000) were outbound from the market. The remaining 3,000 truck trips daily were loaded inbound reefer trucks from all over the country, with 44% arriving between 3:00 am and 7:00 am.

Within the last year, HPMM has received commitments for $140 million from New York City and $110 from a federal grant, in addition to the recent $130 million approved by the New York State Assembly. Still, this is just under half what the produce and fish market needs for redevelopment, as over 30 merchants have outgrown existing storage facilities. The New York City Economic Development Corporation (EDC) oversees the project with the Produce Market Cooperative and a private developer, outlining the modernization efforts to transform the market into a state-of-the-art intermodal freight facility. Adding more than 800,000 square feet of refrigerated warehouse space and 200,000 square feet of ancillary space will reduce the estimated 24,000 gallons of diesel the 1,000 stationery reefer trailers consume daily.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

At $2.39/mile, outbound reefer rates in Georgia are identical to 2019, following last week’s $0.03/mile increase. Reefer linehaul rates in Atlanta increased by $0.05/mile the previous week to $2.13/mile, with tighter capacity reported for the 440-mile haul to Orlando, where spot rates average $2.68/mile, the highest since March and $0.37/mile higher than last month. Further west in Houston, spot rates at $1.89/mile were $0.03/mile higher last week, led by gains on the short-haul 200-mile lane to San Antonio. At $597/load or $3.03/mile, spot rates are slightly higher than in May but just over $130/load or 18% lower y/y.

The USDA continues to report a slight shortage of trucks in Nogales in the Tucson freight market. Last week spot rates increased by $0.05/mile to $2.75/mile, while loads to San Franciso were flat at $2.16/mile. In contrast, capacity on the Nogales to Seattle lane has been tightening for the last two months, and at $2.66/mile, linehaul rates are the highest since last July and $0.013/mile lower than a year ago. Outbound capacity continues to tighten in Fresno, where rates increased by $0.09/mile the previous week to an outbound average of $2.41/mile. San Francisco reefer spot rates increased by the same amount last week to an average of $2.35/mile with loads from Salinas, the nation’s salad bowl, to Hunts Point, NY, at the highest in 12 months at $2.29/mile.

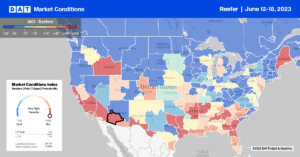

Load to Truck Ratio (LTR)

Reefer spot market volumes dropped by 5% w/w and are now 28% lower since Mother’s Day. Like the dry van sector, reefer volumes are also the weakest in seven years, impacted by lagging produce volumes, mainly in California, where the USDA reports volumes are 33% lower than last year. Carrier equipment posts were 3% lower last week, resulting in the reefer load-to-truck (LTR) decreasing slightly from 3.36 to 3.29, the lowest recorded since 2016 as we pass the halfway mark of the produce season.

Spot Rates

Reefer linehaul rates inched higher last week, averaging just over $2.05/mile with very little change since the Mother’s Day surge in reefer volumes. Last week’s national average was just $0.09/mile higher than in 2019, and compared to the same time the previous year, spot rates are $0.26/mile lower.