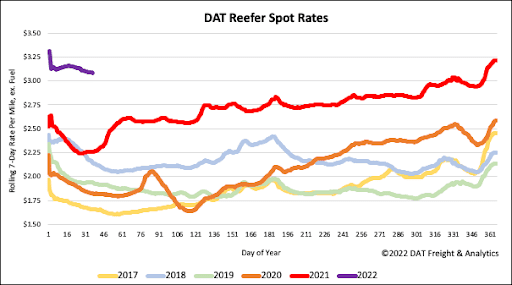

The lack of refrigerated trucks in regional produce markets has persisted ever since the pandemic began in 2020, with no sign that it will change anytime soon.

Since spot rates bottomed out at $1.64/mile excl. FSC in April 2020, they’ve almost doubled and are now closer to $3.15/mile excl. FSC this week. High spot rates and tight capacity go hand in hand with some of the nation’s largest produce markets finding consistent truck availability one of the most significant challenges for brokers and shippers this year. Produce regions that are currently reporting a shortage of trucks in the last 30-days include the following and their respective average rate per mile:

- Upper Valley, Twin Falls Idaho – $3.98/mile for potatoes and onions

- San Luis Valley Colorado – $3.05/mile for potatoes

- Central and South Florida – $3.40/mile for most winter vegetables

- Eastern North Carolina – $5.48/mile for sweet potatoes

- Columbia Basin Washington – $4.49/mile for potatoes

- Minnesota-North Dakota (Red River Valley) – $5.07/mile for potatoes.

Linehaul spot rates for all produce commodities and regions are currently averaging $4.97/mile incl. FSC, which is $1.39/mile higher than DAT’s national average reefer spot of $3.48/mile incl. FSC this week, according to the USDA. The USDA long-haul rates are averaged over regions and commodities. Since the pandemic began, the cost of moving truckloads of fruit and vegetables has increased by 120% from an average of $2.66/mile incl. FSC in April 2020 to $4.97/mile this week. Spot rates for produce have increased by almost $1.00/mile in just the last three months.

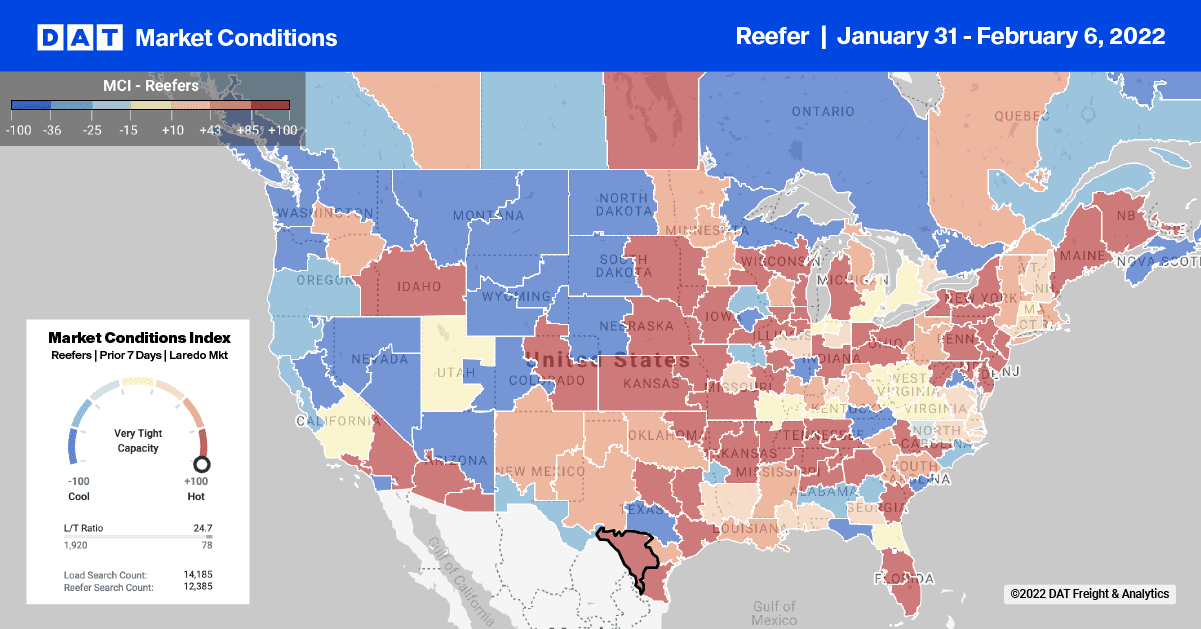

Increasing demand for reefer carriers northbound out of Miami to haul Valentine’s Day flower and winter vegetables tightened last week following a 6% w/w increase in load post volumes. After dropping for the prior three weeks, reefer spot rates were up $0.02/mile this week to an average of $1.91/mile excl. FSC. On the number one volume lane between Miami and Atlanta, spot rates are averaging $2.56/mile excl. FSC, which is $0.54/mile higher than the January average, is almost $0.90/mile higher compared to this time last year. Further north in Lakeland, average outbound spot rates increased by $0.06/mile last week to $2.05/mile, and in neighboring Jacksonville, rates jumped by $0.27/mile to an average of $2.92/mile excl. FSC.

Reefer capacity was very tight in El Paso, where spot rates increased by $0.18/mile to $2.63/mile excl. FSC last week while in the Northeast, spot rates were up $0.08/mile last week to an average of $3.36/mile excl. FSC as Winter Storm Landon dropped snow and ice across significant interstates. Reefer capacity in Allentown PA, has been tightening for the last three week’s following last week’s $0.33/mile increase to an average of $3.45/mile excl. FSC. On the high-volume Allentown to Boston lane, reefer rates hit a new 12-month high averaging $6.33/mile excl. FSC last week, which is $1.18/mile higher than the previous year. Out west capacity continues to ease for loads from Los Angeles to Las Vegas – spot rates are down $0.76/mile from the 2021 peak of $6.35/mile excl. FSC in November, averaging $5.59/mile excl. FSC last week. That’s still $1.74/mile higher than the same week in 2021.

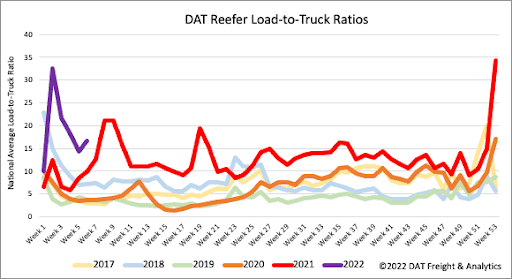

After four weeks of successive declines in January, reefer load post volumes reversed course last week, increasing by 8% w/w as freezing cold air dipped in from Canada. Even though reefer load post volumes are down 34% m/m they remain 70% higher compared to the same week last year. Equipment posts dropped 7% last week, resulting in the reefer load-to-truck ratio increased by 16% w/w from 14.35 to 16.71.

Reefer spot rates dropped another $0.04/mile last week (down $0.08/mile in the previous two weeks) to a national average of $3.07/mile excl. FSC. Reefer spot rates are still $0.82/mile higher than the same period last year and $1.22/mile higher for week five compared to the prior five years at the same time.