In the last 30 days, watermelons, potatoes, onions, apples, tomatoes, and strawberries have dominated truckload produce volumes but with a twist. Due to the weather-impacted late start to the West Coast season, more volume is coming from Mexico to offset lower volumes in California. Still, national volumes are down around 4% y/y, according to the USDA for the week ending 19 June. That shift from domestic to imported volume from Mexico presents opportunities and challenges for truckload carriers as they evaluate where to position assets to take advantage of higher volumes and spot rates. Take tomato production, for example. Even though Mexico supplies 90% of annual tomato production for the U.S. annually, there are two overlapping production/harvest peaks in different regions. The first peak is from December to April, followed by the second harvest from May to November.

Timing is everything, but then so is location. The first peak is dominated by the state of Sinaloa on the Gulf of California. It is ideally located to ship export volume via Nogalies in the Tucson freight market, which accounts for 26% of annual exports to the U.S., peaking in April. Immediately after, volumes crossing into Arizona tail off and shift 1,200 miles east to Texas in the McAllen freight market. The May to November harvest period shifts in Mexico to southern states, including San Luis Potosi, Michoacan, and Zacatecas, which are closer to the Pharr, TX border crossing in south Texas, which accounts for 34% of tomato export to the U.S. Knowing when and where tomato production is occurring is vital for truckload carriers and brokers.

A similar trend occurs on our northern border. Even though Canada accounts for 8% of annual tomato imports, 45% of production is imported in June, July, and August The main growing area in Canada is in Southwestern Ontario in Kent and Essex Counties centered around Leamington, just 45 minutes by truck from the Ambassador Bridge commercial crossing zone into the U.S where three-quarters of tomatoes roll across the border.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

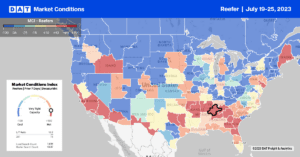

As the produce season moves further north and into the Southeast, capacity is tightening in Savannah and Tifton markets, where spot rates were up $0.02/mile w/w to $2.48/mile. Georgia state-level rates are just $0.02/mile lower at $2.46/mile, which is $0.09/mile higher than in 2019. On the high-volume reefer lane between Atlanta and Orlando, capacity was very tight last week; spot rates jumped to $3.23/mile, the highest since last August. Loads 900 miles north to Hunts Point, NY, the largest produce market in the country, at $3.07/mile, was around $0.28/mile lower compared to the previous year.

On the West Coast in Fresno, spot rates cooled slightly, dropping by $0.03/mile to $2.39/mile, while in Stockton, home to the largest cherry-producing country in Lodi, CA, outbound reefer rates increased $0.03/mile to $2.44/mile. Cherry season in Washington State is just starting to come online and is ahead of the 2022 season. Compared to California’s shorter season, which accounts for 18% of national cherry production, Washington State produced three-quarters of the national volume and will be a crucial driver of reefer linehaul spot rates in the next two months in the Pacific Northwest. State average rates in Washington at $1.58/mile were up $0.03/mile last week and by the same amount compared to 2019.

Load to Truck Ratio (LTR)

After dropping over the four prior weeks, reefer spot market volumes reversed course last week, increasing by 3% w/w. The slow start to the produce season and lagging volumes in California have reduced overall market volumes for temperature-control carriers so far this season. According to the USDA, national volumes are 8% lower than last year, and in California, volumes are 33% lower. Carrier equipment posts were 10% lower last week, resulting in the reefer load-to-truck (LTR) increasing slightly from 3.29 to 3.77.

Spot Rates

Normally reefer spot rates are heating up in the lead-up to July 4 celebrations, but not this year as the spot market continues to drift sideways. Reefer linehaul rates decreased by just over a penny per mile last week to a national average of $2.04/mile. Produce season typically lifts spot rates by around $0.18/mile between mid-April and this week; that increase is just $0.10/mile this year. Last week’s national average was just $0.08/mile higher than in 2019, and compared to the same time the previous year, spot rates are $0.24/mile lower.