According to USDA, weekly truckloads of citrus at the start of December were down 19% y/y underscoring what a difficult year the California produce market has experienced. It’s not just citrus that has been impacted by the West Coast pandemic, port congestion, truckload supply, and weather; total state produce volumes are down 54% y/y over the same timeframe. Compared to early December 2020, volumes are down by 60%. California accounts for around 54% of citrus production nationally and is traditionally a big part of truckload volumes for reefer carriers.

The impact on the 2023 produce season for carriers is expected to be much the same as this year, given Californians live in the state’s driest period on record. Even though recent rains show promise of easing conditions, 38% of the state is still in exceptional drought conditions. Charles Duby, who markets oranges for Sequoia Orange Co, said, “Some growers are drilling deeper or additional wells if they can. Others want to move water from one region to another or between ranches. The water issue is going to drive a lot of people out of citrus.”

According to Casey Creamer, President, and CEO of California Citrus Mutual, “Two years ago, the industry faced a much heavier crop that marketers struggled to move, especially to export markets, due to port delays and shipping logistics, Creamer said. As more fruit ended up in the domestic market, prices slid. The season was extended, with growers holding fruit on trees longer, which resulted in “significant declines” in last year’s crop. We’re sort of recovering this year from that.”

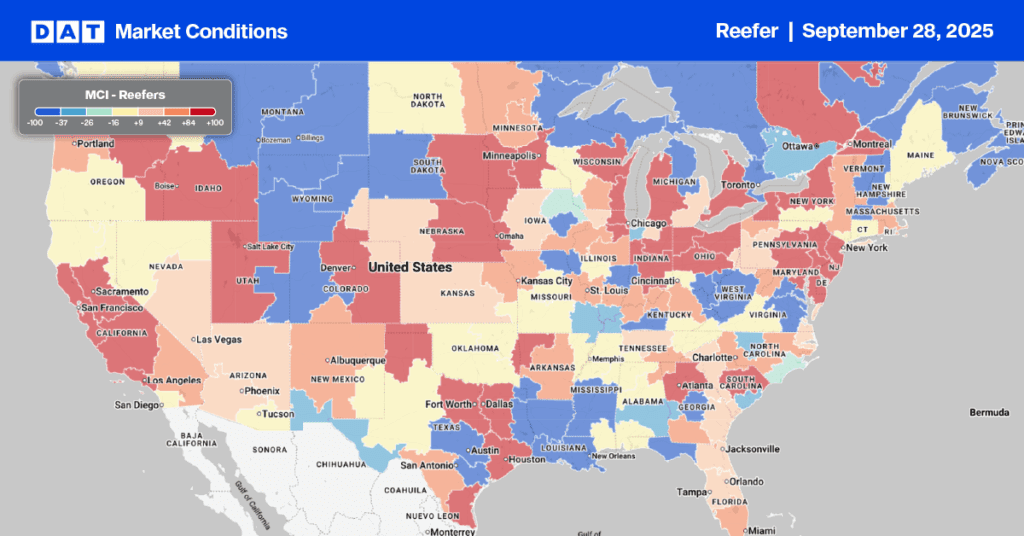

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Reefer capacity in Gulf Coast markets tightened last week following a $0.06/mile w/w increase to an average outbound rate of $1.47/mile. State-level rates in Louisana, at $2.79/mile last week, were the highest in seven years, while in the New Orleans market, rates jumped by $0.53/mile to $2.51/mile. Spot rates for regional loads west to Houston were flat last week at $2.33/mile, while in Houston, the largest Gulf Coast reefer market, increased by $0.02/mile to $1.94/mile for outbound loads.

Laredo’s outbound truckload capacity eased following last week’s $0.10/mile decrease to $2.14/mile, while the opposite occurred on the 350-mile haul to Houston. At $3.65/mile, linehaul reefer rates are $0.06/mile higher than in November and around $0.40/mile lower than the previous year. In New England, reefer capacity tightened last week – spot rates were up $0.17/mile to $2.09/mile for outbound reefer loads. In the region’s second-largest market in Augusta, ME, rates were up by $0.11/mile to $1.89/mile. Loads from Augusta to Elizabeth, NJ, at $2.61/mile, are $0.05/mile higher than in November by almost $0.70/mile lower y/y. Loads from the fresh potato and frozen french fry center in Presque Isle, ME, on the Canadian border, were flat at $3.02/mile last week for loads to New Jersey.

Load to Truck Ratio (LTR)

Reefer load posts are tracking closely with December 2018 and 2019 levels following last week’s 34% w/w decrease. Volumes are also 51% lower than the previous year, while carrier equipment posts remained at their highest level in six years, 23% higher than the oversupplied 2019 market. As a result of lower volumes and an increase in equipment posts, last week’s reefer load-to-truck (LTR) decreased from 6.10 to 3.52.

Spot Rates

Last week’s national average reefer linehaul rate, at $2.04/mile, remains very close to 2017 and 2018 levels following last week’s $0.03/mile decrease. Reefer linehaul rates are $0.91/mile lower y/y, with most of that decrease occurring since June. One data point contributing to lower reefer demand is produce. According to the USDA, volumes are down 18% y/y and identical to 2016 levels. For the first time in years, they are reporting a surplus of trucks throughout California at the start of December.