The journey of the Capitol Christmas Tree, a remarkable 4,000-mile trek, began on October 30 and will conclude on November 21 in Maryland. It encompasses 11 stops, with the tree transported by barge and truck from Wrangell, Alaska, to the West Lawn of the U.S. Capitol building. The U.S. Capitol Christmas Tree Whistlestop Tour kicks off in Ketchikan, Alaska’s “First City.” From there, the tree will be barged to a port in the Pacific Northwest before continuing its journey overland to the lower 48 states.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

A decade ago, Lynden Transport was chosen to transport the Capitol Christmas Tree from Alaska’s pristine forests to the nation’s capital. This year, they will again handle this essential “haul-iday” freight with the same driver, John Schank, who navigated the route in 2015. Fred Austin, another seasoned industry veteran, will assist him.

John Schank was recognized as the Driver of the Year by the Alaska Trucking Association (ATA) in 2014 and 2017. He received commendations from former Alaska Governors Parnell and Walker for his nearly 40 years of accident-free driving on the challenging Dalton Highway, which links Fairbanks to Prudhoe Bay. At that time, Schank had logged 5 million miles on the highway—more than any other driver in history. Since then, he has driven an additional 1.1 million miles, all without an accident.

Fred Austin began his career with Lynden in 1975, coinciding with the start of the Alaska oil pipeline construction in Fairbanks. He is now a driver trainer and mentor at the Lynden Training Center in Fairbanks. In 2015, at 79, he became the oldest person in Alaska to take instructor training and sit for the test.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we focus on the Minnesota reefer market, the top-producing state for fresh turkeys ahead of Thanksgiving. Minnesota is the top turkey-producing state in the United States, raising between 40 and 42 million turkeys annually. It has been the top producer for the past two decades, and about one in five turkeys grown in the US comes from there. Minnesota supplies fresh turkeys to many states during Thanksgiving, including high-demand areas like California, New York, Texas, Illinois, and Pennsylvania.

Outbound truckload volumes in Minnesota increased by 6% last week, pushing up spot rates by $0.04/mile to $2.34/mile. Regional loads to Illinois paid carriers and average of $2.27/mile on a 4% lower volume, while longer-haul loads to California were flat at $1.32/mile.

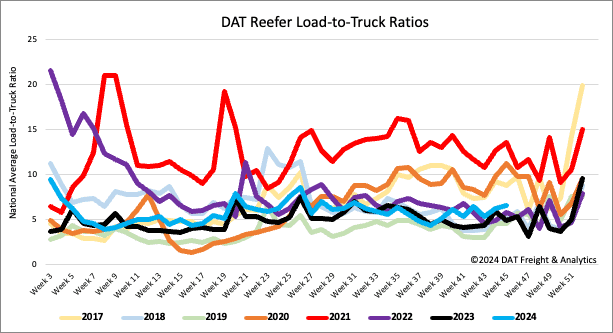

Load-to-Truck Ratio

The USDA reported an 8% lower volume of produce last week nationally, impacting spot market load posts, which were 4% lower. Load post volumes are 5% lower than last year, while carrier equipment posts on our load board are 30% lower, reflecting the ongoing exodus of truckload capacity. Last week’s reefer load-to-truck ratio (LTR) stands at 6.61, up 6% w/w and 36% y/y.

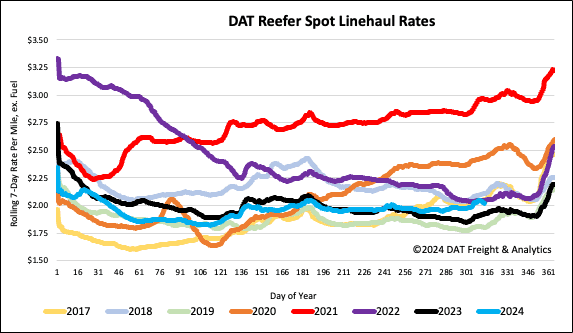

Spot rates

The surge in reefer spot rates ahead of Thanksgiving started following last week’s 2% increase in national truckload volume. Linehaul rates were up a penny per mile, paying carriers an average of $2.03/mile, $0.09/mile higher than last year. Reefer linehaul rates are around $0.05/mile higher than the three-month trailing average.

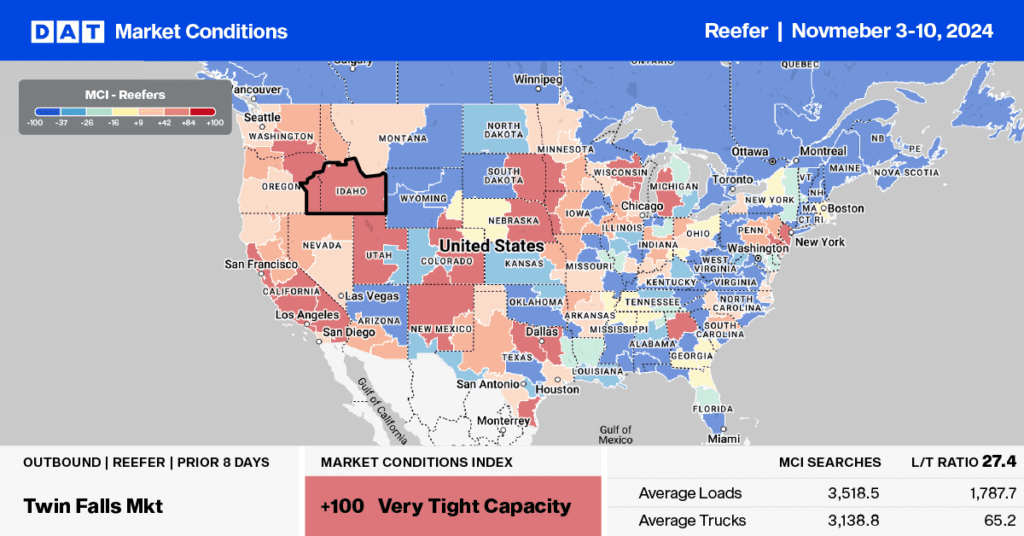

The USDA reported a shortage of trucks in the Yakima Valley in Washington State last week for apples and pears as Fall Produce and Christmas Tree shipping seasons intersect. Washington state average reefer spot rates were up $0.07/mile last week to $2.19/mile, while in the Spokane market, linehaul rates were $0.05/mile higher, averaging $2.26/mile on a 7% lower volume.