Soon sweethearts of all ages will exchange cards, flowers, candy, and gifts in the name of St. Valentine. According to the latest National Retail Federation (NRF) survey, consumers plan to celebrate Valentine’s Day spending an estimated $23.9 billion on candy, greeting cards and flowers, which is 10% more than in 2021 and making this year the second-highest on record.

Close to 76% of consumers surveyed said that they feel it’s important to celebrate given the current state of the pandemic with candy (56%), greeting cards (40%) and flowers (37%) remaining the most popular gift items.

“Nearly a third (31%) of respondents plan to gift an evening out this year, up from 24% in 2021 and just slightly below pre-pandemic levels, for a total of $4.3 billion,” said NRF President and CEO Matthew Shay.

Consumers plan to spend an average $175.41 per person, which is up $11 from last year based on plans to spend more on significant others or spouses this year. As has been the case throughout the pandemic, consumers will purchase more Valentine’s Day gifts online this year. The top shopping destinations are online (41%), department stores (32%) and local small businesses (18%) and florists (17%), the latter two causing the most difficulties for truckers where most loads are time-sensitive, not on pallets and have to be loaded and unloaded by hand. The vast majority of chocolates and greeting cards will already be positioned in warehouses leaving fresh cut flowers to make the most significant impact on short-term volume and rate spikes in the next two weeks.

Handling flowers is all about cold chain management according to Christine Boldt, executive vice president of the Association of Floral Importers of Florida (AFIF).

“Once we pick the product in the country of origin, we hurry to get it in boxes and into the coolers and the faster we can get it cooled in the dormant stage, the longer it can last,” Boldt told DAT Freight & Analytics. “The product loses life if the temperature fluctuates so every time the temperature goes up, that’s when it loses life.”

And that’s where reefer carriers come into their own and in the seven weeks leading up to February 14th, an average of 500 truckloads per day will head north out of Miami where 80% of all flora volume is handled by just three carriers. They typically rely on a large number of company-owned trucks as well as independent contractors to handle the surging volume of roses in particular next week.

Increasing demand for reefer carriers has already started in Miami where load post volumes have increased 15% w/w as brokers and shippers look to secure more outbound capacity ahead of Valentine’s Day. The number one reefer volume lane out of Miami is Los Angeles this week, where spot rates are averaging $1.20/mile excl. FSC, which is only $0.08/mile higher than both the December average and corresponding week last year. Spot rates for loads in the opposite direction from Los Angeles to Miami have cooled after decreasing $0.24/mile in the last month to an average of $3.01/mile excl. FSC this week. That’s still $0.77/mile higher than this time last year.

Atlanta is the number two destination for reefer loads out of Miami, with capacity tightening rapidly following the $0.52/mile m/m increase to an average of $2.35/mile excl. FSC. Reefer spot rates this time last year were $0.65/mile lower at $1.70/mile excl. FSC but were trending upwards to the annual peak just before Mother’s Day in May each year (where they peaked at $2.81/mile in 2021). The number three lane out of Miami is Elizabeth, NJ, where spot rates are averaging $2.15/mile excl. FSC this week, which is $0.55/mile higher than this time last year.

Load to Truck Ratio (LTR)

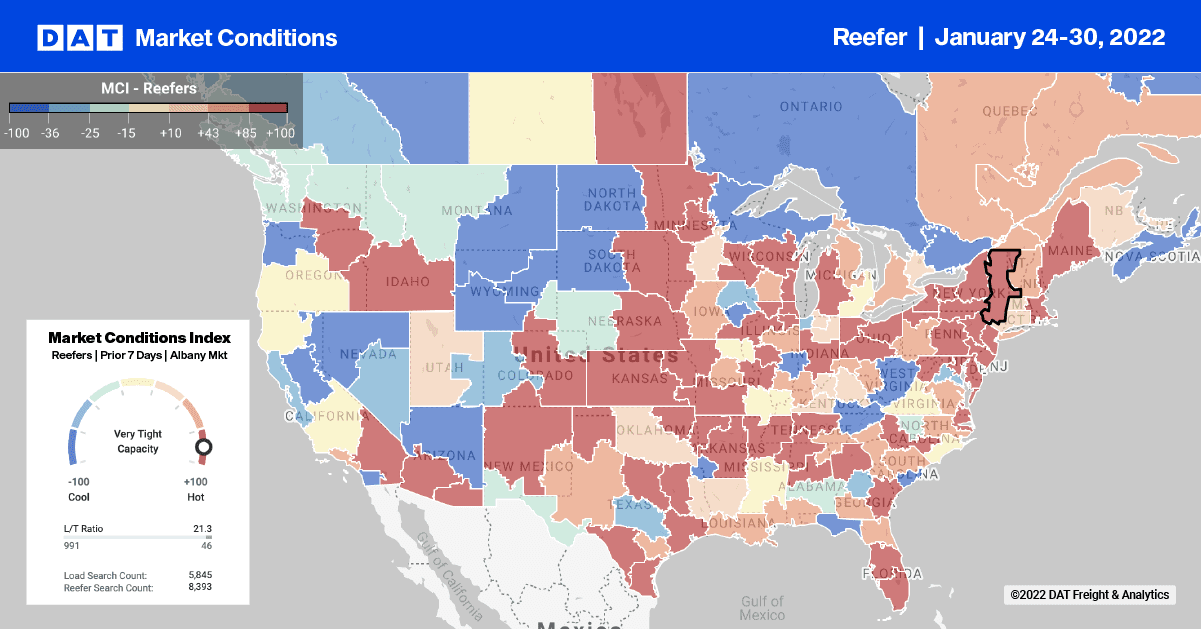

Reefer load post volumes have dropped for four weeks in succession following last week’s 14% w/w decrease. Reefer load post volumes are almost double the same time last year but are now down 40% m/m with signs the reefer spot market is cooling. Following a 9% w/w increase in equipment posts last week, the reefer load-to-truck ratio decreased by 21% w/w from 18.16 to 14.35.

Spot Rates

After remaining flat for most of January, reefer spot rates recorded their largest weekly drop in 2022, decreasing by $0.05/mile to a national average of $3.11/mile excl. FSC. Reefer spot rates are still $0.87/mile higher than the same period last year.