The wait is almost over! The highly anticipated Vidalia onion season is set to begin, with the Georgia Agriculture Commissioner and the Vidalia Onion Committee announcing the official 2025 pack date: April 15. This date marks the start of shipping for these beloved sweet onions to grocery stores nationwide.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Vidalia onions will be available from April through early September and are prized for their sweetness and versatility. The pack date is determined based on weather and soil conditions in 20 counties across South Georgia. This production region has 10,000 acres planted with onions, reflecting strong consumer demand, according to Cliff Riner, Chairman of the Vidalia Onion Committee.

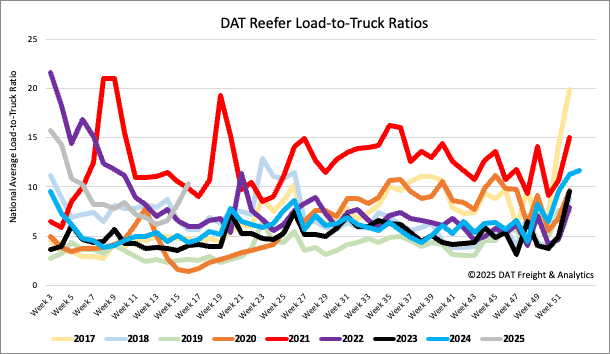

From a freight market perspective, the Vidalia Onion pack date signals the official start of the 2025 produce season. At this time, reefer capacity begins to tighten and volumes increase as temperatures rise. Before this point, produce volumes were already increasing in Florida, peaking in May with fruits like strawberries and winter vegetables. As the season progresses, production moves north to Georgia and parts of South Carolina, where onion and peach growers compete for available freight capacity. This chain reaction typically leads to a rise in reefer demand from April through July 4 each year.

Load-to-Truck Ratio

Reefer load post volumes increased by 22% last week, boosted by the 19% w/w increase in North American produce volumes, mainly due to a surge in volumes from Mexico. Sources south of the border tell DAT they were moving as much produce as possible, expecting that exports to the U.S. could be subject to additional tariffs. The new Administration spared Mexican produce in last week’s tariff announcements. Still, load post volumes in McAllen, where most Mexican produce imports cross into the U.S., were up 28% last week. The national reefer load-to-truck ratio (LTR) was up 26% last week to 10.31, more than double this time last year.

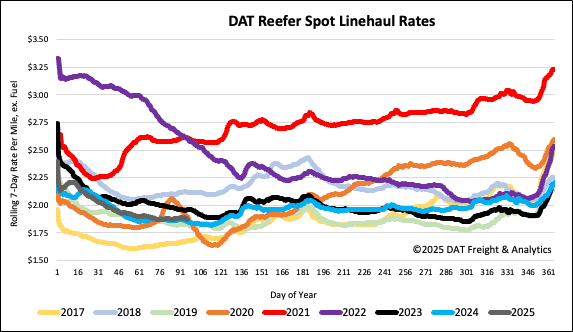

Spot rates

After being flat for most of March, available reefer capacity tightened slightly pushing up linehaul rates by $0.01/mile to $1.90/mile on flat volume. Reefer spot rates are $0.02/mile higher than last year and $0.05/mile higher than 2019.