Despite apple production numbers in the Pacific Northwest falling slightly compared to last year, growers expect final volumes to be up around 20% y/y by season’s end, according to Ignacio Vidales, sales manager for Salix. After two years of shrinking export volumes, Vidales says some factors should help reverse this trend, including “a bigger crop, freight rates adjusting down after spiking during the pandemic and probably more size 100 and smaller apples being available will help some of the overseas export markets – boosting volumes for Middle East markets, and especially India once the import duty reduction starts. We also expect growing volumes for Latin American markets.”

In contrast, the New York apple crop could be down by 20% y/y due to the spring frost that occurred at bloom time in late May. Vineyards and apple orchards across the Northeast are still gauging damage from a late-season frost that wiped out one-third to most of the crop for some growers who say it’s the worst frost damage they have ever seen.

Scott Farm Orchard lost up to 90% of its apple crop in southern Vermont when the temperature dipped to 25 degrees Fahrenheit (minus 3 degrees Celsius) for five hours on May 18. According to head wine grower and vineyard manager Ethan Joseph, at the northern end of the state, Shelburne Vineyards in Shelburne, VT, lost about 50% of its grape crop, potentially a $500,000 loss of revenue.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

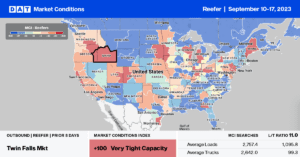

According to the USDA, the Pacific Northwest produce region contributed 22% of last week’s truckload volumes compared to California’s 18% of total loads. In Washington State, produce volumes are 4% lower than in 2022, with outbound produce loads averaging $1.97/mile. In Pendleton, ID, spot rates increased for the fourth week, paying carriers $1.88/mile, while in neighboring Twin Falls, rates averaged $2.14/mile.

Following a 1% w/w increase in outbound truckload produce volume, California’s produce volume is 7% higher than last year, but with an over-supplied reefer market, state-level spot rates continue to fall. Last week, loads paid carriers an average of $2.31/mile, $0.32/mile lower than the July 4 peak and just $0.13/mile higher than in 2019. The USDA has reported a slight surplus of trucks in all six produce-growing regions of the state for the last two weeks.

In New York, reefer capacity continues to tighten, with spot rates averaging $3.07/mile following last week’s $0.19/mile increase. Carriers were paid an average of $3.58/mile in the larger Elmira market last week, up $0.53/mile w/w. Pittsburgh loads were paying $2.73/mile, which is $0.88/mile lower than last year, while Lakeland, FL, loads were the highest since March at $2.02/mile.

Load to Truck Ratio (LTR)

Reefer load posts volume decreased 2% last week and is just over 45% lower than last year. It’ll be another six weeks before the Fall produce season starts to impact reefer truckload spot market volumes, which typically occurs at the end of October each year, according to the USDA. Last week’s reefer load-to-truck ratio (LTR) decreased by 12% from 4.22 to 3.72.

Spot Rates

At $1.97/mile, reefer linehaul spot market rates are at the six-week national average following last week’s penny per-mile decrease. Compared to last year, spot rates are $0.25/mile lower, $0.07/mile higher than in 2019, and identical to the long-term pre-pandemic average for Week 37.