The United States ranks 7th in worldwide watermelon production, with Florida, Georgia, Texas, and California leading domestic production. Watermelon is grown in warm places, from Florida to Guatemala, making it available throughout the year in the U.S., with a typical season spanning April to September, with shipping volumes peaking in June – right around the time of the Watermelon Days Festival. In the last 30 days, watermelon tonnage has dominated shipping volumes, mainly originating in Georgia, which has shipped 320 million pounds, or the equivalent of 7,500 truckloads.

Most Georgia seedless watermelons are grown near Cordele, in Crisp County, known as the “Watermelon Capital of The World,” located just 150 miles south of Atlanta in the Macon freight market. According to the Cordele-Crisp Chamber of Commerce, most melons are exported to northern states and Canada. This year, growers have found sufficient capacity to move loads, unlike last year, when there was a slight shortage of reefer carriers reported by the USDA. This time a year ago, growers were paying an average of $6.80/mile in June compared to $4.68/mile this year.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

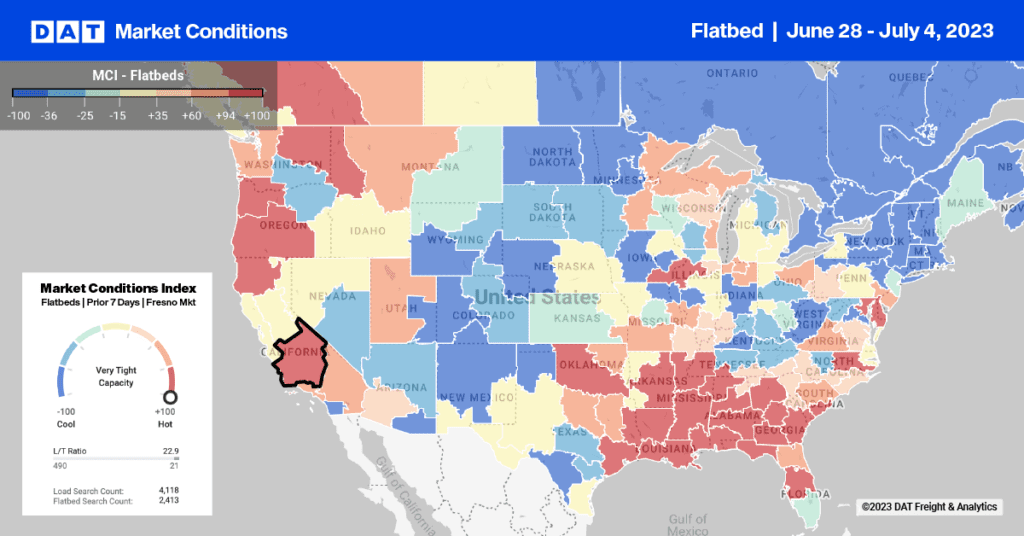

According to the USDA, truckload production volumes increased by 8% last week in California, resulting in tighter capacity in two Northern California markets. After dropping for the prior three weeks, spot rates in San Francisco increased by $0.02/mile last week to an outbound average of $2.18/mile. In the larger Fresno market, rates increased by the same amount to an average of $2.21/mile. At $2.50/mile, outbound California state-level rates were up $0.02/mile last week.

In the smaller San Diego market, which is dominated by refrigerated imports from Central and South America, spot rates jumped by $0.07/mile to $2.71/mile. Regional loads from San Diego to Fresno paid carriers $2.58/mile, while loads to Phoenix averaged $3.34/mile. In Las Vegas, outbound capacity was very tight following last week’s $0.22/mile increase to $2.32/mile. Short-haul loads to Ontario paid carriers $690/load or $2.59/mile, the highest since January, while loads to Los Angeles averaged $2.87/mile, around $0.20/mile higher than last month. Load to Truck Ratio

Reefer spot market volumes improved slightly last week, boosted by an 8% w/w increase in produce truckload volumes in California, the largest produce state in the nation with around 30% market share. Load posts increased by 5% w/w while carrier equipment posts decreased by 10%, resulting in last week’s reefer LTR increasing slightly from 3.57 to 4.14.

Spot Rates

Reefer linehaul rates were flat last week, with the national average remaining around $1.97/mile. Reefer spot rates are $0.30/mile lower than in 2022 and only $0.13/mile higher than in 2019.