Who would have thought that in the space of a year, California would go from a multi-year drought to a series of atmospheric rivers to devastating flooding, landslides, and inaccessible farmland? Lettuce growers are nearing the end of the season in Yuma, AZ, or what’s known as the Winter Salad Bowl, where 90% of leafy greens are grown over Winter between November and March. Around now, growers typically head back to Salinas, CA, to start summer production but not this year, according to Cody Koehler from A&Z Trucking in Phoenix.

In a recent interview with DAT Freight & Analytics, Cody said, “typically, we always have a transition week, and it’s called a week, but it’s usually over a span of two weeks anywhere the second week of April to maybe the last week of April. During this transition period, we ship a lot of split loads where part of the load comes from Salinas and Yuma, some 600 miles apart, which is a long way between pick-ups for truckers. So this year, we are anticipating split loading will last a little longer because of the severe weather in California, which has delayed the start of the lettuce season.

According to the USDA, weekly truckload shipments of lettuce in California are up by 9% YTD through the week ending 3/21/23 compared to the same time frame in 2022. In contrast, Yuma, AZ, lettuce production is up 15% YTD y/y over the same timeframe. In years past, the CA Lettuce volume really started to increase in the second week of April, and we’ll be watching to see how the weather has affected that timeline this year.

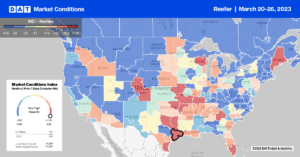

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

At $2.03/mile, outbound reefer rates in California are identical to 2019 levels following last week’s $0.03/mile decrease. The only reefer market to post a gain was in Ontario, where a three-week slide was reversed following the previous week’s $0.02/mile increase to an outbound average of $1.87/mile. In Fresno, the largest produce market in the country, volumes were up 15% last week after decreasing for the prior month. Reefer capacity continues to loosen in Fresno, though. At $1.60/mile, rates have dropped by $0.08/mile in the last month. Fresno to Hunts Point, NY, at $1.44/mile, is on par with the February average but the lowest in 12 months. DAT’s Ratescast is forecasting spot rates on the lane to increase by $0.65/mile and peak at $2.09/mile by the time July 4 celebrations roll around.

In Louisana, rates surged last week, increasing by $0.41/mile to an outbound average of $2.34/mile. Only 2021 and 2022 were higher at the end of March. Solid gains were reported in New Orleans, where rates jumped by $0.44/mile to $2.29/mile on 20% higher volumes. Demand was higher on the 500-mile lane to Atlanta, but with sufficient available capacity, linehaul rates at $1.93/mile were the lowest since last November. In the broader Southeast Region, where the produce season kicks off in a few weeks, reefer spot rates at $1.95/mile have increased by $0.07/mile in the last month.

Load to Truck Ratio (LTR)

Reefer load posts were just 12% higher than in 2019 following last week’s 15% w/w decrease. Volumes are now 66% lower than the previous year contributing to the 12% w/w decrease in the reefer load-to-truck (LTR) drop from 3.15 to 2.77, almost identical to 2019 levels.

Spot Rates

At $2.00/mile, the national average reefer linehaul rate is 29% lower than the previous year following last week’s $0.02/mile decrease. On DATs Top 70 reefer lanes based on the volume of loads moved the previous week, linehaul rates decreased on 42% of lanes, increasing on only 12% with the balance remaining neutral.