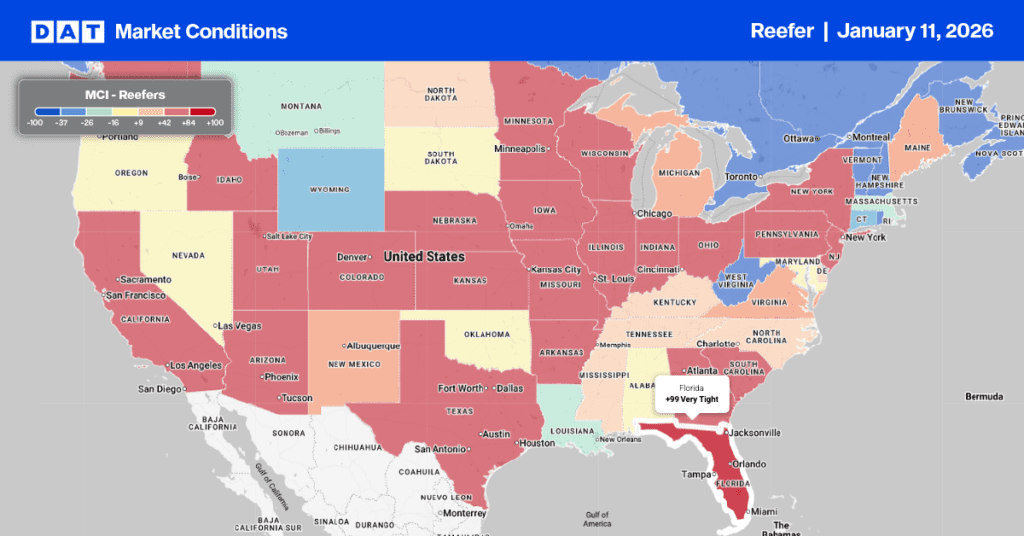

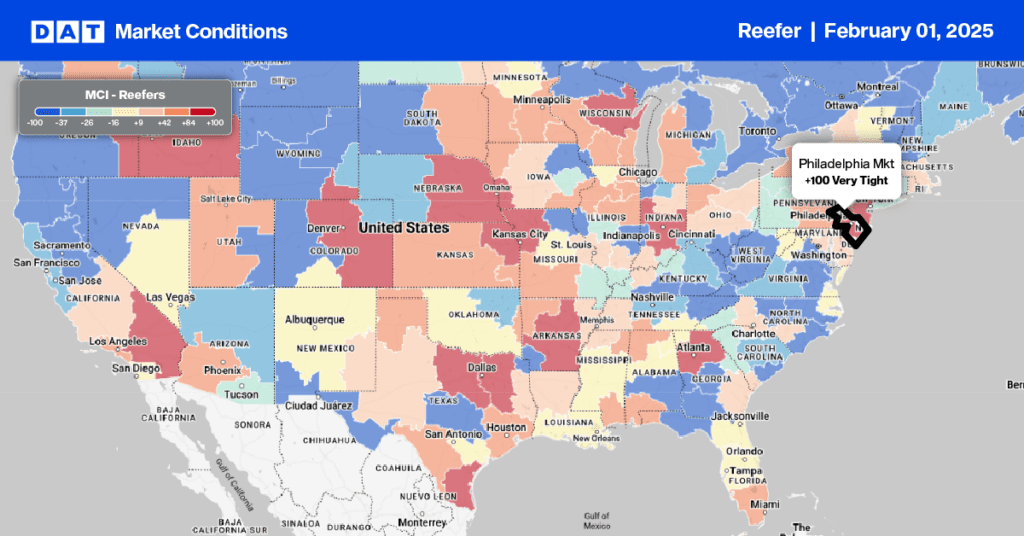

This week, we focus on the Philadelphia freight market, where DATs Market Conditions Index (MCI) expects capacity to remain very tight. The Philadelphia reefer market is the second-largest reefer spot market in the DAT freight network during winter, representing 3% of weekly volume, with nearby Wilmington, Delaware, in the Baltimore market accounting for another 2% of weekly volume. Both markets and ports are located on the Delaware River, ideally for refrigerated imports from South America.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

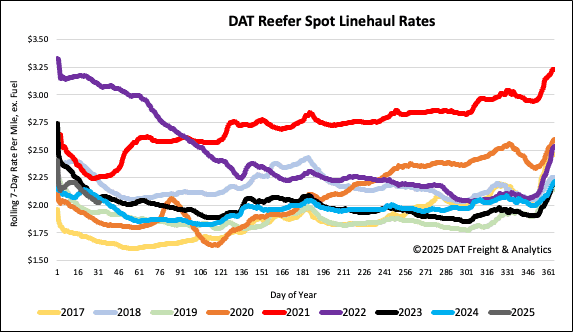

For spot market reefer carriers, top destinations include Chicago, Columbus, and Boston, where loads moved volume up 16% last week and 47% last month. At $2.20/mile last week, reefer linehaul rates are $0.17/mile lower than last year and, from this point on, typically decline through to the end of April when the Produce season results in a national tightening of available capacity.

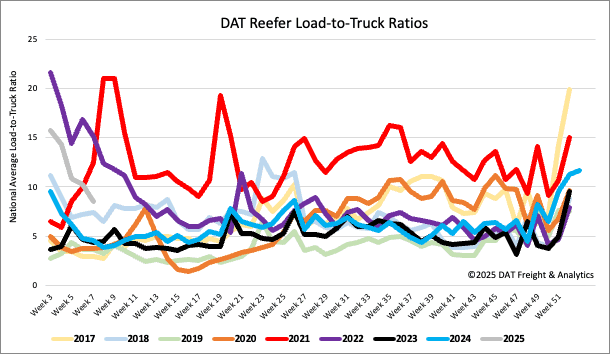

Load-to-Truck Ratio

Softer demand this winter has caused load post volume to be around 4% lower than last year following last week’s 12% decline. Reefer capacity loosened with increased equipment posts, resulting in last week’s reefer load-to-truck ratio (LTR) ending at 8.53.

Spot rates

As temperatures warmed last week, reefer capacity eased, and spot rates plunged last week following the extreme cold in early January, which tightened available reefer capacity. Shippers previously added Protect From Freeze (PFF) to traditional dry van loads early in the month (opting for reefers to keep dry van loads from freezing in transit).

Linehaul rates dropped $0.07/mile last week to a national average of $2.04/mile. Reefer linehaul rates are $0.04/mile lower than last year and $0.05/mile lower than 2023. Looking back to 2016 and excluding the pandemic-influenced freight markets, last week’s 7-day rolling average reefer rate was $0.09/mile higher than the long-term Week 5 average of $1.93/mile.