In addition to being a large military town and a hot spot for winter tourism, Yuma, AZ, is the Winter Salad Bowl, the Sunniest City in the World, and the focal loading point for reefer carriers in the Southwest.

The local lettuce harvest is in full swing in the nation’s winter capital, and combined with California’s Imperial Valley, produces about 90% of leafy greens from November through March. Following the harvest, lettuce is processed quickly at local production plants and then shipped to cities across North America, arriving on dinner tables within days.

During peak production months, the region processes more than 20 million pounds of lettuce daily, or the equivalent of 465 refrigerated truckloads. According to USDA data for the first week of December, the shipped volume of lettuce was the equivalent of 2,149 truckloads, 2% lower than the same period in 2022.

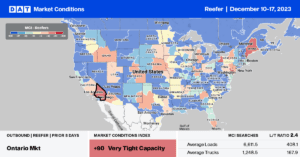

Regional reefer truckload capacity is still loose, and according to the latest USDA truck availability data for the first week of December, there is a slight surplus of available capacity in southeastern California and southwest Arizona.

Find reefer loads and trucks on North America’s largest on-demand freight marketplace.

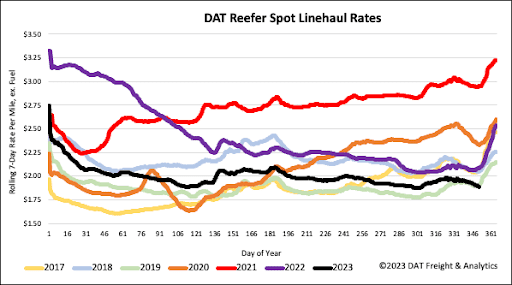

All rates cited below exclude fuel surcharges unless otherwise noted.

The start of produce season in the southwestern U.S. – in California’s Imperial Valley and around Yuma – typically sees reefer capacity tighten in the next few weeks. Linehaul rates can increase as much as $0.50/mile over this timeframe. Outbound Arizona reefer rates are $0.14/mile higher than in 2019. High volume reefer lanes out of the Winter Salad Bowl include San Francisco and Los Angeles, where last week’s loads paid carriers on average $2.09/mile and $2.63/mile, respectively. At $2.63/mile, Los Angeles’ linehaul rates are the highest since March and $0.50/mile higher than last year.

In Miami, outbound reefer capacity tightened slightly last week, impacted by a lack of willingness of carriers to head deep into the state. At $0.85/mile for loads between Miami and Atlanta, which is $0.23/mile lower than last year, carriers have been pushing for higher rates in the opposite direction, up around $0.07/mile in the last month, averaging $2.56/mile last week. That’s around $1.70/mile round-trip, barely enough to cover expenses on what is a marginal lane for reefer carriers at best.

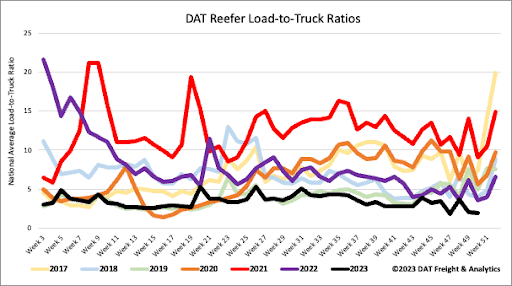

Reefer load posts decreased for the third week following last week’s 8% decline. Carrier equipment posts decreased by 4% w/w, dropping last week’s reefer load-to-truck ratio to 1.95.

After last week’s $0.01/mile decrease, reefer linehaul rates continue to lose ground. At $1.92/mile, reefer linehaul rates are $0.20/mile lower compared to 2022 and only $0.02/mile higher than in 2019. Compared to the prior two recessionary freight periods in 2016 and 2019, reefer linehaul rates increased by $0.20/mile from this point to the end of the year. Like the dry van sector, this year’s spot market is tracking the closest to 2019; both decreased around $0.06/mile during the three weeks after Thanksgiving before starting the year-end climb as capacity tightens.